Understanding Inflation Pass-Through

Inflation doesn’t arise in isolation — it spreads through trade linkages, production costs, and consumer demand chains.

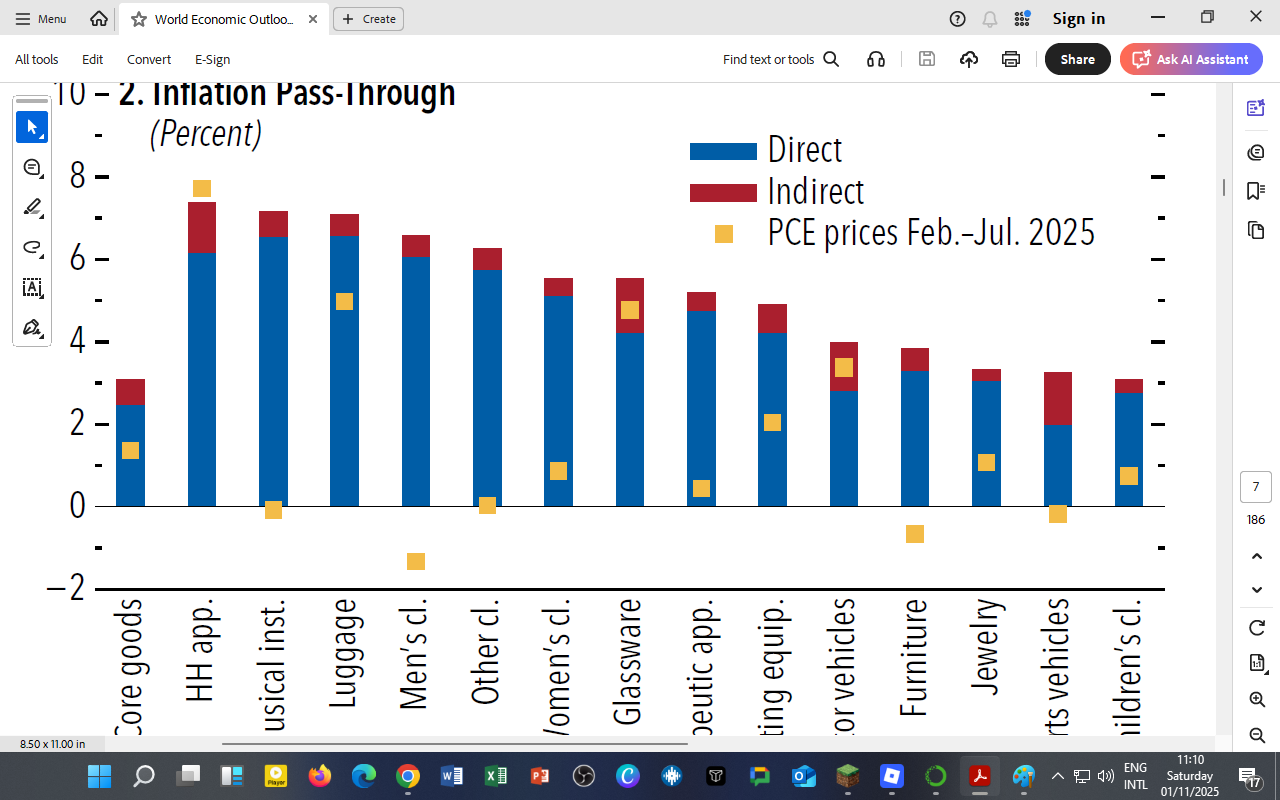

The IMF’s “Inflation Pass-Through” chart reveals how tariff changes and supply disruptions affect U.S. personal consumption expenditure (PCE) prices between February and July 2025.

Each bar in the figure shows the percentage contribution of:

-

🟦 Direct effects (immediate impact of import tariffs on final goods prices)

-

🟥 Indirect effects (cost increases from imported inputs used in domestic production)

-

🟨 Observed PCE price change for the period

Figure — Inflation Pass-Through by Product Category

Highlights:

-

Household appliances, musical instruments, and luggage show the largest total pass-through — 7–8 % — indicating high import dependency.

-

Clothing categories (men’s and women’s) record moderate effects (≈ 6–7 %).

-

Jewelry and furniture exhibit smaller but noticeable indirect inflation.

-

Children’s clothing and sports vehicles show near-zero or slightly negative price changes, implying substitution effects or reduced demand.

The data suggests that tariff-driven inflation was not only sector-specific but also regressive — affecting household goods and essentials more than luxury items.

Direct vs Indirect Transmission

| Transmission Channel | Description | Economic Impact |

|---|---|---|

| Direct Pass-Through | Imported goods become more expensive due to tariffs or shipping costs. | Consumers pay higher retail prices almost immediately. |

| Indirect Pass-Through | Firms using imported components face higher production costs. | Prices rise more gradually through domestic value chains. |

Inflation persists longer when indirect effects dominate — a key challenge in sectors reliant on global manufacturing networks.

Broader Global Context

-

Tariff escalation and geopolitical realignments since 2024 have elevated import prices globally.

-

Emerging markets faced compounded effects due to weaker currencies and energy import costs.

-

The IMF estimates total trade-related inflation added 0.8 % to global consumer prices by mid-2025.

Tariffs designed to protect domestic industries often raise living costs, especially for low- and middle-income households.

Implications for Africa and Kenya

-

Imported inflation: Kenya’s exposure is moderate but rising — household electronics, vehicles, and textiles are sensitive to global trade disruptions.

-

Policy response: Enhancing local value addition and intra-African supply chains (under AfCFTA) can reduce vulnerability to imported price shocks.

-

Monetary stance: CBK’s focus on maintaining a stable shilling helps cushion indirect pass-through effects.

A 10 % rise in shipping costs from Asia could increase local electronics prices by 3–4 % within a quarter due to high import reliance.

For DatalytIQs Academy Learners

You can replicate this IMF figure analytically:

-

Use a stacked bar chart to decompose inflation by sector (direct vs indirect).

-

Apply an input–output matrix to estimate second-round effects in Kenya’s manufacturing sector.

-

Analyze tariff elasticities to measure price sensitivity by product type.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025), Figure 1.7 (2) “Inflation Pass-Through.”

Acknowledgment: IMF staff calculations using Haver Analytics and U.S. PCE data.

Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.