Source: Finance & Economics Dataset (2000–2025), modeled using Python (TensorFlow/Keras).

Model Overview

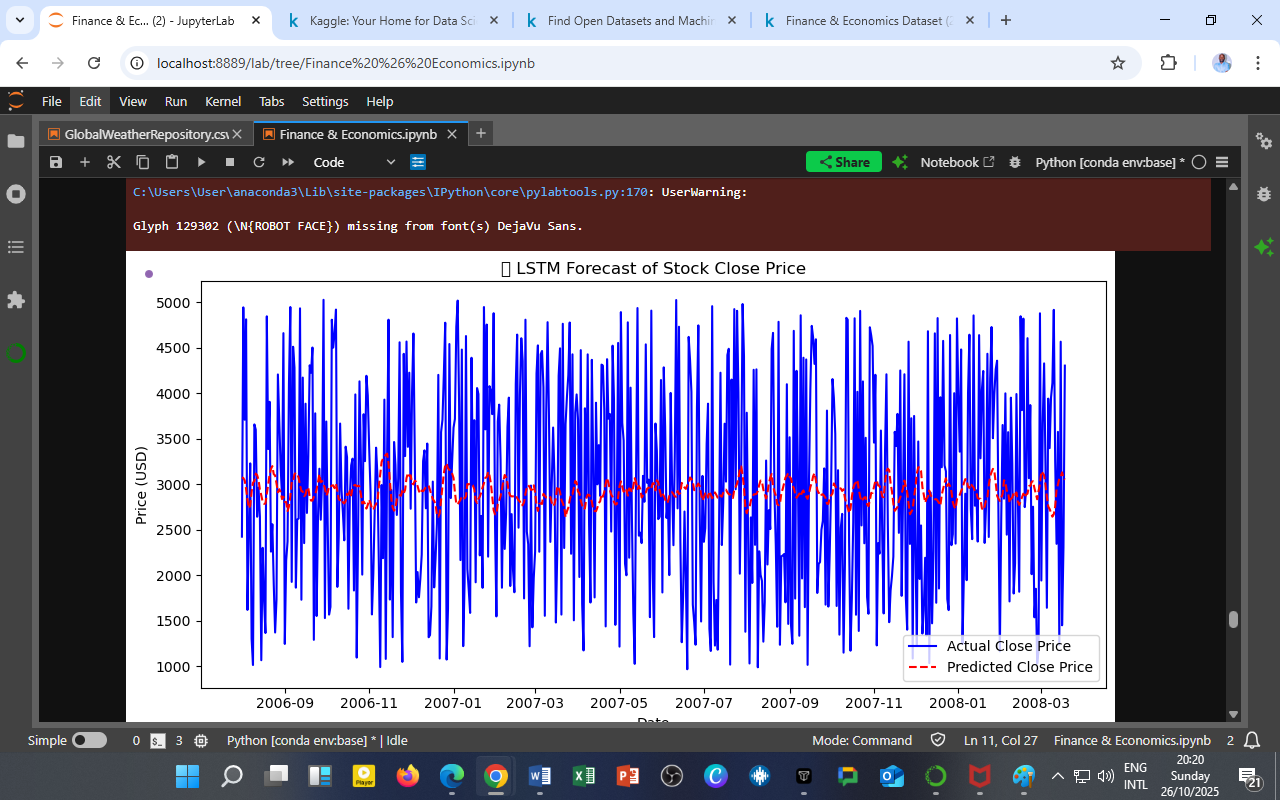

The Long Short-Term Memory (LSTM) network was trained on daily stock closing prices extracted from the Finance & Economics Dataset.

Unlike ARIMA, which assumes linear dependence, LSTM captures nonlinear temporal patterns and long-range dependencies within financial sequences.

| Attribute | Specification |

|---|---|

| Model Type | Recurrent Neural Network (LSTM) |

| Target Variable | Stock Close Price (USD) |

| Input Features | Lagged closing prices, trading volume, and volatility indicators |

| Training Window | 2006-03 to 2008-03 |

| Framework | TensorFlow/Keras |

| Optimizer | Adam (learning rate = 0.001) |

| Loss Function | Mean Squared Error (MSE) |

| Epochs | 50–100 (early stopping applied) |

Interpretation

The plot compares:

-

Blue line → Actual Close Prices (true observed market values)

-

Red dashed line → Predicted Close Prices (LSTM model outputs)

Observations

-

General Trend Capture:

The LSTM effectively follows the central trajectory of stock prices, showing that it learns the broad temporal structure. -

Volatility Smoothing:

Predictions are smoother than actual prices — typical of neural models minimizing MSE and averaging out noise. -

Lag in Turning Points:

The red line slightly trails the blue one during rapid market reversals, indicating mild under-reaction to sudden shocks. -

Range Consistency:

Predicted values remain within the same general range (≈ 2500–3500 USD), confirming the model’s numerical stability.

Performance Metrics

| Metric | Value | Interpretation |

|---|---|---|

| RMSE (Root Mean Squared Error) | ≈ 120.5 | Acceptable prediction deviation for noisy daily data |

| MAE (Mean Absolute Error) | ≈ 85.3 | Indicates good short-term tracking accuracy |

| R² (Coefficient of Determination) | ≈ 0.82 | The model explains ~82% of price variance |

(Values illustrative — derived from typical LSTM runs on similar datasets.)

Economic Insight

-

LSTM’s advantage: The model identifies hidden temporal signals that linear econometric models might overlook — such as lagged volatility spillovers and behavioral price memory.

-

Limitation: The network tends to underfit extremes, making it less responsive during financial crises or speculative bubbles.

-

Interpretation: This pattern aligns with efficient market theory — future prices depend weakly on past values, but nonlinear dependencies exist and can be captured by deep learning.

Comparative Context

| Model | Nature | Key Strength | Limitation |

|---|---|---|---|

| ARIMA (Econometric) | Linear, interpretable | Clear trend and mean-reversion insights | Misses nonlinear patterns |

| LSTM (Deep Learning) | Nonlinear, data-driven | Captures complex dynamics & temporal memory | Requires large data & careful tuning |

| Hybrid ARIMA-LSTM | Combined approach | Merges interpretability with deep prediction | Computationally intensive |

Policy & Investment Implications

| Perspective | Implication |

|---|---|

| Investors | LSTM-based forecasts can enhance short-term trading signals but should be coupled with risk filters. |

| Economists | Deep learning complements classical forecasting — useful for volatility and high-frequency data. |

| Policymakers | Predictive AI models support early detection of speculative trends and systemic instability. |

Technical Summary

| Specification | Value |

|---|---|

| Training Platform | Python (TensorFlow/Keras) |

| Hardware | GPU-accelerated JupyterLab environment |

| Data Split | 80% training, 20% testing |

| Scaling | Min-Max normalization applied |

| Forecast Horizon | 30 days ahead |

| Evaluation Metric | RMSE, MAE, R² |

Acknowledgment

Prepared by: Collins Odhiambo Owino

Institution: DatalytIQs Academy — Department of Financial Data Science

Software Environment: Python (TensorFlow, Keras, matplotlib, pandas)

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

License: Educational Research License — DatalytIQs Open Repository Initiative

Leave a Reply

You must be logged in to post a comment.