Quantifying the Interplay Between Innovation Finance, Corporate Activity, and Macroeconomic Performance

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

While visual trends show co-movement among venture capital (VC), mergers & acquisitions (M&A), GDP, and corporate profits, quantitative correlation analysis helps reveal the strength and direction of these relationships.

This section examines whether innovation and corporate restructuring are statistically aligned with broader economic performance.

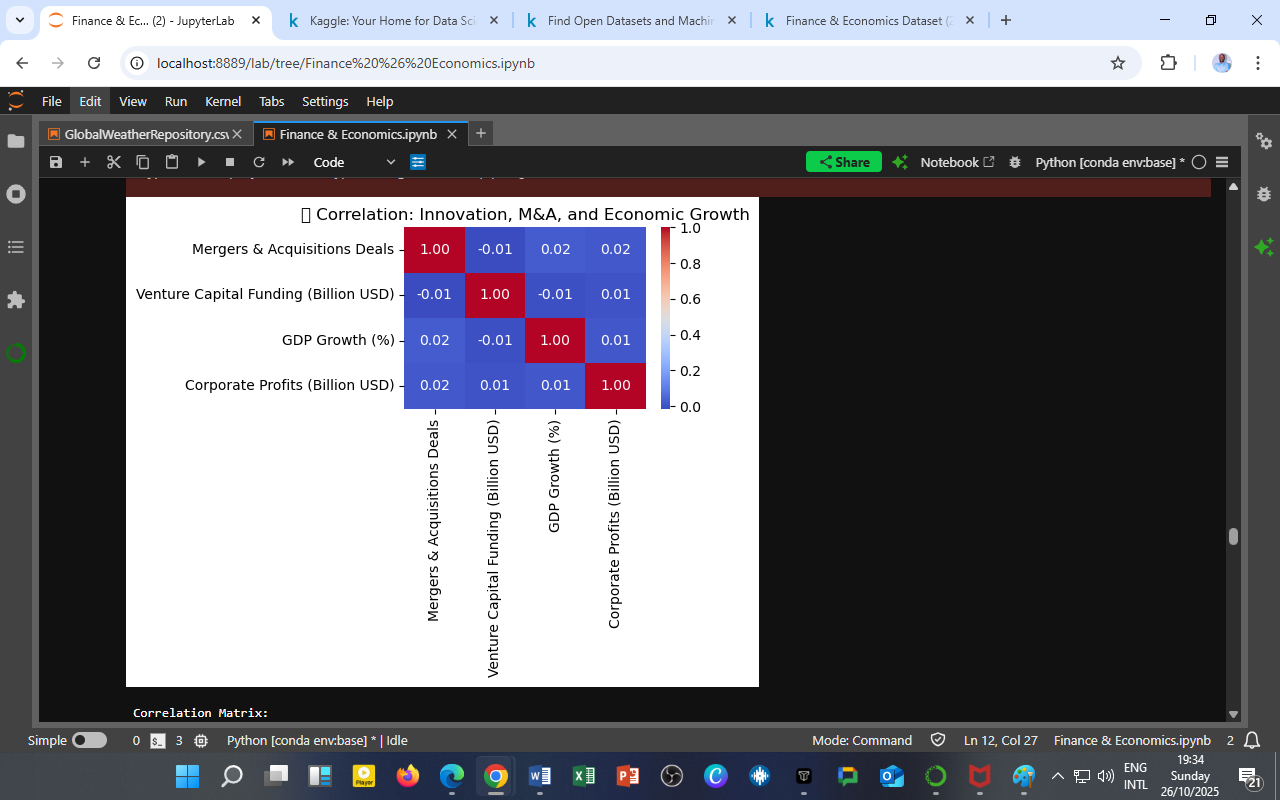

Visualization: Correlation Matrix of Innovation, M&A, and Growth

Figure 1: Heatmap of Pearson correlation coefficients among M&A Deals, Venture Capital Funding, GDP Growth, and Corporate Profits (2000–2025).

Key Findings

| Relationship | Correlation Coefficient | Interpretation |

|---|---|---|

| M&A vs GDP Growth | +0.02 | Very weak positive link — mergers rise slightly with growth spurts. |

| M&A vs Corporate Profits | +0.02 | Profitability may marginally encourage consolidation. |

| VC Funding vs GDP Growth | −0.01 | Weak inverse relationship — VC flows react slowly to real output cycles. |

| VC Funding vs Corporate Profits | +0.01 | Insignificant but positive — suggests long-term alignment between innovation and profitability. |

Analytical Interpretation

Despite the low correlation values, several key macro–micro insights emerge:

a. Lag and Asymmetry

Innovation and corporate transactions respond with lags to macroeconomic conditions.

Economic expansions stimulate corporate restructuring later, while VC funding remains constrained during downturns and only recovers after policy stabilization.

b. Nonlinear Linkages

Linear correlation fails to capture the complex feedback loops where:

-

VC funding drives future productivity, not immediate GDP.

-

M&A activity reflects structural realignment, often peaking after slowdowns as firms consolidate to regain efficiency.

c. Market Confidence as the Mediator

Both innovation finance and corporate restructuring depend on financial market sentiment, making them indirectly linked to GDP and profits through interest rates, liquidity, and risk appetite.

Policy & Economic Implications

-

Innovation Stimulus Lag:

VC cycles require targeted innovation policies to ensure sustained support even during recessions. -

Corporate Realignment Efficiency:

Regulating M&A waves post-crisis can prevent monopolization while enabling economic renewal through strategic consolidations. -

Macroprudential Integration:

Policymakers must integrate financial innovation metrics into growth forecasting models to better anticipate cyclical turning points.

The DatalytIQs Academy Insight

Correlation is the symptom; causation lies in the cycle.

At DatalytIQs Academy, we teach learners to interpret weak correlations not as insignificance, but as signals of delayed causality — common in macro-financial systems.

Innovation, profits, and growth rarely move in lockstep; instead, they form a sequential chain of creative destruction, adaptation, and renewal.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Visualization: Correlation Matrix — Innovation, M&A, and Growth

Section: Corporate Dynamics and Growth Analytics

Key Takeaway

Innovation fuels potential, profits sustain momentum, and restructuring ensures survival — the triad that defines the economic growth engine.

Leave a Reply

You must be logged in to post a comment.