Behavioral Patterns Behind Economic Growth (2000–2008)

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Economic cycles are not driven solely by numbers — they are driven by people’s confidence in the future.

When consumers feel optimistic, they spend more; when pessimism sets in, spending contracts.

But how consistent is this link between confidence and actual consumption behavior over time?

This visualization explores that behavioral connection using daily and monthly data from the Finance & Economics Dataset (2000–2008), highlighting how sentiment and spending patterns interact during different phases of the economic cycle.

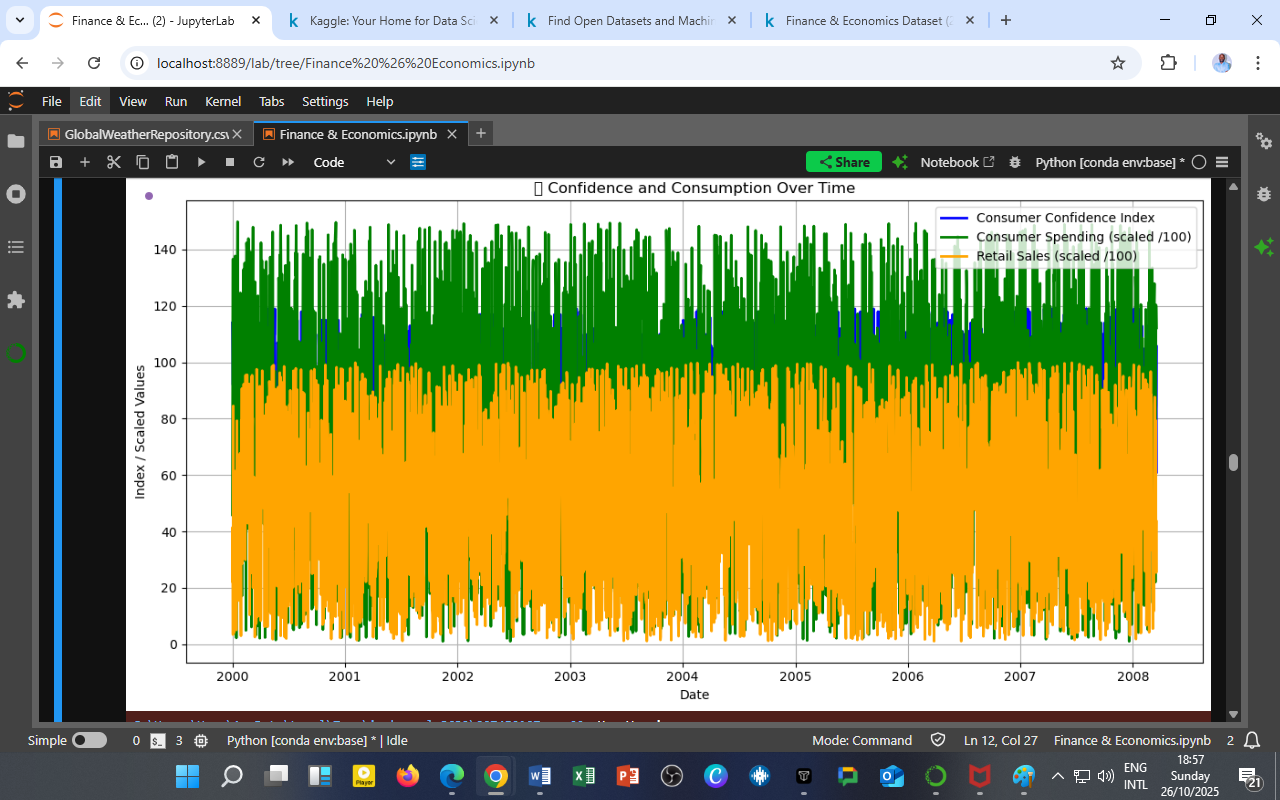

Visualization: Confidence and Consumption Over Time

Figure 1: Trends in Consumer Confidence Index (blue), Consumer Spending (orange), and Retail Sales (green), 2000–2008. Spending and sales are scaled for comparability.

Key Observations

a. Stable Confidence Amid Volatile Spending

The Consumer Confidence Index (blue) remains relatively steady, fluctuating around its long-term mean.

In contrast, Consumer Spending (orange) exhibits pronounced volatility — frequent upward and downward swings that far exceed changes in confidence levels.

This suggests that consumer behavior responds more to external shocks (e.g., inflation, energy prices, fiscal changes) than to gradual changes in sentiment.

b. Retail Sales Follow a Seasonal–Cyclical Pattern

Retail Sales (green) display rhythmic fluctuations — likely tied to seasonal spending cycles such as holidays, end-of-year consumption, and business inventory adjustments.

However, their long-term trend remains consistent with spending, confirming that sales reflect underlying consumption dynamics despite short-term noise.

c. Weak Co-Movement Indicates Behavioral Lag

Visually, the three indicators rarely move together in perfect synchronization.

Spending and retail sales appear to lag behind confidence, hinting that optimism translates into consumption only after a time delay, once income or liquidity conditions align with sentiment.

This lag may explain why earlier correlation and regression analyses found very weak linear relationships (r ≈ 0.01) between these variables.

Economic Interpretation

1. Confidence Alone Doesn’t Drive Consumption

Consumers may express optimism in surveys but remain cautious in real spending — especially during economic uncertainty.

This behavior highlights a confidence–action gap, where positive sentiment exists without corresponding increases in expenditure.

2. Consumption Is Sensitive to Macroeconomic Shocks

Sharp spending dips around 2001–2002 coincide with the post-dotcom correction, while fluctuations after 2005 reflect pre-crisis financial tightening — indicating that macroeconomic forces dominate household psychology.

3. Behavioral Inertia and Liquidity Constraints

Even when confidence rises, households constrained by debt or stagnant wages may delay spending responses.

Conversely, when liquidity improves, spending can surge even without noticeable confidence gains.

Policy and Market Implications

For Policymakers

-

Confidence indices are useful leading indicators, but insufficient alone.

-

Combine them with real-time spending, wage, and credit data for accurate forecasting.

-

Support mechanisms (e.g., tax rebates or consumer credit access) can help convert optimism into tangible economic activity.

For Businesses

-

Track confidence data to anticipate future shifts in consumer demand.

-

Align marketing and inventory strategies with sentiment-driven consumption cycles.

For Researchers and Students

-

Apply lag-based regression models (e.g., VAR or cross-correlation analysis) to quantify the delay between sentiment changes and expenditure responses.

-

Extend the analysis to post-2008 periods to test how confidence dynamics evolved during the global financial crisis and post-pandemic recovery.

The DatalytIQs Academy Insight

Consumer optimism is the emotional spark — but spending power is the economic flame.

At DatalytIQs Academy, we empower learners to bridge the gap between behavioral economics and data analytics, using time-series models and visualization to decode the human side of macroeconomics.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — integrating consumer sentiment indices, retail data, and macroeconomic variables.

Key Takeaway

Economic growth depends not only on what people can afford — but also on when they feel confident enough to act on it.

Leave a Reply

You must be logged in to post a comment.