By Collins Odhiambo Owino

Author | DatalytIQs Academy

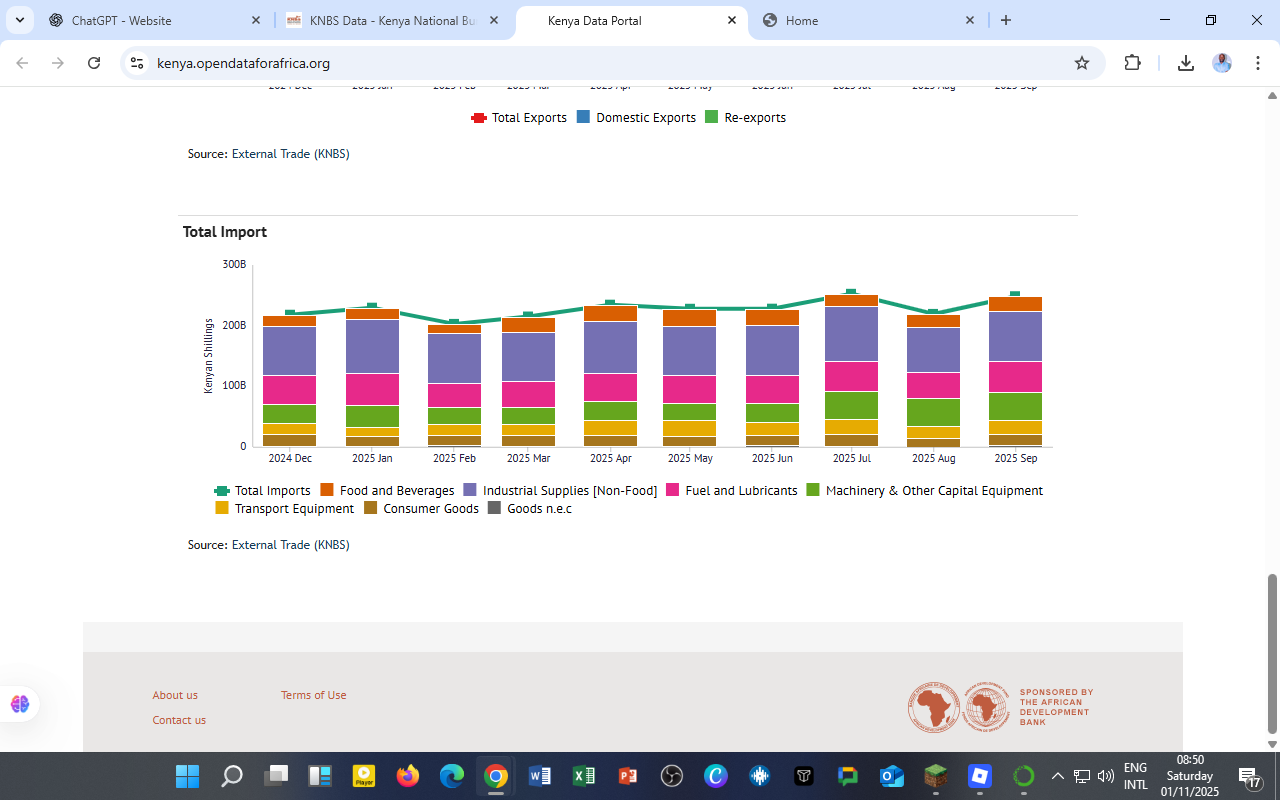

Data Source: Kenya National Bureau of Statistics (KNBS) – Kenya Data Portal

Introduction

Kenya’s economy is highly interconnected with global markets through trade. Imports play a vital role in sustaining the country’s industrial, agricultural, and consumer sectors. Analyzing the KNBS external trade data (2024–2025) provides insights into how global trends, domestic demand, and policy interventions shape Kenya’s import behavior.

The figure below, extracted from the Kenya Data Portal, illustrates monthly import patterns by category from December 2024 to September 2025.

Key Observations

-

Stable but High Import Levels:

The total import bill fluctuates around KSh 200–250 billion per month, showing resilience despite global inflationary pressures and exchange rate fluctuations. -

Dominance of Industrial Supplies:

Industrial supplies (non-food) form the largest component of imports, highlighting Kenya’s heavy reliance on foreign raw materials and intermediate goods for manufacturing. -

Fuel and Lubricants – A Persistent Burden:

The magenta segment shows that petroleum products continue to absorb a significant share of the import bill. Volatile oil prices and currency depreciation amplify this cost burden. -

Machinery and Transport Equipment Rising:

Imports of machinery and transport equipment remain substantial, reflecting ongoing infrastructure and industrialization projects — from energy plants to construction machinery. -

Food and Beverages:

Though relatively smaller, food imports underscore Kenya’s vulnerability to agricultural shocks such as droughts, floods, and global grain supply disruptions.

Economic Implications

-

Exchange Rate Pressure:

Sustained imports weigh on Kenya’s current account balance, putting pressure on the Kenyan shilling against major currencies. -

Industrial Dependence:

The high share of industrial supplies signals limited domestic production capacity for essential inputs — an area ripe for local investment and innovation. -

Fuel Price Sensitivity:

Any global oil price spikes directly influence Kenya’s import costs, inflation, and transport expenses.

Policy Reflections

To manage external vulnerability and foster economic stability, Kenya could consider:

-

Expanding local manufacturing of intermediate goods.

-

Diversifying energy sources to reduce fuel import dependence.

-

Promoting export-oriented industries to offset import bills.

-

Leveraging AfCFTA trade frameworks to substitute imports with regional products.

Insight for Learners

For DatalytIQs Academy students and enthusiasts, this dataset provides an excellent opportunity to:

-

Practice time-series visualization using Python (Matplotlib/Seaborn).

-

Apply trend and seasonality analysis using ARIMA models.

-

Explore import–export correlations with GDP growth or inflation.

Data Source and Acknowledgment

Dataset: External Trade Data (Imports by Category, 2024–2025)

Source: Kenya Data Portal – KNBS External Trade

Acknowledgment: Kenya National Bureau of Statistics (KNBS) and the African Development Bank for their data transparency and continuous contribution to open data in Africa.

Author: Collins Odhiambo Owino, DatalytIQs Academy.

Leave a Reply

You must be logged in to post a comment.