By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Public borrowing is a double-edged sword: it can finance development and stimulate demand — or burden economies with unsustainable debt service.

Understanding how government debt levels relate to GDP growth helps policymakers strike the right fiscal balance between expansion and stability.

Using the Finance & Economics Dataset (2000–2008), this analysis explores the empirical relationship between Government Debt (in Billion USD) and GDP Growth (%) through visualization and regression analysis.

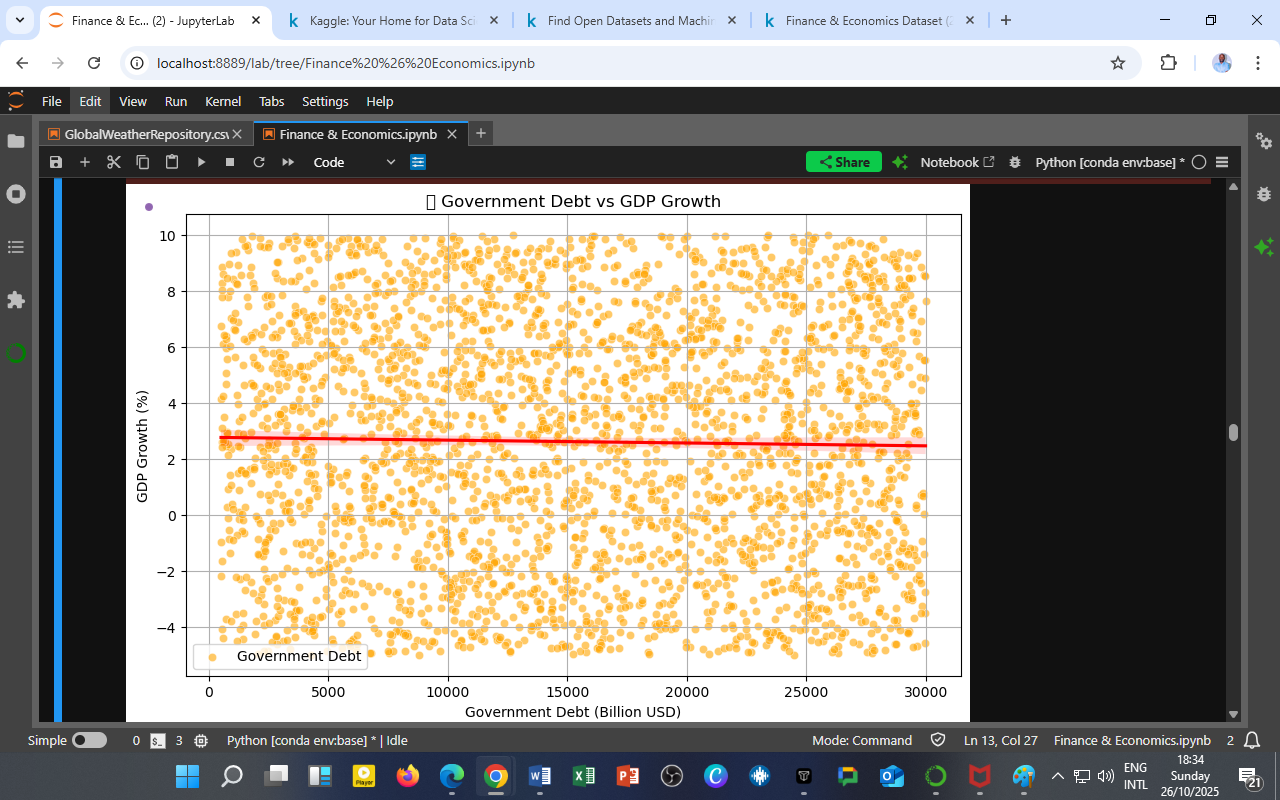

Visualization: Government Debt vs GDP Growth

Figure 1: Scatter plot showing the relationship between Government Debt (Billion USD) and GDP Growth (%), with trendline (in red).

Observations

a. Slight Negative Relationship

The red trendline slopes marginally downward, consistent with the regression result (coefficient ≈ –1.02×10⁻⁵).

This suggests a weak inverse relationship — as debt rises, GDP growth shows a slight tendency to decline, though not statistically significant (p = 0.266).

b. Broad Dispersion

The scatter points are widely distributed, revealing that growth outcomes vary greatly across different debt levels.

This dispersion implies that the impact of debt on growth depends heavily on context, particularly:

-

The productivity of borrowed funds, and

-

The macroeconomic environment (interest rates, inflation, and private investment climate).

c. Positive Outliers

A few instances of high growth despite high debt appear, often reflecting post-crisis stimulus or public investment surges.

These cases reinforce that debt is not inherently harmful, provided it finances productive activities.

Interpretation: When Debt Helps or Hurts Growth

1. Productive vs. Unproductive Debt

Debt drives growth when channeled into:

-

Infrastructure, innovation, education, and energy transition.

However, unproductive debt (e.g., administrative consumption or corruption losses) erodes fiscal health.

2. The Crowding-Out Effect

High government borrowing can raise interest rates, reducing private sector investment.

This mechanism — known as crowding out — weakens the growth multiplier from public debt.

3. Fiscal Discipline & Policy Credibility

Countries with strong fiscal frameworks can sustain higher debt-to-GDP ratios without market penalties.

Conversely, nations with weak institutions face reduced investor confidence, slowing growth even at moderate debt levels.

Quantitative Summary (OLS Model Recap)

| Variable | Coefficient | Std. Error | p-Value | Significance | Interpretation |

|———–|————-:|————-:|———-:|—————-|

| Government Debt (Billion USD) | –1.02×10⁻⁵ | 9.19×10⁻⁶ | 0.266 | ❌ Not significant | Weak negative effect |

| Corporate Profits (Billion USD) | +3.49×10⁻⁵ | 5.48×10⁻⁵ | 0.523 | ❌ Not significant | Slight positive link |

| Constant (Intercept) | +2.6766 | 0.213 | 0.000 | ✅ Significant | Baseline growth level |

Model fit: R² = 0.001, F-statistic = 0.8155 → debt & profits jointly explain less than 1% of GDP growth variation.

Thus, other variables (inflation, trade, consumption, and monetary policy) play larger roles in explaining macroeconomic performance.

Policy Implications

For Governments

-

Maintain debt sustainability thresholds by ensuring that borrowed funds finance capital formation, not recurrent spending.

-

Adopt medium-term debt management strategies (MTDS) integrating cost, risk, and maturity profiles.

-

Invest in fiscal transparency and public accountability to sustain market trust.

For Economists and Analysts

-

Monitor Debt-to-GDP ratio trends alongside growth volatility to assess fiscal vulnerability.

-

Use dynamic models (e.g., Debt–Growth ARDL or VAR) to estimate the lagged impact of debt on future output.

For Students and Researchers

This dataset illustrates how data visualization and econometrics combine to tell nuanced fiscal stories — demonstrating that correlation is not causation, but it signals deeper dynamics worth exploring.

The DatalytIQs Academy Insight

Debt itself isn’t dangerous — it’s how you spend, manage, and service it that defines a nation’s future.

At DatalytIQs Academy, we empower learners to analyze public finance trends using econometric modeling, data visualization, and real-world policy interpretation — turning fiscal data into actionable economic intelligence.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — based on government fiscal accounts, corporate financial data, and GDP indicators.

Key Takeaway

Borrowing can build or break economies. The difference lies in whether debt fuels consumption or productivity.

Leave a Reply

You must be logged in to post a comment.