Context: Tariffs and the Price Channel

When governments impose tariffs, one of the key questions is: How much do import prices actually rise?

In theory, tariffs make imports costlier, but exchange-rate movements, supplier pricing, and corporate margins often absorb part of the shock.

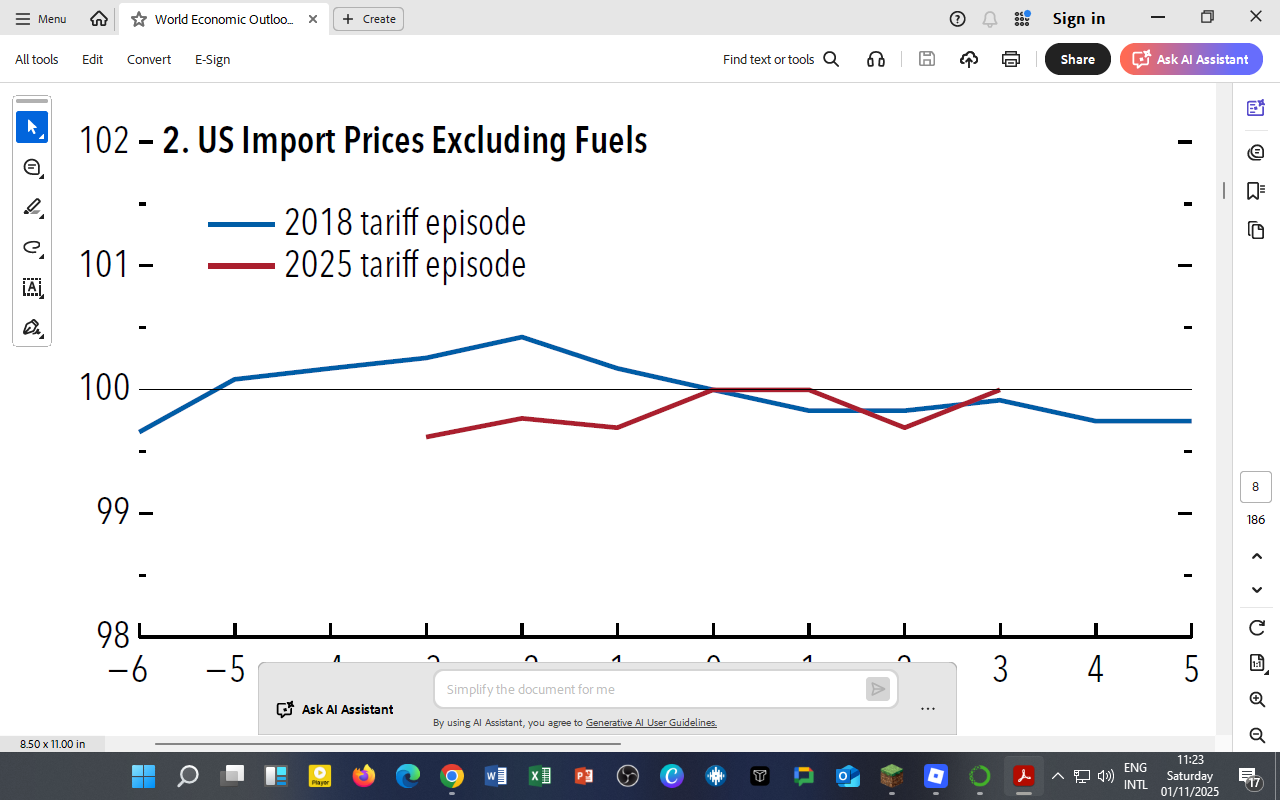

The IMF’s analysis of US import prices excluding fuels compares two major tariff episodes:

-

2018 episode (blue line): Tariffs during the US–China trade tensions.

-

2025 episode (red line): New trade restrictions and supply-chain restructuring under the 2025 global tariff wave.

Figure 1.8 (2) — US Import Prices (Excluding Fuels)

Observation:

-

Both episodes show limited movement in import prices (index near 100).

-

In 2018, prices rose slightly after tariffs were imposed, but fell back within a year.

-

In 2025, despite higher tariffs, import prices remained flat — reflecting stronger dollar appreciation and shifts toward alternative suppliers.

Tariffs in 2025 appear to have had smaller pass-through effects on import prices compared to 2018, suggesting firms have become more adept at diversifying supply chains and absorbing costs.

Why Prices Stayed Stable

| Stabilizing Factor | Description |

|---|---|

| Exchange Rate Buffer | A stronger US dollar offset import price increases. |

| Global Supply Diversification | Imports shifted from China to lower-cost Asian and Latin American producers. |

| Corporate Absorption | Retailers and manufacturers narrowed margins to protect demand. |

| Declining Freight Costs | Post-pandemic normalization of shipping rates reduced trade costs. |

Unlike 2018, global markets in 2025 are better positioned to absorb tariff shocks through structural flexibility rather than price inflation.

Implications for Global Trade and Emerging Economies

-

Reduced Pass-Through: Advanced economies are now less inflation-sensitive to tariff shocks.

-

Emerging Market Exposure: Developing economies like Kenya still feel indirect effects through imported goods (machinery, electronics).

-

Trade Re-routing: The redirection of US import demand creates new export opportunities for Asia, Africa, and Latin America.

Tariffs alone don’t always cause visible inflation — their impact depends on currency strength, trade substitution, and supply resilience.

Lessons for Kenya and Africa

-

Kenya can capitalize on supply-chain diversification by positioning itself as a value-added exporter within the AfCFTA framework.

-

Building regional manufacturing clusters in electronics, textiles, and logistics could attract trade re-routing from Asia.

-

Maintaining exchange-rate stability remains essential to shield against imported inflation.

For DatalytIQs Academy Learners

Recreate this analysis by:

-

Using Matplotlib to plot 2018 vs 2025 tariff episode indices.

-

Simulating the effect of a 5 % tariff increase on Kenya’s imported goods using exchange-rate elasticities.

-

Calculating pass-through coefficients to estimate how much global price shocks translate into domestic inflation.

Data and Acknowledgment

Source: IMF World Economic Outlook (October 2025) – Figure 1.8 (2) “US Import Prices Excluding Fuels.”

Acknowledgment: IMF staff calculations using Bureau of Labor Statistics (BLS) import price indices.

Author: Collins Odhiambo Owino, DatalytIQs Academy

Leave a Reply

You must be logged in to post a comment.