By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

The relationship between corporate profits and economic growth lies at the heart of modern macroeconomic analysis.

When businesses thrive, they invest more, hire more, and pay more taxes — all of which can fuel national output.

Yet, in some cases, profit surges coexist with weak economic expansion, revealing deeper structural imbalances.

This analysis explores whether rising corporate earnings are significantly correlated with GDP growth, using empirical data from the Finance & Economics Dataset (2000–2008).

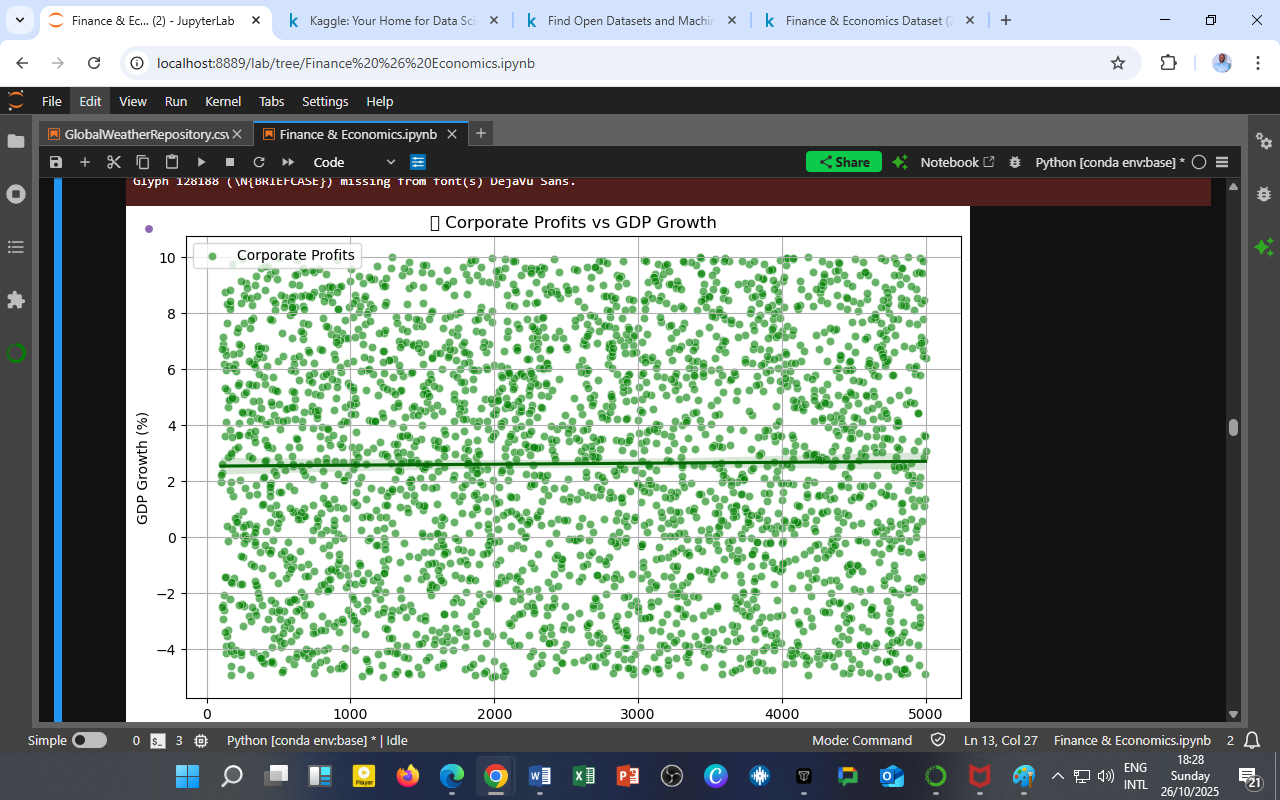

Visualization: Corporate Profits vs GDP Growth

Figure 1: Scatter plot showing Corporate Profits (Billion USD) versus GDP Growth (%), highlighting the trend line.

Observations

a. Flat Relationship

The scatterplot reveals no strong trend between corporate profits and GDP growth — the data points are widely dispersed with only a slight upward tilt.

This indicates that profit levels alone do not predict growth performance, supporting the earlier regression results (OLS p-value = 0.523).

b. High Variability

Across the observed range:

-

GDP growth fluctuates between approximately –4% and +10%,

-

Corporate profits vary widely but without a consistent macroeconomic influence.

This suggests that while firms’ earnings are crucial micro-level indicators, aggregate economic growth depends on multiple interlinked factors — including fiscal policy, household consumption, and global trade flows.

Economic Interpretation

1. Structural Decoupling

The weak correlation indicates a decoupling between corporate performance and real economic expansion — a trend observed globally since the early 2000s:

-

Profits increasingly arise from financial markets and intellectual property, not just real production.

-

Productivity gains are concentrated in a few multinational firms, reducing the economy-wide multiplier.

2. Profit Distribution Matters

When profits are unevenly distributed, GDP growth benefits less.

If firms hoard earnings or repurchase shares instead of reinvesting in local capacity, the broader economy sees limited stimulus.

3. Fiscal–Corporate Interplay

The earlier regression results (from the GDP–Debt–Profit model) showed that while corporate profits have a positive sign, they are statistically insignificant.

Hence, policy-driven demand and public investment may play larger roles in driving GDP growth than corporate earnings alone.

Policy Implications

For Governments

-

Encourage corporate reinvestment incentives (e.g., tax credits for capital expansion and innovation).

-

Strengthen public-private linkages — channel profits into productive sectors through infrastructure, R&D, and job creation.

For Corporates

-

Reinvest surplus earnings into domestic operations, training, and technology to create sustainable growth linkages.

-

Improve transparency in profit utilization to enhance investor and public confidence.

For Researchers

Future models (e.g., Granger causality tests or vector error correction models) could help identify:

-

Whether profits lead GDP growth (investment-driven cycles), or

-

GDP growth drives profits (demand-driven cycles).

The DatalytIQs Academy Insight

Corporate success without inclusive growth is like a tree that grows tall without roots — impressive, but unstable.

At DatalytIQs Academy, we integrate data-driven econometric analysis with policy and business insights to help learners understand how firm-level decisions ripple through national economies.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from corporate financial statements, fiscal data, and GDP indicators.

Key Takeaway

Profits reflect business success, but growth reflects shared prosperity. Economies thrive when earnings translate into productive reinvestment and innovation.

Leave a Reply

You must be logged in to post a comment.