Why Services Matter

While goods prices have eased worldwide, services inflation—covering rent, transport, health, hospitality, and education—remains stubbornly high.

Services are labor-intensive and slow to respond to monetary policy, making them the last mile of global disinflation.

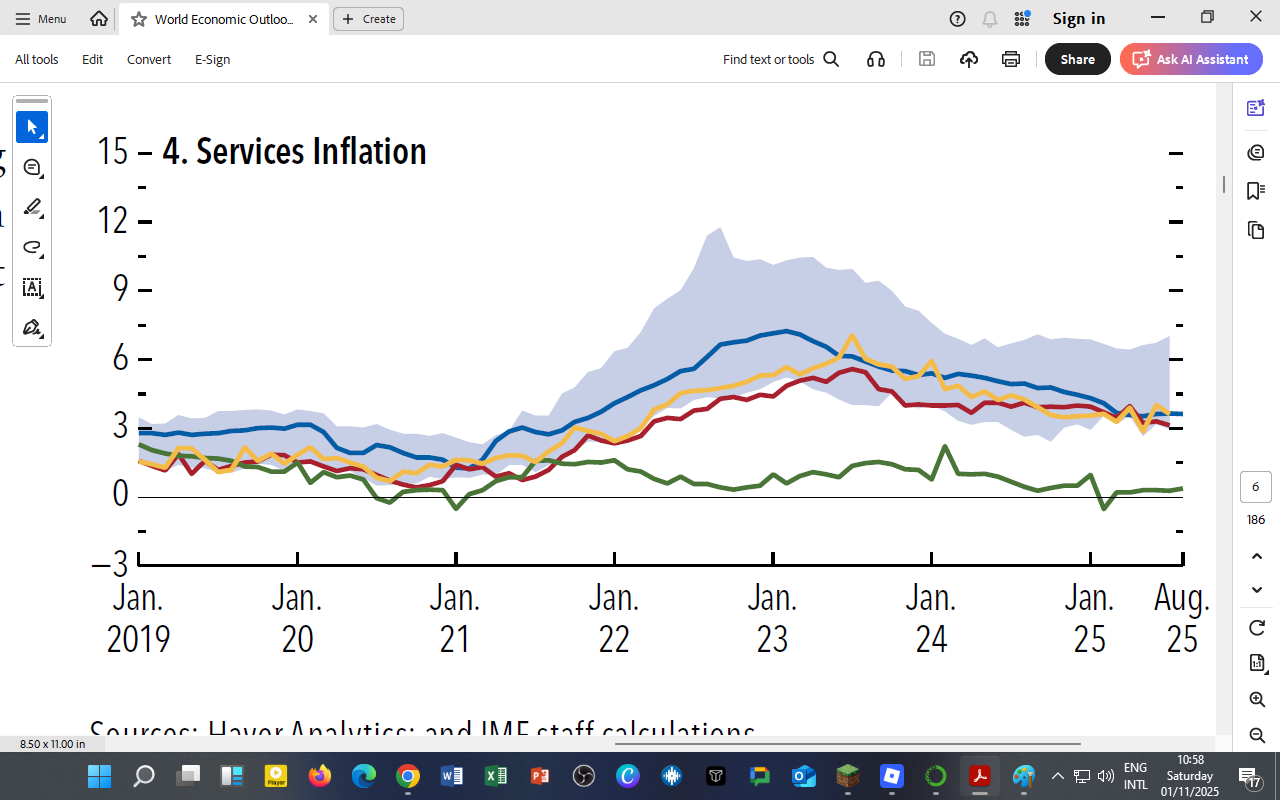

Figure 1.6 (4) — Services Inflation Trends (2019 – 2025)

Key Regions:

-

United States (blue)

-

Euro Area (red)

-

Other Advanced Economies (gold)

-

China (green)

-

Other Emerging and Developing Economies (EMDEs) – blue-shaded band

Global Patterns and Persistence

1. Gradual Rise (2020 – 2022):

As pandemic restrictions lifted, global demand for travel, housing, and leisure surged. Tight labor markets lifted wages, pushing up prices in core services sectors.

2. Sticky Plateau (2023 – 2025):

Unlike goods inflation, services inflation declined only slowly.

-

U.S. and Euro Area hover around 3–4 %.

-

Other AEs mirror similar patterns as wage negotiations catch up with living costs.

-

China remains below 1 %, reflecting weaker consumption.

-

EMDEs show the widest variability (3–9 %), dominated by transport and education costs.

Services inflation has replaced food and energy as the main obstacle to achieving 2 % inflation targets.

Why Services Inflation Is So Sticky

| Structural Factor | Description | Effect on Prices |

|---|---|---|

| Labor Intensity | Wages are 60–80 % of service-sector costs. | Rising wages sustain inflation even as input prices fall. |

| Limited Tradeability | Most services cannot be imported cheaply. | Domestic cost pressures remain local. |

| Housing Shortages | Tight rental markets across cities. | Persistent shelter inflation. |

| Health & Education | High demand post-pandemic. | Structural inflation above target. |

Central banks face a slow transmission of rate hikes to service prices because of multi-year contracts and labor agreements.

Regional Reflections — Africa and Kenya

-

Kenya’s services inflation averages ≈ 4 %, driven by transport and housing.

-

Public transport fare adjustments and energy pass-through effects mirror global pressures.

-

Growing demand for private education and healthcare adds to non-tradable inflation.

-

CBK’s 9.25 % policy rate anchors expectations but cannot fully offset domestic structural drivers.

Service-sector inflation demonstrates why macroeconomic stability depends on supply-side policy — urban housing, skills development, and productivity reforms.

For DatalytIQs Academy Learners

-

Recreate this chart using Python’s

fill_between()for the EMDE band. -

Compare core goods vs services inflation to illustrate post-pandemic divergence.

-

Conduct a correlation analysis between Kenya’s services inflation and global indices.

-

Simulate policy scenarios showing how interest rates affect service prices over 12–18 months.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025) – Figure 1.6 (4) “Services Inflation.”

Acknowledgment: Haver Analytics and IMF staff for data and visual insights.

Author: Collins Odhiambo Owino, DatalytIQs Academ

Leave a Reply

You must be logged in to post a comment.