By Collins Odhiambo Owino

Author | DatalytIQs Academy

Data Source: International Monetary Fund (IMF), OECD, and World Bank Global Economic Prospects (2025–2026)

Introduction

The global economy is navigating a delicate transition in 2025 — balancing recovery momentum with tightening financial conditions and policy uncertainty.

New data from the IMF World Economic Outlook (October 2025) reveals that while growth continues, it remains uneven across regions, constrained by trade frictions, inflation persistence, and subdued consumer confidence.

This post unpacks the global patterns behind the numbers, focusing on GDP growth contributions, consumer sentiment, and business confidence across leading economies.

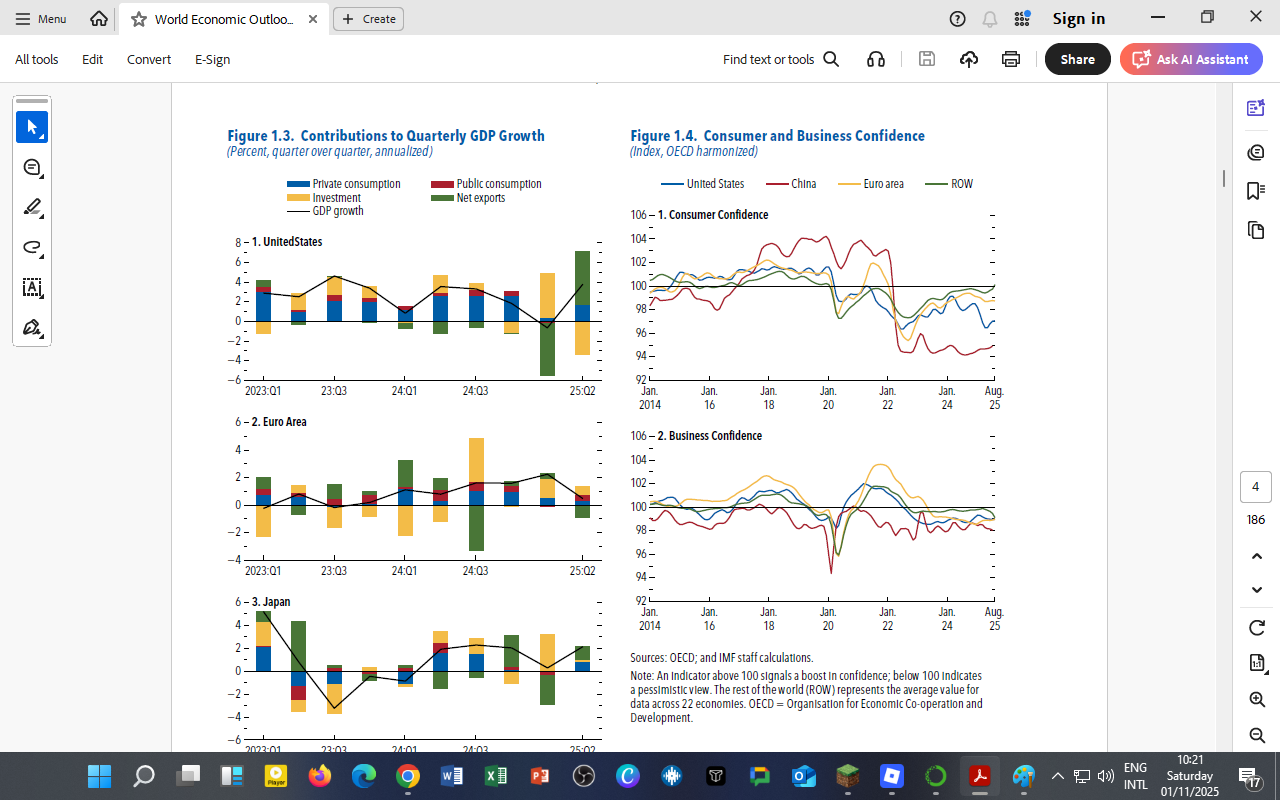

Figure 1.3 — Contributions to Quarterly GDP Growth

Source: IMF World Economic Outlook (Oct 2025)

This figure shows how private consumption, public spending, investment, and net exports have shaped growth across major economies — the United States, Euro Area, and Japan.

United States

-

Growth remains consumer-driven, with private consumption contributing the largest share.

-

Investment fluctuated amid tighter borrowing costs and elevated policy uncertainty.

-

Net exports weakened due to a strong dollar and softer global demand.

-

GDP growth revived in Q2 2025, signaling resilience in labor markets and fiscal stability.

🇪🇺 Euro Area

-

GDP growth remained subdued, driven mostly by public consumption and investment recovery.

-

Industrial output lagged due to high energy costs and geopolitical fragmentation.

-

The region’s recovery is modest, averaging 1.2–1.5% annualized growth.

🇯🇵 Japan

-

Growth momentum weakened in early 2024, followed by mild rebounds in mid-2025.

-

Exports and investment supported modest gains, while consumption softened under inflationary pressures.

Across advanced economies, domestic demand continues to sustain growth, but high interest rates and slower global trade remain major constraints.

Figure 1.4 — Consumer and Business Confidence

Source: OECD and IMF Staff Calculations

Confidence levels — a proxy for expectations about future growth — reveal the global economy’s mixed sentiment:

Consumer Confidence

-

China shows persistent pessimism below 100, reflecting slower household spending and property market stress.

-

The Euro Area remains steady but cautious, constrained by inflation and wage stagnation.

-

The U.S. has recovered modestly since 2023, buoyed by strong employment data.

-

Rest of the World (ROW) trends mirror moderate optimism, reflecting diverse regional recoveries.

Business Confidence

-

Global business sentiment declined in early 2024 but rebounded slightly by mid-2025.

-

Uncertainty surrounding tariffs, global demand, and energy transitions continues to cloud investment decisions.

Interpretation: Confidence indices above 100 signal optimism; below 100 indicate uncertainty. The narrow band across regions underscores global fragility — firms and households remain cautious despite easing inflation.

Global Economic Implications

| Indicator | 2025 Trend | Key Implications |

|---|---|---|

| GDP Growth | Global: 3.2% | Slower trade and tighter monetary policy dampen momentum. |

| Advanced Economies | 1.5% | Limited fiscal space, cooling demand. |

| Emerging Economies | 4.3% | Asia drives global expansion, especially India and ASEAN. |

| Consumer Confidence | Mixed | Households are cautious amid high living costs. |

| Business Confidence | Improving slightly | Investment sentiment is stabilizing post-tariffs. |

Growth persists but remains uneven, a reflection of adjustment to a “higher for longer” interest-rate world and evolving global trade structures.

Relevance to Africa and Kenya

-

Export Linkages: Slower global demand reduces Kenya’s tea, horticulture, and coffee exports.

-

Investment Outlook: Tight global liquidity raises borrowing costs for African economies.

-

Business Sentiment: Regional confidence improves with the African Continental Free Trade Area (AfCFTA), offering an alternative growth path through intra-African trade.

-

Policy Takeaway: Kenya and Sub-Saharan Africa must enhance productivity, diversify exports, and invest in digital and green transformation to offset global volatility.

For DatalytIQs Academy Learners

Students and researchers can use this data to:

-

Recreate GDP decomposition plots in Python (Matplotlib/Pandas).

-

Analyze confidence indicators as leading predictors of economic cycles.

-

Simulate the effects of tariffs and trade uncertainty on global growth.

-

Develop country-level dashboards connecting global projections to Kenya’s macroeconomic indicators.

Data and Acknowledgment

Sources:

International Monetary Fund (IMF), World Economic Outlook (October 2025).

Organisation for Economic Co-operation and Development (OECD) Confidence Indices.

World Bank Global Economic Prospects (2025–2026).

Acknowledgment:

IMF and OECD data teams for open access to macroeconomic datasets.Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.