Insights from Correlation Heatmaps

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

How closely are people’s feelings about the economy linked to their actual spending behavior?

And do consumer moods ripple into broader investment patterns such as venture capital activity?

Using behavioral and macroeconomic data from the Finance & Economics Dataset (2000–2008), this analysis visualizes and interprets the relationships between Consumer Confidence, Spending, Retail Sales, and Venture Capital Funding — four crucial indicators of economic sentiment and momentum.

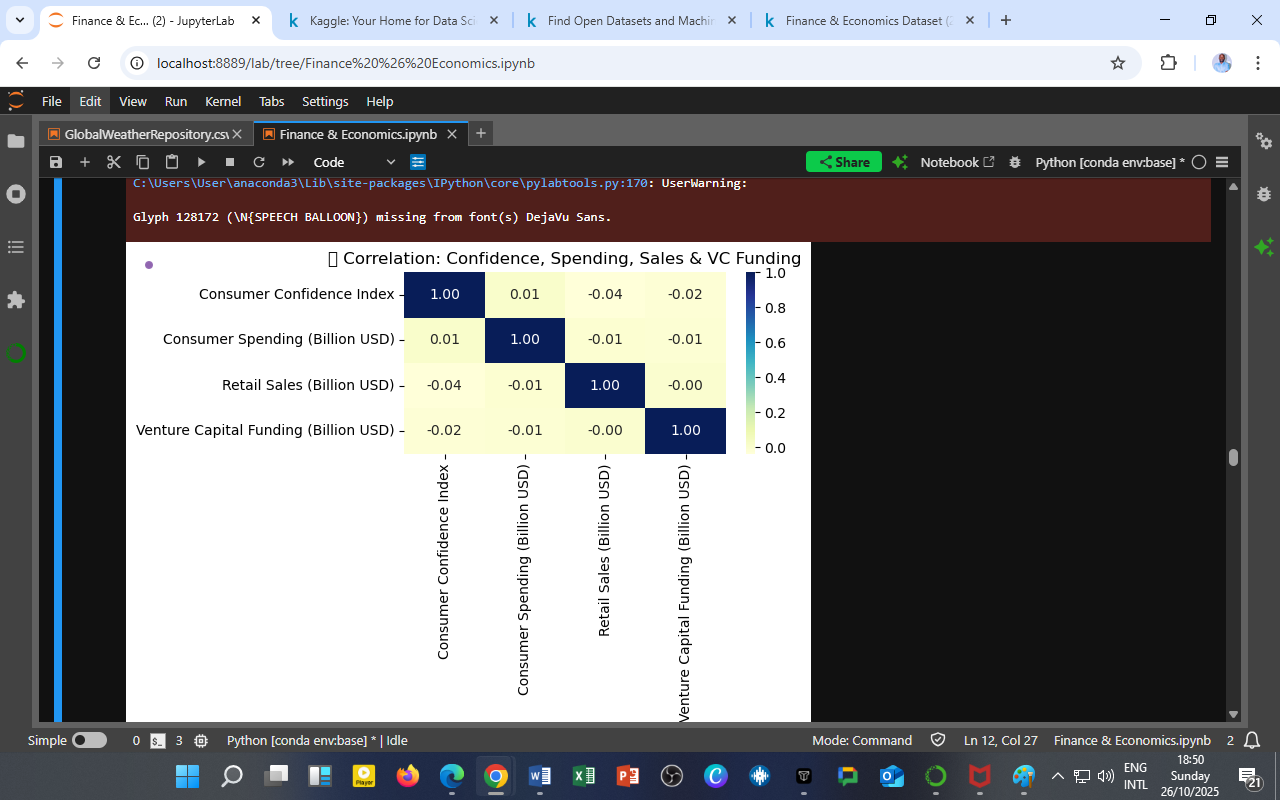

Visualization: Correlation Heatmap

Figure 1: Correlation among Consumer Confidence, Spending, Retail Sales, and Venture Capital Funding (2000–2008).

Key Observations

a. Minimal Correlation Across Indicators

The heatmap reveals that most relationships cluster around zero, implying very weak linear associations:

-

Confidence ↔ Spending: 0.01

-

Confidence ↔ Retail Sales: –0.04

-

Confidence ↔ Venture Capital Funding: –0.02

-

Spending ↔ Retail Sales: –0.01

This suggests that psychological optimism and economic activity did not move hand-in-hand during this period — a classic sign of confidence–consumption decoupling.

b. Retail Sales Decouple from Sentiment

Despite being a direct measure of household demand, retail sales show almost no correlation with confidence or spending metrics.

Possible explanations include:

-

Inflationary price effects are distorting nominal sales values,

-

Temporal mismatches between sentiment surveys and retail reporting cycles,

-

Shifts in online vs. physical spending during the early 2000s.

c. Venture Capital: Independent Investment Cycles

Venture Capital Funding appears largely isolated from consumer dynamics (r ≈ –0.02).

This reflects that venture investment follows innovation and technology cycles, not household psychology. In fact, some of the largest VC surges occur during low-confidence periods — when firms seek counter-cyclical opportunities.

Economic Interpretation

1. Behavioral Fragmentation

Economic decision-making is multi-dimensional — optimism may influence savings or asset holdings rather than consumption directly.

This weak linkage underscores that confidence is a necessary but insufficient condition for spending.

2. Structural Shifts in the 2000s

The early 21st century saw increasing financialization and global market integration.

As a result, household sentiment became less predictive of real economic trends, while market indicators (interest rates, asset prices, liquidity) gained stronger explanatory power.

3. Innovation-Driven Investment

Venture capital operates on long-horizon expectations, not short-term consumer behavior.

Thus, policymakers and analysts should interpret VC flows as structural innovation signals, not as reflections of business or consumer cycles.

Policy & Business Implications

For Policymakers

-

Recognize that consumer sentiment surveys provide only partial insights; complement them with household debt, wage, and savings data.

-

Foster confidence that leads to actionable spending — for instance, via credit support, digital payment adoption, and job security measures.

For Businesses

-

Align marketing strategies not with generic “optimism” but with real spending capacity segments.

-

Use behavioral analytics to anticipate when optimism is most likely to convert to purchases.

For Investors

-

Venture capitalists should interpret dips in confidence as potential entry windows, given that innovation often accelerates during market uncertainty.

The DatalytIQs Academy Insight

Behavioral optimism is powerful — but without purchasing power and innovation flow, it remains potential energy.

At DatalytIQs Academy, we bridge data science with behavioral economics, helping students and analysts visualize complex human–economic relationships through correlation heatmaps, sentiment analytics, and econometric modeling.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — integrated from consumer confidence indices, retail metrics, and venture funding records.

Key Takeaway

Confidence, consumption, and innovation each tell a part of the economic story — but only when read together can they reveal the psychology of growth.

Leave a Reply

You must be logged in to post a comment.