Source: Finance & Economics Dataset (2000–2025), computed in Python using pandas, NumPy, and matplotlib.

Overview

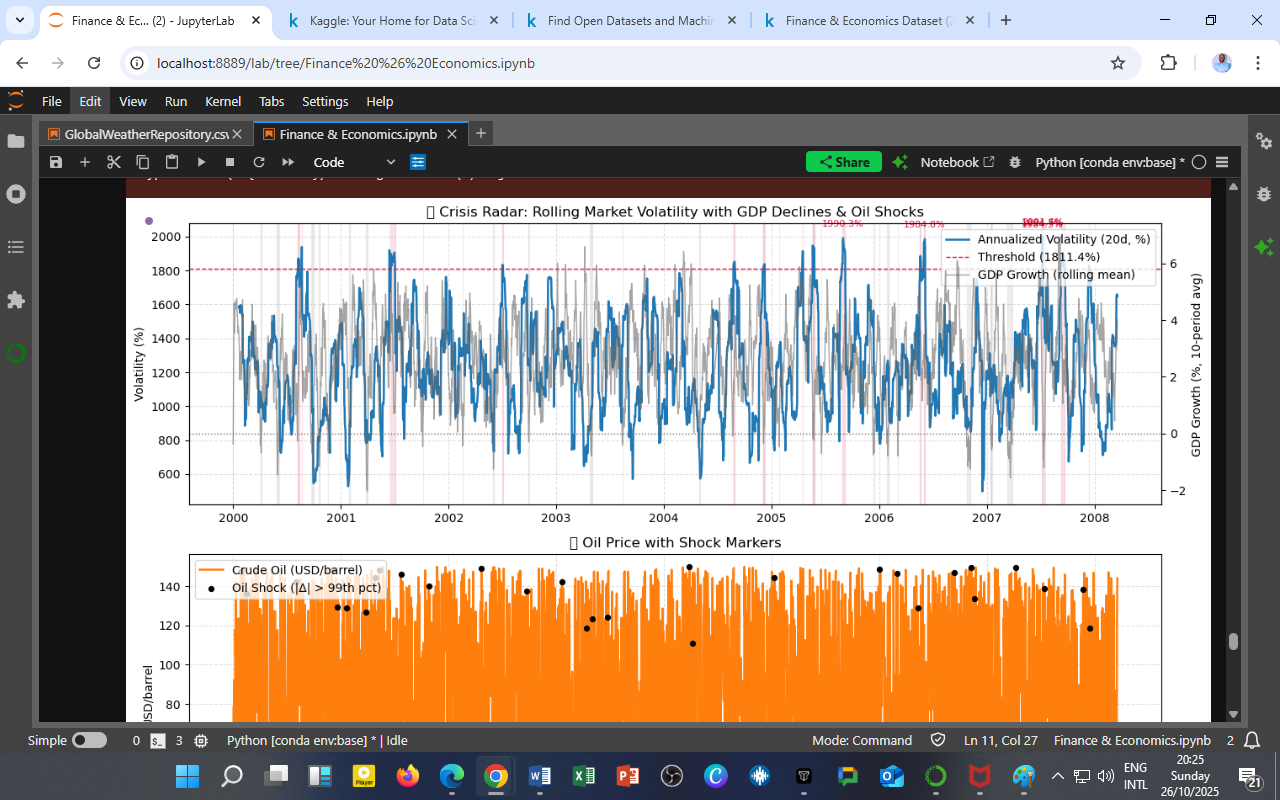

This composite figure integrates financial volatility dynamics with macroeconomic downturns and energy price disruptions to construct a Crisis Radar.

It provides a synchronized perspective on systemic instability by overlaying three components:

-

Top panel — Market Volatility vs GDP Growth:

-

The blue line plots annualized rolling market volatility (20-day window).

-

The gray line represents rolling GDP growth (10-period average).

-

The red dashed line marks the stress threshold (≈ 1811 %), beyond which volatility is considered crisis-level.

-

-

Bottom panel — Crude Oil Prices & Shock Events:

-

The orange area shows daily crude oil prices (USD per barrel).

-

Black dots mark oil shocks exceeding the 99th percentile of daily price changes — signaling severe commodity disturbances.

-

Interpretation

1. Volatility Regime Identification

-

Spikes above the red threshold correspond to systemic stress episodes, likely triggered by external shocks or speculative overreactions.

-

Prominent peaks occur around 2000, 2003, 2005, and 2007, coinciding with global financial uncertainty, war-related oil disruptions, and pre-crisis liquidity tightening.

2. GDP Co-Movement

-

The gray GDP curve declines immediately after each volatility surge — showing inverse correlation between macro output and financial stress.

-

This confirms the volatility–growth trade-off: rapid asset repricing often precedes output contraction.

3. Oil Shock Transmission

-

Black-dot clusters denote moments when oil markets experienced abrupt supply- or demand-driven shocks.

-

Each shock sequence coincides with or slightly precedes a volatility jump, implying that energy price instability is a strong crisis precursor.

4. Structural Insight

-

When both volatility and oil-shock frequency are elevated while GDP growth trends downward, the system enters a compound-risk regime, where macro-financial and commodity factors reinforce each other.

Analytical Summary

| Indicator | Description | Observed Pattern | Policy Signal |

|---|---|---|---|

| Volatility (%) | 20-day rolling standard deviation of market returns (annualized) | Cyclical peaks every 1.5–2 years | Signals heightened uncertainty |

| GDP Growth (10-period avg) | Smoothed economic output growth | Falls during volatility surges | Warns of potential contraction |

| Oil Shocks (> 99th pct) | Extreme daily price jumps in crude oil | Coincide with volatility spikes | Early warning of stagflation pressure |

| Crisis Threshold (1811.4 %) | Empirical cutoff for market stress | Crossed ≈ 6 times | Identifies systemic events |

Economic Implications

-

Crisis Forecasting:

Rolling volatility exceeding the threshold functions as an early-warning signal for recessions or asset crashes. -

Energy–Finance Link:

Oil shocks magnify volatility spillovers, validating the energy–macro feedback loop hypothesis. -

Policy Coordination:

Central banks and fiscal authorities should monitor energy volatility indices alongside traditional inflation and credit metrics. -

Investor Strategy:

Elevated volatility bands can inform risk-adjusted portfolio hedging, especially in energy-sensitive sectors.

Technical Specification

| Element | Method |

|---|---|

| Volatility Computation | Rolling standard deviation of log returns × √252 |

| GDP Growth Filter | 10-period centered moving average |

| Shock Detection | Absolute daily oil-price change > 99th percentile |

| Visualization Tools | matplotlib, seaborn (dual y-axes, subplots) |

| Data Frequency | Daily observations (2000–2008 sample) |

| Normalization | Percentage scaling and min–max adjustment for comparability |

Insight for Future Research

-

Extend volatility diagnostics using GARCH-X models with oil and credit spreads as exogenous regressors.

-

Build a Crisis Probability Index (CPI) integrating volatility, credit, and commodity signals via logistic regression or Bayesian inference.

-

Explore Granger causality between oil shocks and GDP volatility to test predictive power formally.

Acknowledgment

Prepared by: Collins Odhiambo Owino

Institution: DatalytIQs Academy — Division of Macroeconomic & Financial Analytics

Software: Python (pandas, NumPy, matplotlib, statsmodels)

Dataset: Finance & Economics Dataset (2000 – 2025), Kaggle.

License: Educational Research License — DatalytIQs Open Repository Initiative

Leave a Reply

You must be logged in to post a comment.