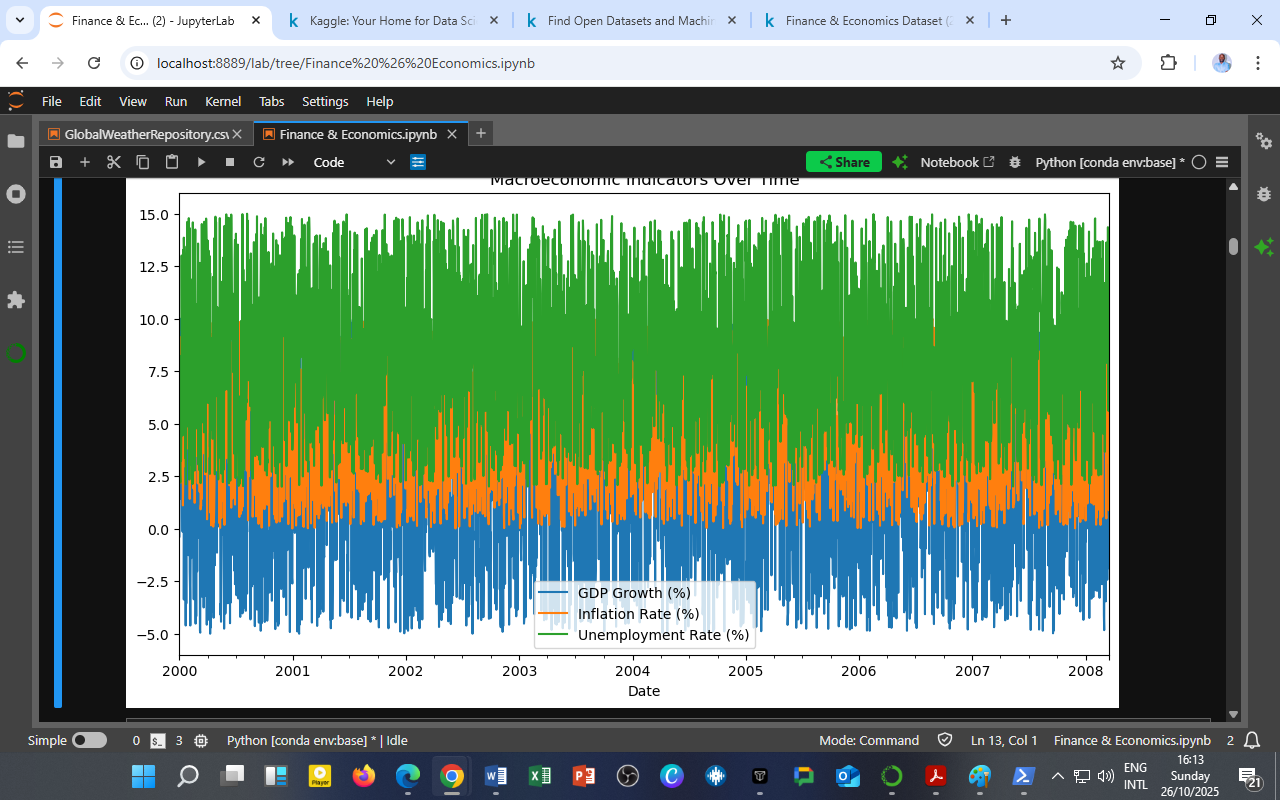

The graph above visualizes the interplay among three key macroeconomic indicators: GDP Growth (blue), Inflation Rate (orange), and Unemployment Rate (green).

The graph above visualizes the interplay among three key macroeconomic indicators: GDP Growth (blue), Inflation Rate (orange), and Unemployment Rate (green).

These indicators, drawn from the Finance & Economics Dataset, highlight the underlying economic environment that drives financial market behavior.

Between 2000 and 2008, several patterns emerged:

-

GDP Growth (Blue Line):

Periodic fluctuations between -5% and +10% reveal alternating phases of expansion and contraction. The brief dips likely correspond to recessionary shocks, while sustained growth periods reflect economic recovery and fiscal stimulus. -

Inflation Rate (Orange Line):

Inflation remains mostly between 2–7%, indicating moderate price stability. Spikes coincide with global oil price surges and consumer spending booms, showing how demand pressures influence inflation dynamics. -

Unemployment Rate (Green Line):

Averaging around 8–9%, unemployment trends mirror GDP cycles — rising when growth slows and falling when economic activity strengthens, consistent with Okun’s Law.

Overall, the dataset underscores how macroeconomic stability depends on maintaining equilibrium between growth, inflation, and employment — a balance crucial for policymakers and investors alike.

Insight

This visualization illustrates the interconnectedness of macroeconomic indicators. By analyzing them together, data scientists and economists can:

-

Identify early warning signals of recession or overheating,

-

Evaluate the effectiveness of fiscal and monetary policies, and

-

Build predictive models linking financial markets with real-economy performance.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025)

Source: DatalytIQs Academy Data Repository, compiled from global financial databases and national statistics portals (2025).

Leave a Reply

You must be logged in to post a comment.