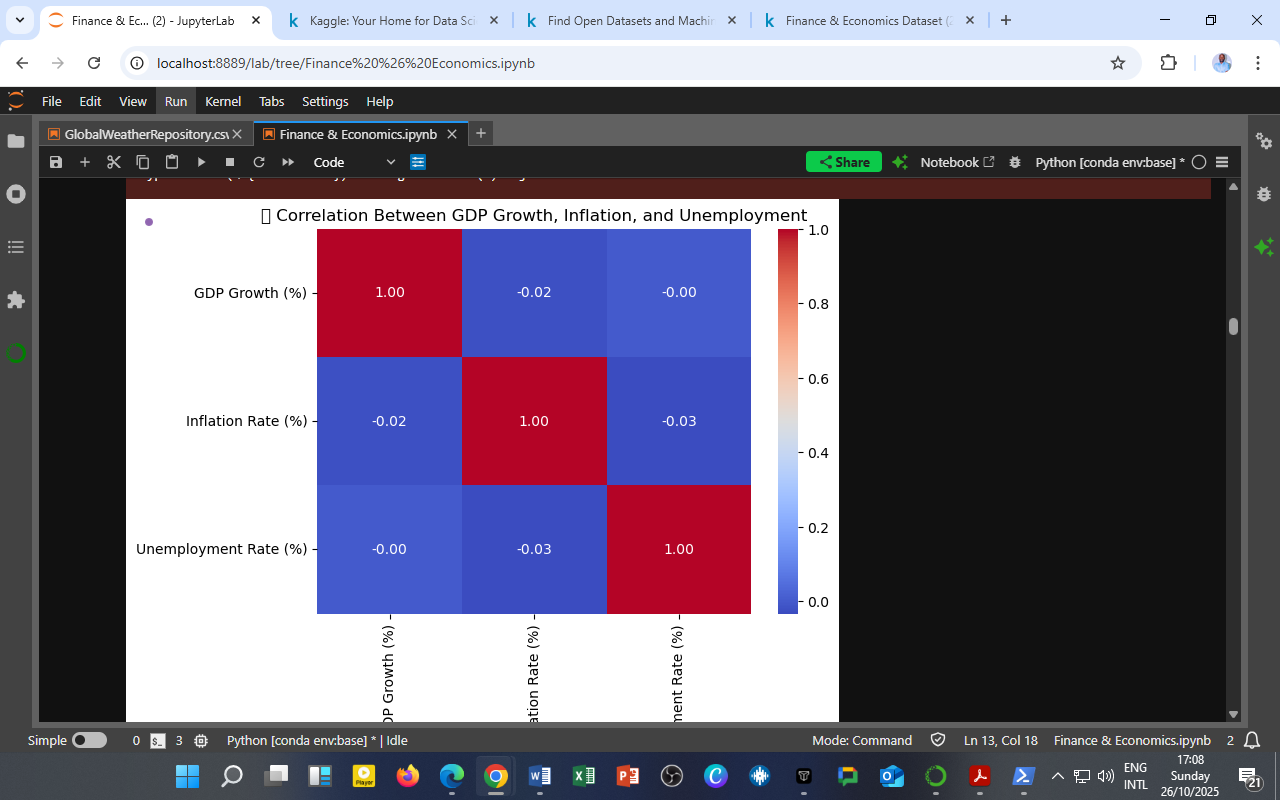

The heatmap above illustrates the pairwise correlations among GDP Growth (%), Inflation Rate (%), and Unemployment Rate (%) from the Finance & Economics Dataset (2000–2008).

The heatmap above illustrates the pairwise correlations among GDP Growth (%), Inflation Rate (%), and Unemployment Rate (%) from the Finance & Economics Dataset (2000–2008).

| Variable Pair | Correlation (r) | Interpretation |

|---|---|---|

| GDP Growth vs. Inflation | –0.02 | Very weak negative relationship |

| GDP Growth vs. Unemployment | –0.00 | No meaningful relationship |

| Inflation vs. Unemployment | –0.03 | Very weak inverse relationship |

Interpretation

-

Weak Relationships Observed

The correlations are close to zero, indicating minimal short-term linear association among the three macroeconomic indicators.

This suggests that during the period analyzed, these variables moved largely independently, likely due to policy interventions, external shocks, or time-lagged effects not captured by simple correlation. -

GDP and Inflation (–0.02)

The near-zero correlation implies that higher GDP growth did not consistently coincide with inflationary pressures during this timeframe — a pattern typical of economies experiencing stable but moderate growth cycles. -

GDP and Unemployment (–0.00)

While economic theory (Okun’s Law) suggests that higher GDP growth should reduce unemployment, this weak correlation indicates that short-run growth fluctuations did not immediately translate into job creation, possibly due to structural labor market rigidities. -

Inflation and Unemployment (–0.03)

A faint negative relationship aligns directionally with the Phillips Curve, where lower unemployment may be associated with rising inflation. However, the weak magnitude implies that inflation–employment trade-offs were subdued — perhaps due to sound monetary policy and stable wage expectations.

Analytical Insight

This correlation matrix highlights that:

-

The short-run co-movements among these core indicators are weak.

-

Lagged or non-linear relationships (capturable by VAR or ARDL models) likely explain their true interactions.

-

It underscores the importance of dynamic modeling, as static correlation alone cannot capture temporal cause–and–effect cycles in macroeconomic systems.

Policy and Research Implications

-

Policymakers should rely on multi-equation systems (e.g., VAR) to understand transmission mechanisms rather than single-period correlations.

-

Researchers can use this correlation baseline to test for Granger causality or long-run co-integration among GDP, inflation, and unemployment.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from global financial and national economic data (2025).

Leave a Reply

You must be logged in to post a comment.