By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

In financial markets, interest rates influence more than just asset prices — they shape market liquidity, investor confidence, and the overall pace of trading.

When rates rise, borrowing costs increase, risk appetite weakens, and traders may retreat. Conversely, low interest rates tend to stimulate both investment and speculative activity, driving higher trading volumes.

To test this hypothesis empirically, the Finance & Economics Dataset (2000–2008) was analyzed to explore the relationship between interest rates and stock market trading volume.

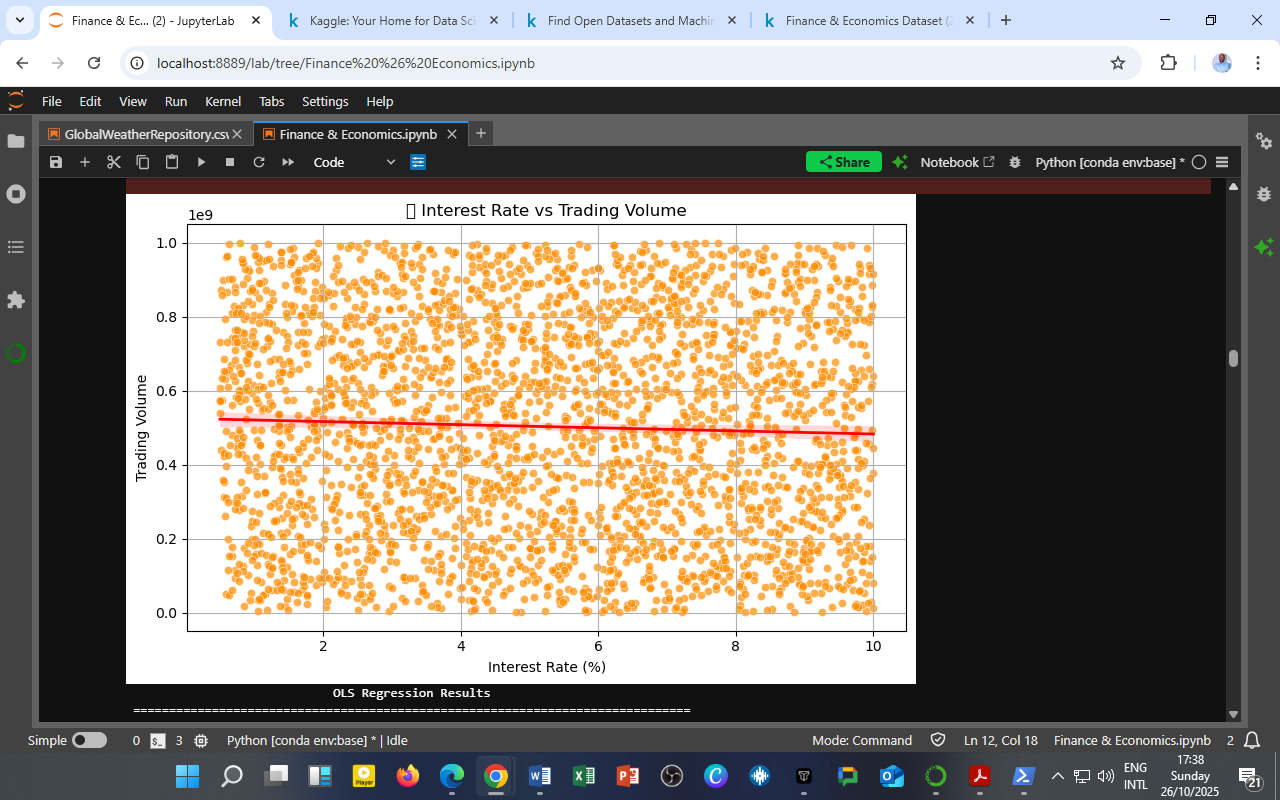

Visualization: Interest Rate vs. Trading Volume

The scatterplot above shows thousands of daily observations where each orange point represents a combination of interest rate and market trading volume.

The red regression line summarizes the direction of the relationship.

Observations

-

Slight Negative Trend

The regression line tilts gently downward, suggesting a weak inverse relationship between interest rates and trading volume.

→ Interpretation: As interest rates increase, trading activity tends to decline slightly, consistent with the idea that higher borrowing costs and risk aversion can dampen market participation. -

High Dispersion of Data Points

The scatter is broadly distributed, indicating that trading volume fluctuates substantially regardless of the rate level.

This reflects that short-term liquidity is influenced by multiple concurrent factors — including investor sentiment, earnings announcements, macroeconomic news, and global capital flows. -

Liquidity Resilience

Even at higher interest rate levels (8–10%), a significant number of observations show strong trading volume, suggesting that active markets can persist under tightening monetary conditions, especially when investors reposition portfolios.

Analytical Interpretation

| Indicator | Observation | Implication |

|---|---|---|

| Correlation | Weakly negative | Higher interest rates slightly reduce trading activity |

| Regression Line | Nearly flat | Short-run rate changes have a limited immediate impact on liquidity |

| Data Spread | Broad dispersion | Market liquidity is driven by diverse global and behavioral factors |

While interest rates exert a marginal downward influence on market trading volume, liquidity remains remarkably resilient, implying that investor psychology and global capital mobility often outweigh domestic monetary constraints.

Broader Economic Implications

-

For Policymakers:

The muted link between rates and trading activity suggests that moderate rate adjustments do not necessarily cause liquidity shocks — a positive signal for stable financial transmission. -

For Investors and Fund Managers:

Periods of rising rates may bring sector rotation rather than overall withdrawal. Active trading strategies may shift toward fixed-income, commodities, or defensive equities. -

For Researchers:

The finding reinforces the need for multivariate time-series models (VAR, ARDL) to isolate how rates interact dynamically with other variables such as volatility, returns, and macro expectations.

The DatalytIQs Academy Insight

At DatalytIQs Academy, we emphasize data-driven financial intelligence — helping learners explore how macroeconomic levers like interest rates ripple through the market ecosystem.

This visualization is a classic example of how empirical finance connects theory with observable behavior, teaching students to interpret patterns in real-world datasets.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from open global financial and macroeconomic sources (2025).

Key Takeaway

Interest rates subtly influence market participation, but liquidity in modern financial systems remains adaptive — shaped by global capital flows, investor sentiment, and structural depth rather than short-term monetary shifts.

Leave a Reply

You must be logged in to post a comment.