By Collins Odhiambo Owino

Author | DatalytIQs Academy

Data Source: International Monetary Fund (IMF) World Economic Outlook – October 2025

Headline Overview

After two years of pandemic- and war-driven price surges, global inflation continues to decline in 2025. Yet the path of disinflation differs sharply between advanced and emerging economies.

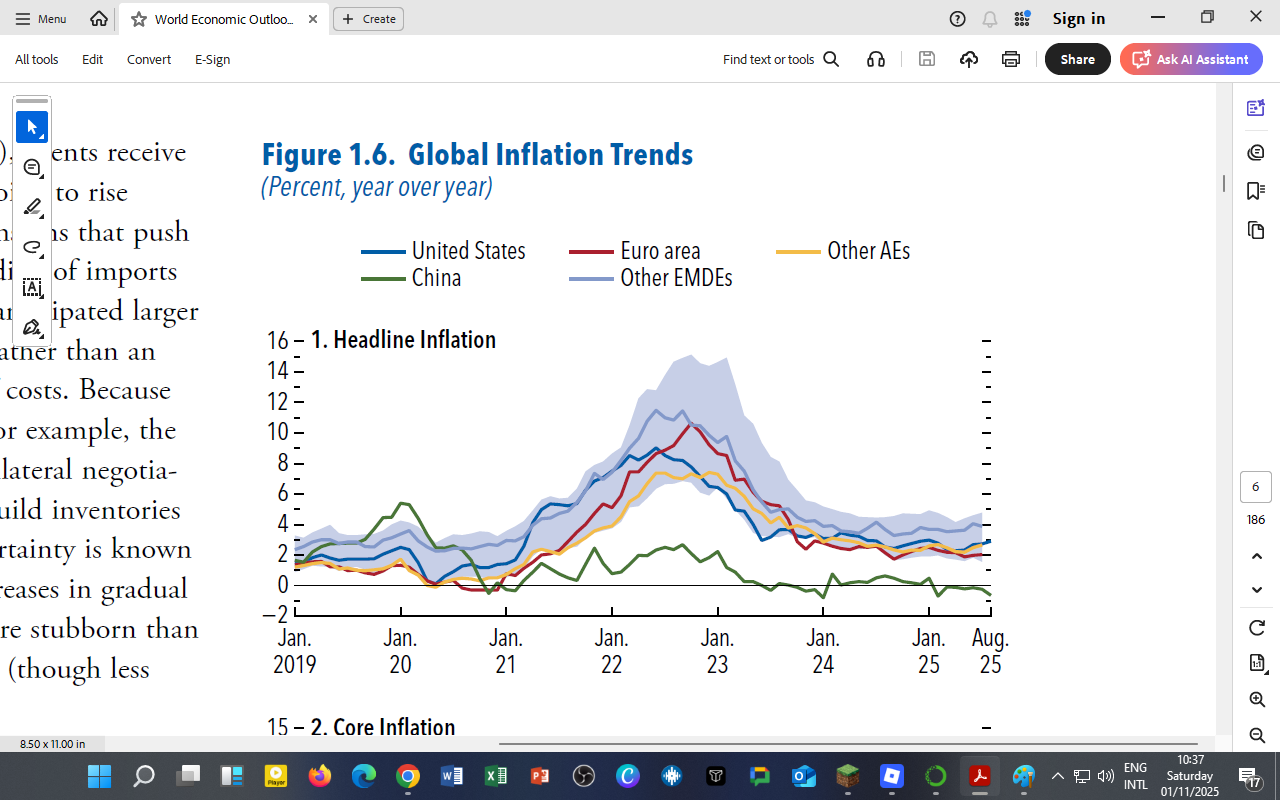

The IMF’s Global Inflation Trends chart shows year-on-year consumer-price movements from 2019 to 2025 for:

-

United States (blue)

-

Euro Area (red)

-

Other Advanced Economies (AEs) (gold)

-

China (green)

-

Other Emerging and Developing Economies (EMDEs) (light blue band)

Headline Inflation Patterns

Peak and Retreat:

-

Inflation spiked between 2021 and mid-2022, hitting double-digit levels in many advanced economies.

-

The drivers: global supply-chain bottlenecks, post-pandemic demand rebound, and energy-price shocks linked to the Ukraine conflict.

-

Since late 2023, inflation has gradually eased as commodity prices normalized and central banks raised interest rates aggressively.

Regional Highlights:

-

United States: Inflation peaked above 9% in 2022, falling below 3% by mid-2025 as monetary policy remained tight.

-

Euro Area: Slightly lagged the U.S., owing to persistent energy-price pressures and slower wage adjustments.

-

China: Experienced mild inflation averaging 1–2%, reflecting weaker domestic demand and overcapacity in manufacturing.

-

Other EMDEs: Displayed the widest volatility range (blue shaded band ≈ 4 – 16%), emphasizing exposure to currency depreciation and food-price shocks.

Core Inflation Dynamics

While headline inflation cooled, core inflation (excluding energy & food) remains elevated in many economies:

-

Sticky service prices and wage growth keep core inflation around 4–5% in advanced economies.

-

EMDEs face second-round effects from earlier commodity surges and exchange-rate passthrough.

Central banks must walk a fine line—maintaining credibility on inflation while avoiding over-tightening that could dampen growth.

Policy Responses and Outlook

| Policy Area | Advanced Economies | Emerging Economies |

|---|---|---|

| Monetary Policy | “Higher for longer” stance by the Fed and ECB to prevent inflation relapse. | Selective tightening—India and Brazil easing gradually; Kenya and Ghana remain hawkish. |

| Fiscal Policy | Gradual consolidation, targeting debt sustainability. | Fiscal discipline under IMF programs; focus on social protection and food security. |

| Inflation Target | 2 % targets remain intact but are challenged by wage persistence. | Flexible inflation targeting is gaining traction. |

Projection: Global inflation expected to average 4.8 % in 2025 and 4.2 % in 2026, still above pre-pandemic norms.

Implications for Africa and Kenya

-

Imported Inflation: Kenya’s price pressures mirror global energy and fertilizer costs.

-

Monetary Tightening: CBK rate at 9.25 % (Oct 2025) keeps inflation ≈ 4.6 %, within target.

-

Exchange-Rate Link: A weaker shilling raises import costs, but disinflation in global oil markets offsets part of the pressure.

-

Policy Advice: Kenya should maintain a cautious monetary policy while accelerating domestic food and energy resilience.

Inflation in Kenya cannot be viewed in isolation; it is interconnected with global monetary cycles and commodity markets.

For DatalytIQs Academy Learners

-

Build a Python notebook to replicate the IMF chart using Matplotlib (

fill_betweenfor the EMDE band). -

Apply rolling-window averages to study how inflation volatility differs between regions.

-

Simulate the impact of interest-rate changes on inflation trajectories via simple AR models.

-

Link global inflation trends to Kenya’s CPI data from KNBS and CBK for a comparative project.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025) – Figure 1.6 Global Inflation Trends.

Additional References: OECD Statistics Portal and World Bank Commodity Outlook 2025.

Acknowledgment: IMF staff for data visualization and open access to macroeconomic datasets.

Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.