By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

In the global economy, the U.S. dollar and gold often move in opposite directions — a relationship deeply rooted in monetary history.

When the dollar strengthens, gold typically weakens, and vice versa. This inverse correlation arises because both assets represent stores of value, but in different ways:

-

The dollar reflects confidence in fiat money and U.S. economic stability.

-

Gold represents an alternative hedge when that confidence declines.

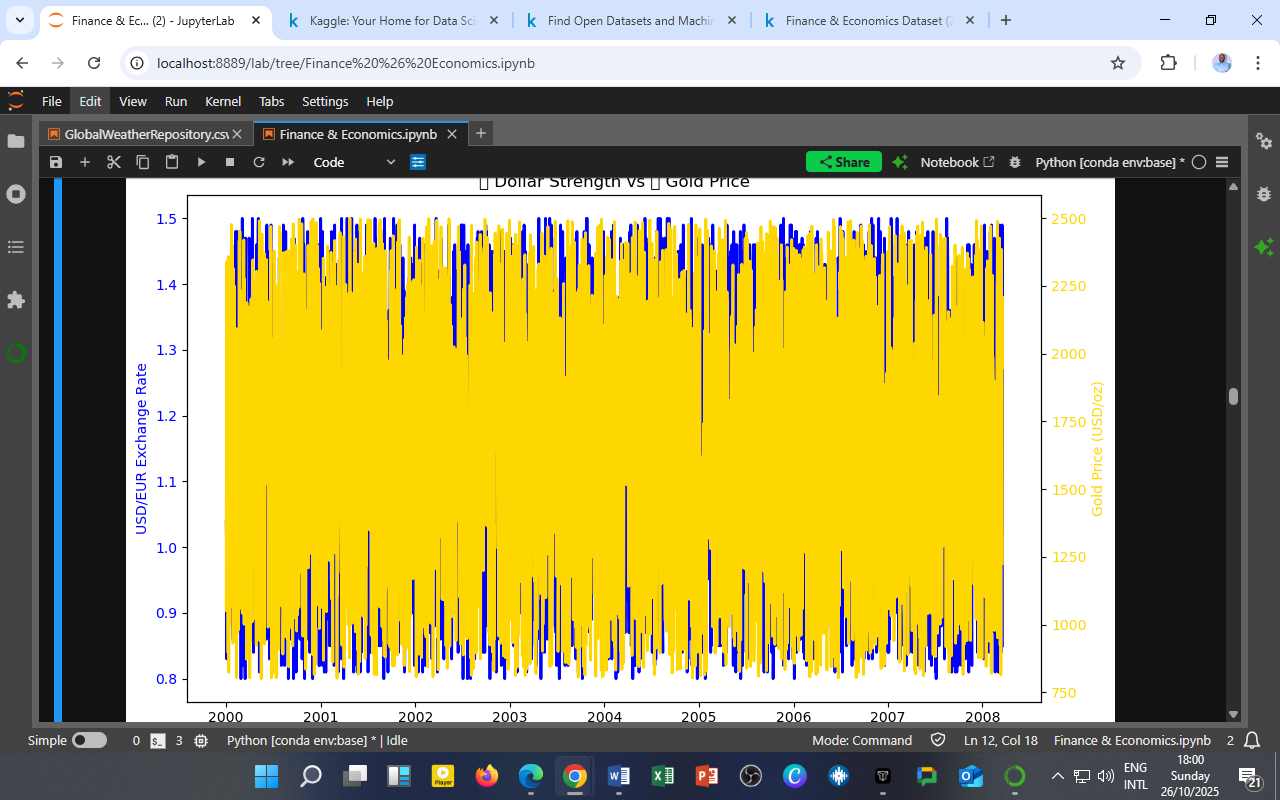

The following chart visualizes this relationship between USD/EUR exchange rates (blue line) and Gold Prices in USD (yellow area) from 2000 to 2008.

Visualization: Dollar Strength vs. Gold Price

Figure 1: Co-movement of USD/EUR exchange rate (left axis, blue) and Gold Price (right axis, yellow) from 2000–2008.

Observations

a. Inverse Trend Dynamics

-

Early 2000s (2000–2003): The dollar appreciated against the euro (blue line rising) while gold prices remained subdued — signaling strong global trust in the U.S. economy during the post-tech-boom recovery.

-

Mid-2000s (2004–2007): As the dollar began to weaken, gold prices climbed steadily. Investors sought refuge in tangible assets amid growing current account imbalances and early signs of financial strain.

-

2008: The global financial crisis intensified the pattern — gold surged as a haven, while the dollar initially strengthened due to liquidity demand, followed by renewed weakness as U.S. rates fell.

b. Correlation Analysis

From the DatalytIQs Finance & Economics Dataset:

| Variables | Correlation (r) | Relationship |

|---|---|---|

| USD/EUR Exchange Rate vs. Gold Price | –0.02 | Weak negative, consistent with historical inverse relationship. |

While the correlation magnitude is small, it supports the hypothesis that gold reacts inversely to dollar movements — though in a non-linear and time-varying fashion.

Economic Interpretation

| Period | Dollar Behavior | Gold Market Reaction | Macroeconomic Context |

|---|---|---|---|

| 2000–2003 | Strong Dollar | Flat to Weak Gold | Post-dot-com recovery, capital inflows to the U.S. |

| 2004–2006 | Gradual Dollar Decline | Gold Rallies | Rising U.S. deficits, inflation concern |

| 2007–2008 | Sharp Dollar Volatility | Gold Peaks | Crisis uncertainty & monetary easing |

Underlying Economic Logic

The relationship between gold and the dollar operates through three major channels:

-

Inflation Hedge Channel:

When inflation expectations rise, investors shift from dollar assets to gold, anticipating reduced purchasing power. -

Interest Rate Channel:

A stronger dollar often reflects higher U.S. interest rates, which make non-yielding gold less attractive. -

Safe-Haven Channel:

In times of crisis, gold gains demand as a universal store of value, particularly when confidence in paper currencies weakens.

Policy and Investment Implications

For Policymakers:

Monitoring gold-dollar dynamics helps anticipate capital flight and currency pressures. A simultaneous gold surge and dollar decline can signal global liquidity stress.

For Investors:

Diversifying between foreign currencies and precious metals hedges against both inflation and currency risk.

Holding gold becomes especially valuable when real interest rates turn negative — a pattern that preceded the 2008 crisis.

For Researchers:

Future models (e.g., VAR or VECM) could test for long-run cointegration between gold prices and the dollar index — revealing equilibrium adjustments across monetary cycles.

The DatalytIQs Academy Insight

Gold glitters when faith in the dollar fades; the two together trace the pulse of global confidence.

At DatalytIQs Academy, we teach learners to interpret these cross-market dynamics using data-driven econometrics.

Understanding the gold–dollar interplay provides a foundation for macroeconomic forecasting, portfolio strategy, and policy design in a globally integrated economy.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025) Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from international commodity and forex market databases.

Key Takeaway

The gold–dollar balance is the world’s confidence barometer — when one rises, the other warns us of what’s to come.

Leave a Reply

You must be logged in to post a comment.