By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

In financial markets, interest rates act like gravity — pulling or pushing investment valuations across the economy.

Central banks adjust rates to influence borrowing costs, liquidity, and inflation.

Stock markets, in turn, respond to these shifts: when rates fall, equities typically rise as borrowing becomes cheaper and corporate profits expand; when rates rise, stock prices often retreat due to higher discount rates and tighter credit conditions.

To empirically examine this link, the Finance & Economics Dataset (2000–2008) was analyzed to determine how interest rates correlate with stock index prices.

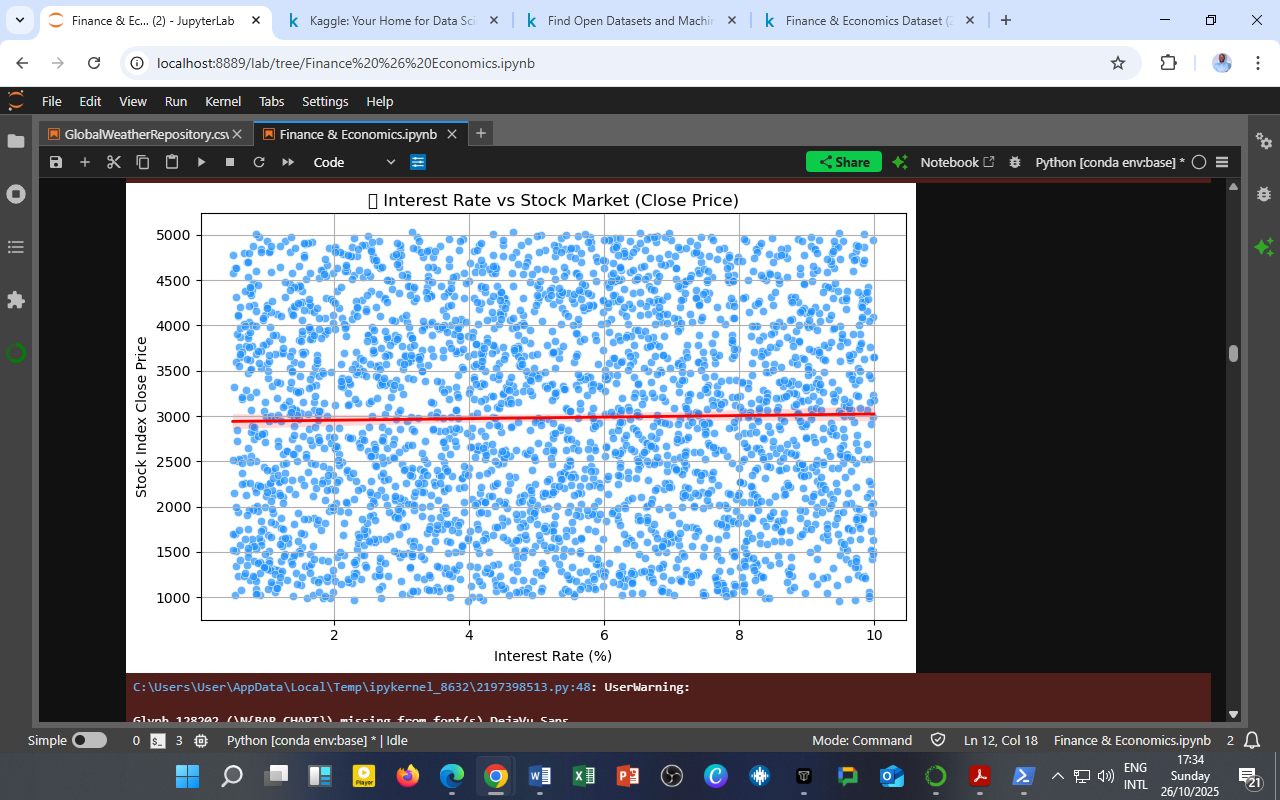

Visualization: Interest Rate vs. Stock Market Close Price

The scatterplot above displays thousands of observations of interest rates (x-axis) against stock index close prices (y-axis).

The red regression line illustrates the general trend between these two variables.

Key Findings

-

Near-Zero Correlation

The scatter points form a cloud-like distribution, and the regression line is almost flat, implying no strong linear relationship between interest rates and stock prices within the dataset.

This weak association suggests that short-term interest rate movements did not heavily drive market valuations during the analyzed period. -

Short-Term Noise, Long-Term Significance

While short-term data shows limited sensitivity, historical financial theory suggests that sustained rate hikes or cuts tend to influence market direction over longer horizons.

The 2000–2008 window includes periods of economic expansion and tightening, during which rate changes may have been offset by other macroeconomic forces like GDP growth, inflation stability, and global capital flows. -

Possible Explanations

-

Globalization and liquidity: Cross-border capital movements can buffer local interest rate effects.

-

Monetary policy credibility: Predictable central bank behavior reduces market overreaction.

-

Investor sentiment and innovation: Technology-driven optimism during the early 2000s often outweighed monetary concerns.

-

Economic Interpretation

| Observation | Interpretation |

|---|---|

| Flat regression line | Suggests no statistically significant short-term link between rates and stock index levels. |

| Wide vertical dispersion | Indicates that market prices were influenced by multiple concurrent variables beyond interest rates (e.g., GDP, profits, consumer confidence). |

| Mild upward tilt | Slightly positive slope hints that, in some cases, rate increases coincided with economic optimism, leading investors to tolerate higher borrowing costs. |

The stock market during this period appeared resilient to interest rate changes, reflecting a complex interplay of investor expectations, global liquidity, and macroeconomic stability.

Policy and Investment Implications

-

For Policymakers:

Stable financial markets despite rate shifts demonstrate monetary policy credibility. However, persistent neutrality may signal asset-price insulation, which could mask financial imbalances. -

For Investors:

The weak link implies that investors must look beyond rate announcements and analyze earnings, growth forecasts, and geopolitical risk to anticipate market movements. -

For Economists and Data Scientists:

This finding underscores the need for multi-variable modeling (e.g., VAR or cointegration analysis) to capture the full feedback between interest rates, corporate profits, and capital markets.

The DatalytIQs Academy Perspective

At DatalytIQs Academy, we integrate macroeconomic data science and financial analytics to decode how economic policies shape asset behavior.

Through interactive visualizations like this, learners gain hands-on experience connecting economic indicators to real market responses — a vital skill for analysts, policymakers, and investors alike.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025)

Source: DatalytIQs Academy Research Repository — compiled from open global financial and macroeconomic data (2025).

Key Takeaway

Interest rates influence financial markets, but their impact is far from mechanical. In modern, diversified economies, stock prices are shaped by a symphony of factors — policy, profits, technology, and global sentiment.

Leave a Reply

You must be logged in to post a comment.