Understanding the Primary Balance

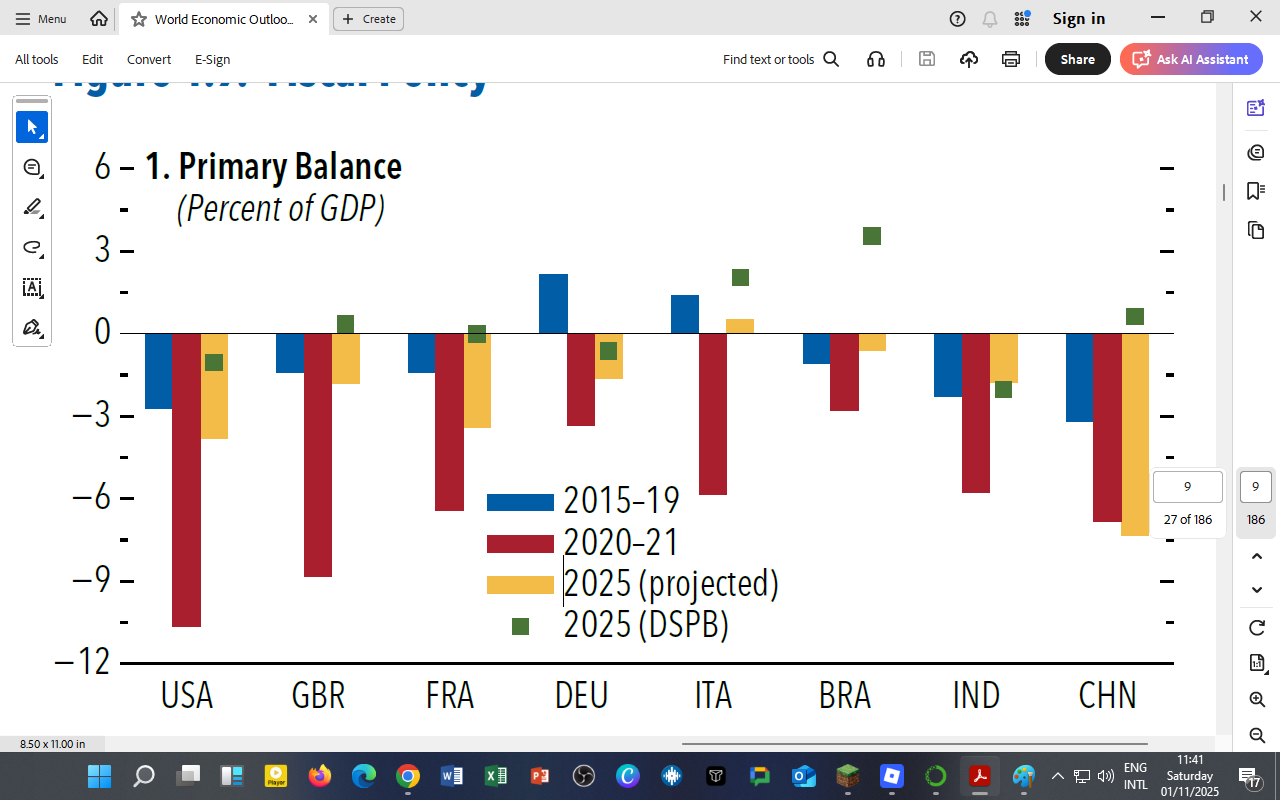

The primary balance measures the difference between a government’s revenues and non-interest expenditures — expressed as a percentage of GDP.

It indicates whether a country’s fiscal policy is expansionary (deficit) or consolidating (surplus).

The chart below tracks fiscal positions for selected economies across four periods:

-

2015–19 (blue): Pre-COVID baseline years

-

2020–21 (red): Pandemic-related fiscal stimulus

-

2025 (projected, yellow): Medium-term fiscal adjustment path

-

2025 (DSPB, green): “Debt-Stabilizing Primary Balance” — the level needed to keep debt ratios constant

Figure — Primary Balance (% of GDP)

Countries covered: USA, GBR, FRA, DEU, ITA, BRA, IND, CHN

Fiscal Storyline

1. 2015–19: Stability and Modest Deficits

Before the pandemic, most economies maintained small primary deficits (–1 % to –3 % of GDP). Fiscal positions were broadly sustainable, anchored by low interest rates and moderate debt levels.

2. 2020–21: The Pandemic Shock

All major economies experienced historic fiscal deterioration as governments launched unprecedented support packages.

-

The United States and the United Kingdom ran double-digit primary deficits (–9 % to –10 %).

-

France, Italy, and India recorded severe slippages due to health and social spending.

-

China and Brazil also loosened fiscal policy aggressively to cushion demand.

3. 2025: Gradual Consolidation but Uneven Progress

-

Fiscal balances have improved but remain below pre-pandemic levels.

-

Germany (DEU) returns close to surplus, reflecting disciplined fiscal management.

-

Italy and France continue to run moderate deficits, while Brazil and India maintain expansionary stances to support growth.

-

China’s projected primary deficit near –5 % of GDP highlights persistent stimulus to sustain domestic demand.

Most countries have yet to reach the Debt-Stabilizing Primary Balance (DSPB), meaning public-debt ratios will keep rising unless further adjustments occur.

Fiscal Trade-Offs in 2025

| Policy Objective | Fiscal Implication | Examples |

|---|---|---|

| Growth Support | Slower consolidation to sustain demand. | India, Brazil |

| Debt Sustainability | Tighter fiscal policy and expenditure cuts. | Germany, UK |

| Social Stability | Protecting welfare spending despite debt pressures. | France, China |

| Green & Digital Investment | Redirecting budgets toward long-term transformation. | EU economies |

The global fiscal debate has shifted from stimulus to sustainability — finding the delicate balance between economic recovery and debt control.

Implications for Africa and Kenya

-

Kenya, like many emerging economies, faces a post-COVID debt overhang with rising interest payments and constrained fiscal space.

-

The primary deficit is near –3.5 % of GDP (2025 projection), suggesting limited progress toward debt stabilization.

-

Fiscal reforms, improved tax administration, and targeted subsidies will be crucial to align Kenya’s primary balance with growth priorities.

-

Lessons from Germany’s fiscal prudence and Brazil’s targeted social spending offer useful models.

A primary balance close to zero is essential for long-term debt sustainability, especially where interest costs are high.

For DatalytIQs Academy Learners

You can extend this analysis by:

-

Recreating the stacked-period bar chart in Python/Matplotlib to visualize fiscal evolution.

-

Calculating Kenya’s debt-stabilizing primary balance using the formula:

where r = interest rate and g = GDP growth.

-

Comparing IMF projections with the Kenya National Treasury’s 2025 Budget Policy Statement.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025), Figure 1.9 – “Primary Balance (% of GDP)”

Acknowledgment: IMF Fiscal Affairs Department and Haver Analytics for data compilation.

Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.