Venture Capital and M&A Trends as Engines of Structural Transformation

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

Innovation and restructuring are the twin forces driving long-run economic transformation.

While Venture Capital (VC) funding fuels innovation by financing startups and new technologies, Mergers & Acquisitions (M&A) drive restructuring, enabling firms to scale, consolidate, and adapt to changing markets.

Tracking both indicators reveals how entrepreneurial dynamics interact with macroeconomic conditions.

Visualization: Innovation and Corporate Restructuring

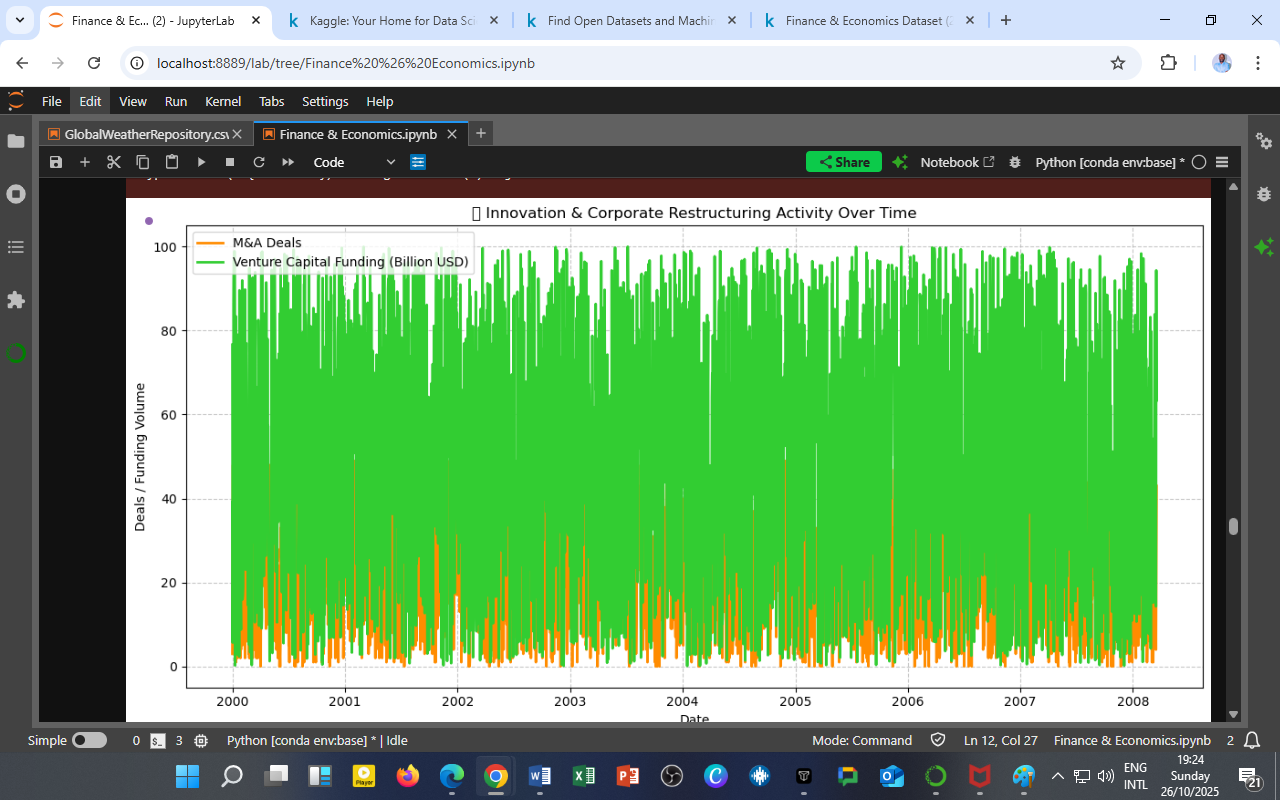

Figure 1: Time-series visualization of Venture Capital Funding (orange) and M&A Deals (green) from 2000–2008, highlighting the intensity and cyclicality of innovation and consolidation activity.

Observations and Patterns

a. Parallel Growth Dynamics

Both VC funding and M&A activity exhibit cyclical intensity, often peaking together.

This suggests that innovation booms and corporate consolidation move hand-in-hand — when capital is abundant and confidence is high, firms innovate and merge aggressively.

b. Periodic Downturns

Noticeable dips (e.g., 2001–2002) coincide with macroeconomic contractions — reduced liquidity and investor caution cause declines in both venture funding and deal volume.

c. Structural Consistency

Despite volatility, M&A volumes (green) remain consistently higher, reflecting their role as a core mechanism for industrial reorganization, while VC funding (orange) represents a risk appetite indicator within financial markets.

Analytical Interpretation

| Dimension | Venture Capital Funding | Mergers & Acquisitions | Economic Implication |

|---|---|---|---|

| Nature | High-risk, innovation-focused | Strategic, consolidation-driven | Represents creative destruction in motion |

| Cycle Sensitivity | Highly procyclical | Moderately procyclical | Mirrors capital market liquidity |

| Policy Leverage | Encouraged through innovation grants, startup incentives | Regulated to prevent monopolization | Balances competition and innovation |

| Impact on GDP Growth | Long-run productivity enhancement | Short-run efficiency and capital reallocation | Complementary mechanisms for resilience |

Economic and Policy Insights

-

Innovation Ecosystem Health:

Sustained VC activity signals a vibrant innovation climate — a crucial input for long-term technological progress and competitiveness. -

Corporate Adaptability:

Increased M&A activity following recessions reflects strategic repositioning — firms seek synergies and market share in response to shocks. -

Policy Timing:

Counter-cyclical fiscal or credit incentives (e.g., startup tax relief, innovation bonds) can help stabilize VC cycles, cushioning innovation ecosystems during downturns.

The DatalytIQs Academy Insight

Innovation lights the spark — restructuring shapes the flame.

At DatalytIQs Academy, this analysis underscores the link between finance, entrepreneurship, and industrial evolution, illustrating how micro-level innovation connects to macroeconomic recovery and growth.

Learners studying Corporate Finance, Innovation Economics, or Applied Econometrics can replicate this approach to visualize structural transformation cycles.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Visualization: Venture Capital Funding (Billion USD) & M&A Deals

Section: Innovation & Corporate Dynamics Module

Key Takeaway

Innovation and corporate restructuring move together — one invents the future, the other organizes it.

Leave a Reply

You must be logged in to post a comment.