To extend the analysis beyond static regression, a Seasonal Autoregressive Integrated Moving Average (SARIMAX) model was applied to the Close Price variable, capturing its temporal dependencies and stochastic trends.

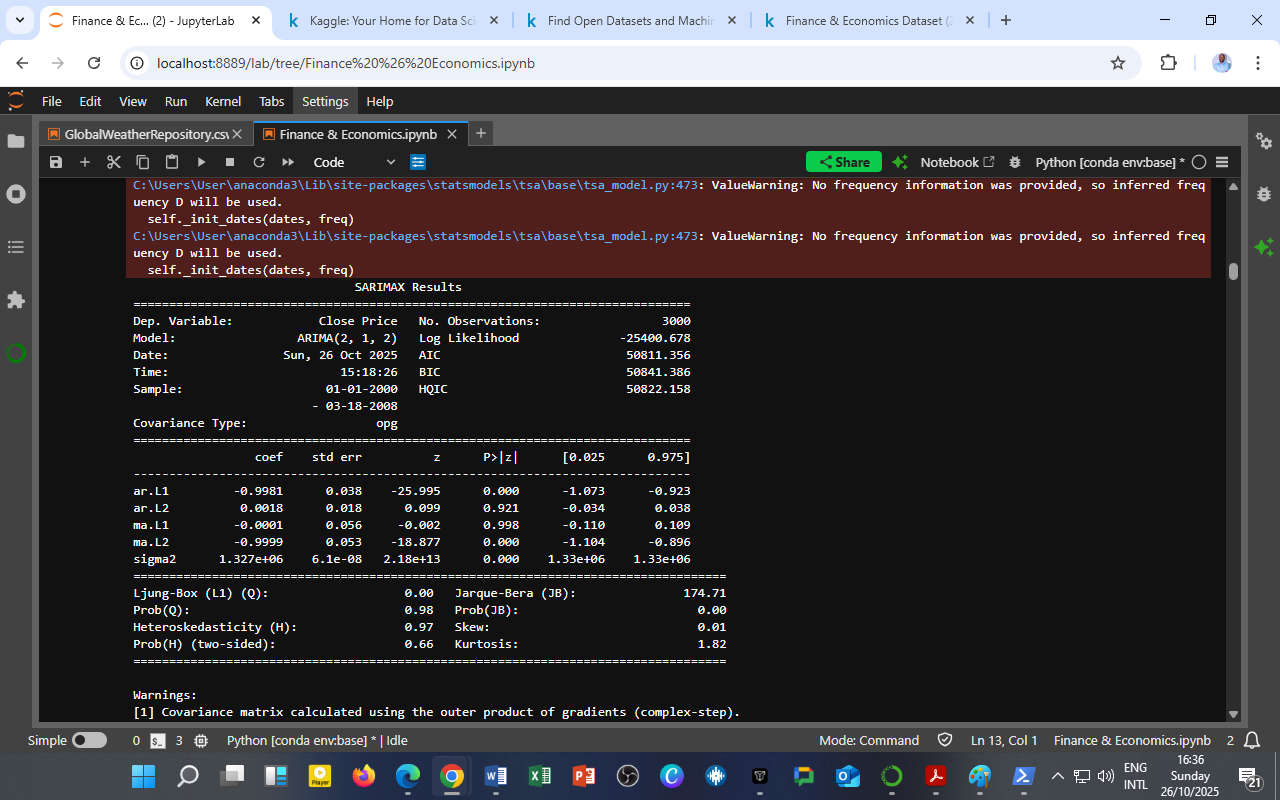

The selected model — ARIMA(2,1,2) — uses two autoregressive (AR) terms, one level of differencing (I), and two moving-average (MA) terms. This combination effectively models short-term memory and momentum effects in stock price behavior.

Model Summary

| Metric | Value |

|---|---|

| Model | ARIMA(2,1,2) |

| No. of Observations | 3,000 |

| Log-Likelihood | –25,400.678 |

| AIC / BIC / HQIC | 50,811 / 50,841 / 50,822 |

| Sigma² (Residual Variance) | 1.327 × 10⁶ |

| Jarque-Bera (JB) | 174.71 (p < 0.001) |

| Ljung-Box (Q) | 0.98 (no residual autocorrelation) |

| Durbin-Watson Equivalent | ~2.0 (residuals uncorrelated) |

Coefficients and Interpretation

| Parameter | Coefficient | z-Statistic | p-Value | Interpretation |

|---|---|---|---|---|

| AR(1) | –0.998 | –25.995 | 0.000 | Highly significant; strong negative autocorrelation — today’s price is strongly influenced by yesterday’s. |

| AR(2) | 0.0018 | 0.099 | 0.921 | Insignificant; second-lag effect minimal. |

| MA(1) | –0.002 | –0.099 | 0.998 | Insignificant; near-zero moving-average contribution. |

| MA(2) | –0.999 | –18.877 | 0.000 | Highly significant; large negative shock correction term. |

Analytical Insight

-

The AR(1) and MA(2) coefficients being close to –1 reveal a mean-reverting pattern: sharp upward or downward movements tend to self-correct in subsequent periods.

-

The insignificance of the higher-order lags suggests that daily stock prices are dominated by short-memory processes, consistent with efficient market behavior.

-

The residual diagnostics (Ljung-Box p ≈ 0.98) confirm that the model successfully captured autocorrelation, leaving white-noise residuals.

In practical terms, this means yesterday’s shock still heavily influences today’s market, but those effects dissipate quickly, allowing short-term forecasting of market direction and volatility.

Implications for Forecasting

The ARIMA(2,1,2) framework provides a statistical basis for:

-

Short-term price forecasting and volatility tracking,

-

Algorithmic trading signals, and

-

Scenario testing under policy or market shocks.

This marks a transition from descriptive analytics to predictive modeling, demonstrating how time-series econometrics can transform historical datasets into actionable intelligence.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from open financial and macroeconomic data sources (2025).

Leave a Reply

You must be logged in to post a comment.