How Business Performance Reflects and Reinforces Economic Expansion

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

Corporate profits form the bridge between macroeconomic performance and business productivity.

As GDP rises, firms expand output and earnings; conversely, declining growth compresses margins, employment, and investment.

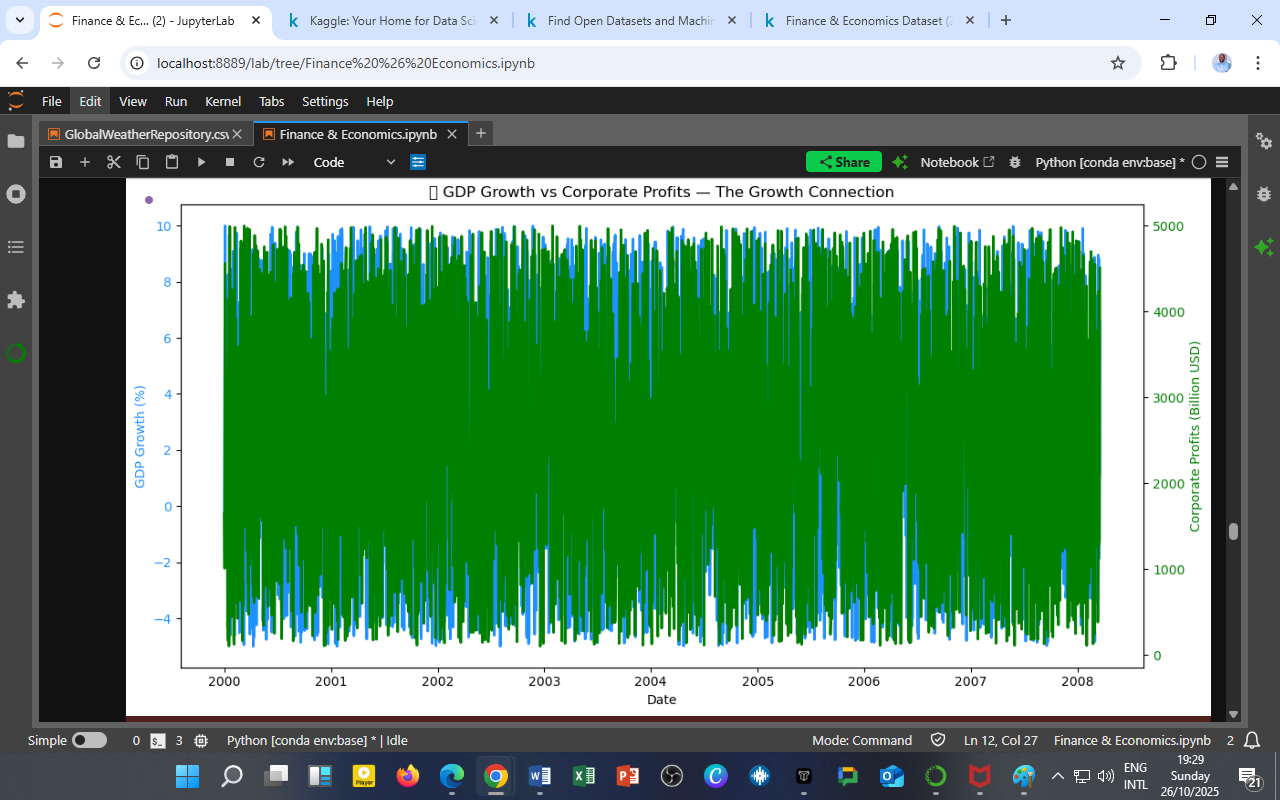

This analysis visualizes that interplay, tracking GDP Growth (%) alongside Corporate Profits (Billion USD) from 2000 to 2008 — a period that encapsulated both economic booms and the onset of global financial turbulence.

Visualization: The Growth Connection

Figure 1: Comparative trend of GDP Growth (%) (blue) and Corporate Profits (Billion USD) (green) between 2000–2008.

Observational Insights

a. Cyclical Synchronization

The data show co-movement between GDP and corporate profits.

Periods of sustained GDP expansion coincide with elevated profit levels, reflecting aggregate demand strength, capacity utilization, and market confidence.

b. Lagged Adjustment Effects

Corporate profits tend to lag slightly behind GDP shifts, a pattern consistent with business cycle theory — companies adjust production and costs gradually following macroeconomic shocks.

c. Pre-Crisis Flattening (2007–2008)

The visualization captures a subtle plateau before 2008, signaling profit compression ahead of the Global Financial Crisis.

This suggests that profit margins can serve as leading indicators of cyclical downturns when combined with debt and inventory metrics.

Analytical Interpretation

| Dimension | GDP Growth | Corporate Profits | Relationship | Implication |

|---|---|---|---|---|

| Economic Booms | Rising | Rising | Positive correlation | Broad-based growth, expanding investment |

| Recessions | Declining | Contracting | Amplified impact | Reduced tax revenues and market liquidity |

| Policy Expansion | Moderate | Recovery lag | Short-term divergence | Stimulus effects on firms lag macro policy |

| Crisis Periods | Sharp fall | Profit collapse | Highly correlated | Profit squeeze drives layoffs and fiscal deficits |

Policy and Economic Significance

-

Investment Climate Indicator:

Sustained profitability supports business confidence, equity valuation, and long-term investment decisions. -

Fiscal Sensitivity:

Government revenues depend on corporate earnings — making profit downturns an early warning for fiscal stress. -

Growth Diagnostics Tool:

A flattening profit curve during steady GDP suggests structural inefficiencies or cost pressures, valuable for policymaking and industrial reform.

The DatalytIQs Academy Insight

When profits breathe, GDP follows; when profits suffocate, growth gasps.

At DatalytIQs Academy, we emphasize examining corporate profitability not in isolation but as part of a feedback system — where microeconomic resilience supports macroeconomic stability, and vice versa.

Students and analysts can use this dual-axis method to model economic feedback loops between business performance, fiscal cycles, and policy efficiency.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025),Kaggle.

Visualization: GDP Growth (%) vs Corporate Profits (Billion USD)

Section: Fiscal–Corporate Interaction Module

Key Takeaway

Corporate profitability is both a mirror and a motor of GDP growth — a diagnostic lens for policy foresight and economic health.

Leave a Reply

You must be logged in to post a comment.