Background

Japan, the world’s third-largest economy and a leading automobile exporter, has long relied on stable trade relations with both North America and the rest of the world.

Yet, 2025 has brought renewed trade frictions, currency volatility, and shifting demand patterns — particularly in the auto industry.

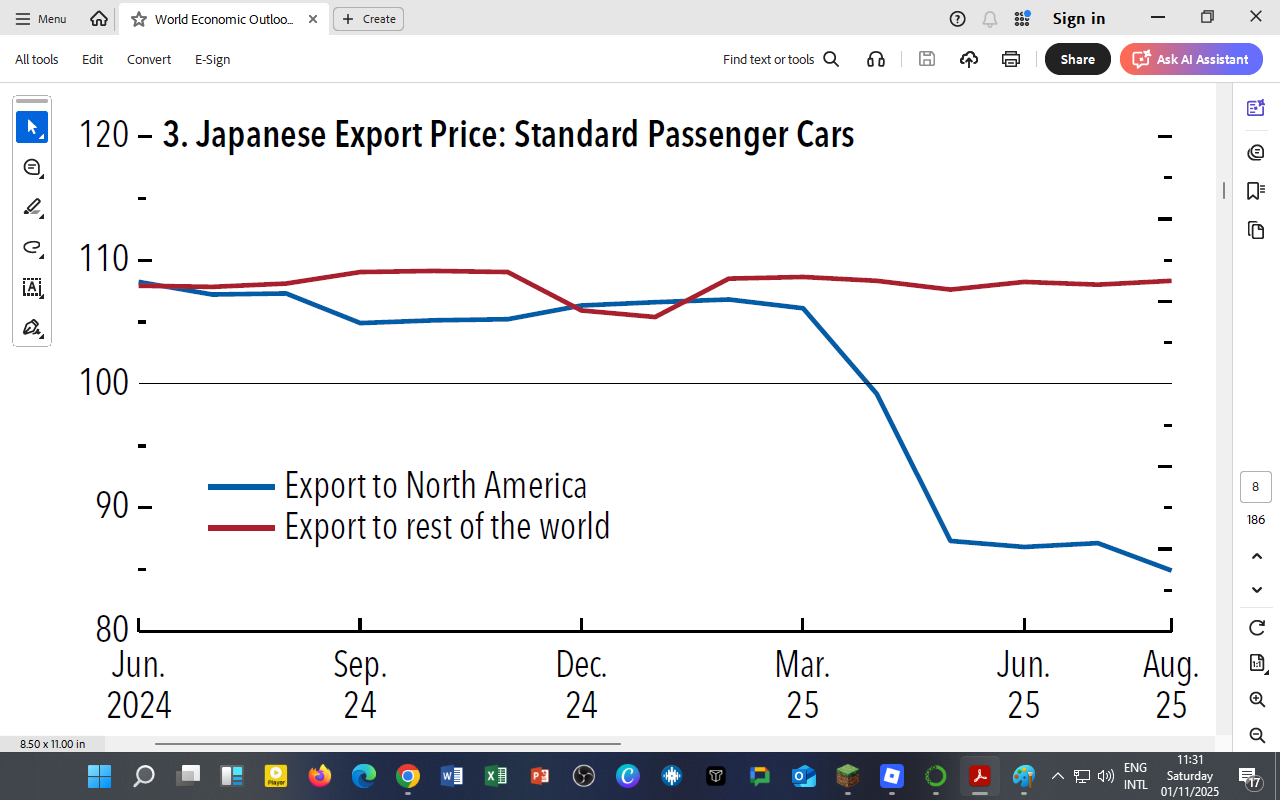

The chart below compares Japanese export prices (standard passenger cars) by destination, showing the impact of tariffs and exchange rate movements over time.

Figure — Japanese Export Price: Standard Passenger Cars

Key Observations (June 2024 – August 2025):

-

Export prices to North America (blue line) fell sharply — dropping nearly 25 % between early 2025 and mid-2025.

-

Prices to the rest of the world (red line) remained largely stable around 110 (index value), signaling more stable trade terms.

-

The divergence after March 2025 marks a significant break — a response to new U.S. tariff measures and a sharp yen depreciation, which made Japanese cars cheaper abroad.

The IMF analysis suggests that exchange-rate movements — not just tariffs — are now the dominant force in global price competitiveness.

For Japan, a weaker yen (around ¥160 per USD in mid-2025) amplified export volumes but squeezed profit margins.

What’s Driving the Divergence?

| Factor | Description | Impact |

|---|---|---|

| Tariffs on Autos (2025) | Renewed U.S. trade restrictions to protect domestic EV manufacturers. | Japanese exporters cut prices to retain market share. |

| Yen Depreciation | Sharp fall in the yen improves export competitiveness but lowers the unit price in USD. | Exports become cheaper abroad. |

| Domestic Cost Pressures | Rising energy and wage costs within Japan. | Firms offset with a currency advantage abroad. |

| Shift to EVs and Hybrids | Growing demand for electric vehicles globally. | Traditional vehicle exports face declining demand. |

Export prices to the U.S. fell steeply, while prices to Asia, Europe, and Africa held steady thanks to diversified trading networks and regional demand growth.

Global Implications

-

Competitive Devaluation Pressure – Japan’s weak yen raises competitiveness concerns for South Korea, Germany, and China’s auto sectors.

-

Trade Diversion – The U.S. may increasingly source vehicles from Mexico and Europe instead of Japan.

-

Inflation Effects – Cheaper Japanese exports help moderate import inflation in North America, offsetting some tariff-driven cost increases.

Tariffs may not raise consumer prices if offset by exchange-rate movements — a crucial lesson for policymakers balancing trade protection and inflation control.

Lessons for Kenya and Emerging Economies

-

Exchange Rates Matter: A weaker local currency can temporarily boost export competitiveness but erodes purchasing power for importers.

-

Sectoral Strategy: Kenya can learn from Japan’s diversification—building export resilience across markets reduces vulnerability to policy shocks.

-

Trade Integration: AfCFTA implementation could allow regional producers to reprice exports more competitively against global shifts.

For DatalytIQs Academy Learners

Apply this concept to practical exercises:

-

Plot export price indices for two trading partners using real data.

-

Simulate how a 10 % currency depreciation affects export prices and trade volumes.

-

Discuss how monetary policy interacts with trade policy in managing competitiveness.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025) – Figure 1.8 (3) “Japanese Export Price: Standard Passenger Cars.”

Acknowledgment: IMF staff calculations based on Haver Analytics trade data.

Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.