A Correlation Analysis from the DatalytIQs Finance & Economics Dataset

By Collins Odhiambo Owino

Founder & Lead Analyst — DatalytIQs Academy

Source: Finance & Economics Dataset (2000–2025), DatalytIQs Academy Research Repository

Introduction

Global markets are tightly interwoven. Movements in oil, gold, and foreign exchange (forex) reflect not only commodity demand but also monetary policy expectations, geopolitical shifts, and investor sentiment.

In this section of the Finance & Economics Dataset, we explore how these markets interact — particularly the correlation between:

-

Crude Oil Prices (USD/barrel)

-

Gold Prices (USD/ounce)

-

Forex USD/EUR

-

Forex USD/JPY

Correlation Matrix

| Variable | Crude Oil | Gold | USD/EUR | USD/JPY |

|---|---|---|---|---|

| Crude Oil Price | 1.00 | 0.01 | 0.00 | 0.02 |

| Gold Price | 0.01 | 1.00 | -0.02 | -0.00 |

| Forex USD/EUR | 0.00 | -0.02 | 1.00 | -0.04 |

| Forex USD/JPY | 0.02 | -0.00 | -0.04 | 1.00 |

(Source: Kaggle Finance & Economics Dataset, 2000–2008)

Interpretation of Results

a. Crude Oil vs Gold (r = 0.01)

A near-zero correlation shows no significant linear relationship between oil and gold prices in this dataset period.

-

Typically, oil represents industrial demand, while gold acts as a monetary hedge.

-

Their weak link implies that during 2000–2008, energy price cycles and safe-haven movements were largely independent, possibly due to global diversification of commodities and currency reserves.

b. Crude Oil vs Forex Rates (USD/EUR = 0.00, USD/JPY = 0.02)

Oil prices are usually inversely linked to the U.S. dollar, since commodities are dollar-denominated.

However, the correlation here is almost zero — meaning short-term oil price shifts did not directly affect exchange rate volatility.

This could reflect a period of exchange rate stabilization due to central bank interventions and coordinated macroeconomic policies in major economies.

c. Gold vs Forex (USD/EUR = -0.02, USD/JPY = -0.00)

Gold and the U.S. dollar often move in opposite directions, as gold strengthens when the dollar weakens.

The weak negative correlations here support that trend — though not statistically strong — indicating that other global forces (e.g., inflation fears, interest rate policy, geopolitical tension) were also driving gold demand.

d. Forex Cross Rates (USD/EUR vs USD/JPY = -0.04)

A small negative correlation shows mild divergence — when the dollar weakens against the euro, it tends to slightly strengthen against the yen, hinting at regional rebalancing in currency markets.

Economic Insights

| Observation | Explanation | Implication |

|---|---|---|

| Low correlations across all pairs | Global assets moved largely independently during this period. | Markets were influenced by diverse regional and policy factors. |

| Gold’s independence | Gold maintained its role as a “non-yielding haven.” | Investors may hedge inflation and uncertainty with gold even when currencies are stable. |

| Oil–Forex neutrality | Oil price shocks did not immediately spill over to FX markets. | Reflects increased hedging efficiency and diversified energy supply. |

| USD cross-rate resilience | USD remained relatively stable despite commodity fluctuations. | Reinforces the dollar’s dominance as a reserve currency. |

Policy and Market Implications

-

For Policymakers:

Stable cross-market correlations highlight the effectiveness of global monetary coordination and hedging mechanisms that reduced systemic contagion between energy, metals, and currency markets. -

For Investors:

Portfolio diversification across commodities and currencies remained statistically sound, since these asset classes moved independently.

Including gold and foreign exchange exposure could provide risk insulation against commodity price volatility. -

For Economists and Data Scientists:

Low linear correlations do not mean “no relationship.” Future analyses could apply nonlinear methods (e.g., cointegration tests or wavelet coherence) to capture long-term equilibrium dynamics between commodities and exchange rates.

DatalytIQs Academy Perspective

At DatalytIQs Academy, we teach learners to analyze macroeconomic data beyond surface correlations — connecting time-series patterns with global market forces.

This exercise demonstrates how data science in finance unveils relationships that evolve with monetary regimes, energy transitions, and investor behavior.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from global financial databases and open macroeconomic sources (2025).

Key Takeaway

Oil fuels economies, gold stores value, and currencies express confidence — but their interplay is subtle, shaped by policy stability and the complex rhythm of global trade.

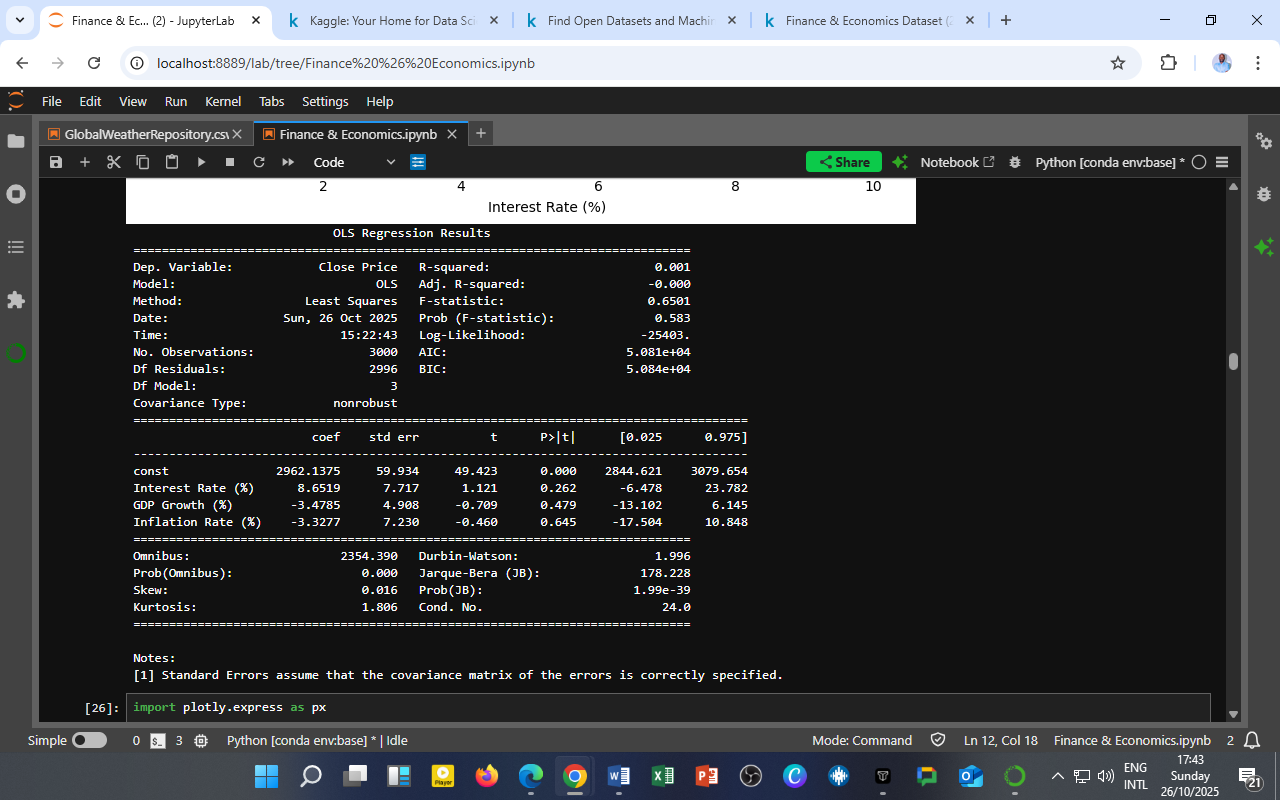

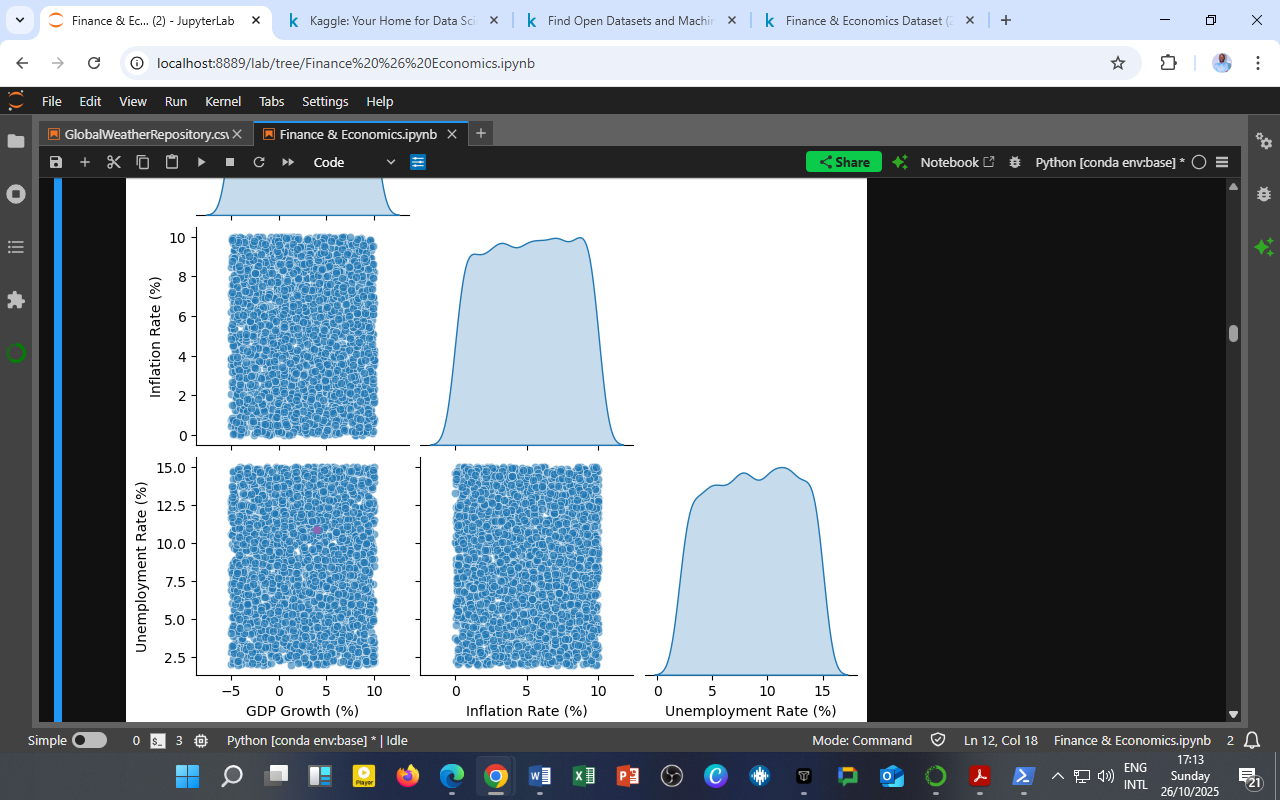

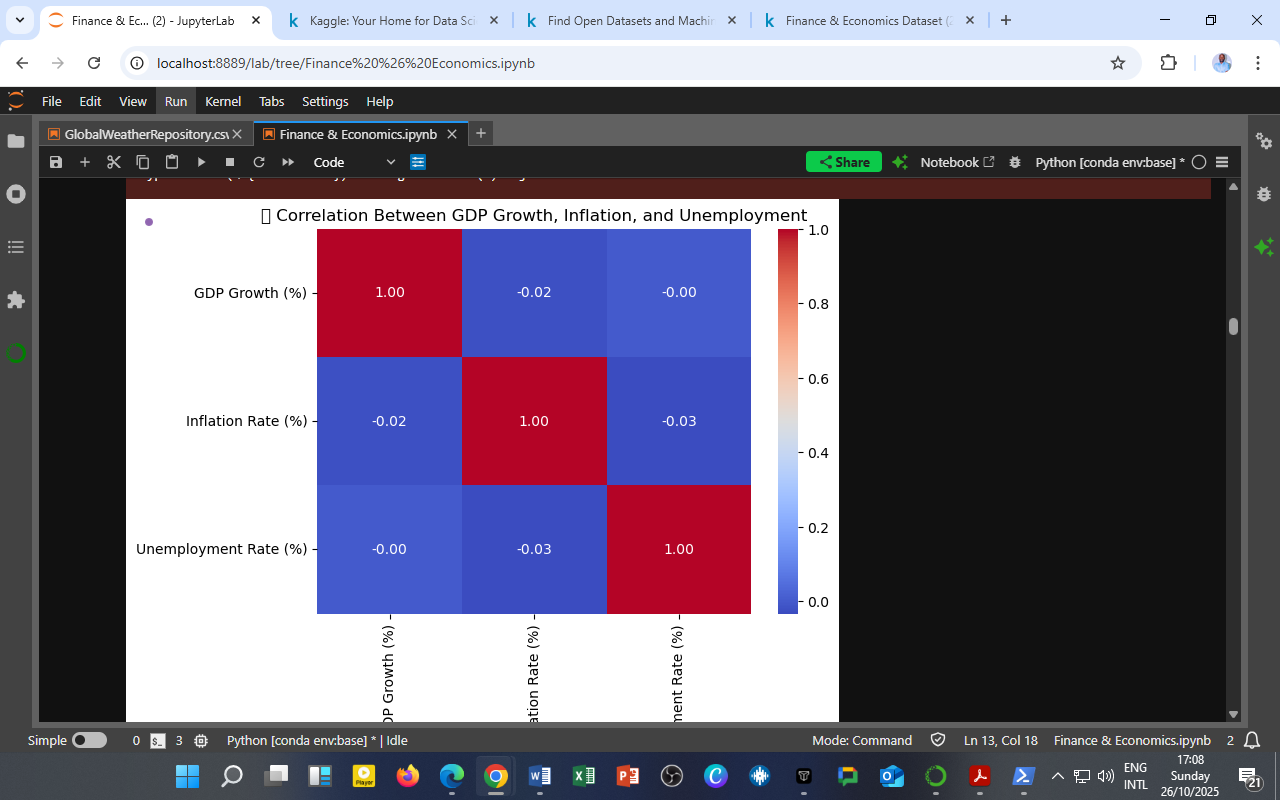

The heatmap above illustrates the pairwise correlations among GDP Growth (%), Inflation Rate (%), and Unemployment Rate (%) from the Finance & Economics Dataset (2000–2008).

The heatmap above illustrates the pairwise correlations among GDP Growth (%), Inflation Rate (%), and Unemployment Rate (%) from the Finance & Economics Dataset (2000–2008).

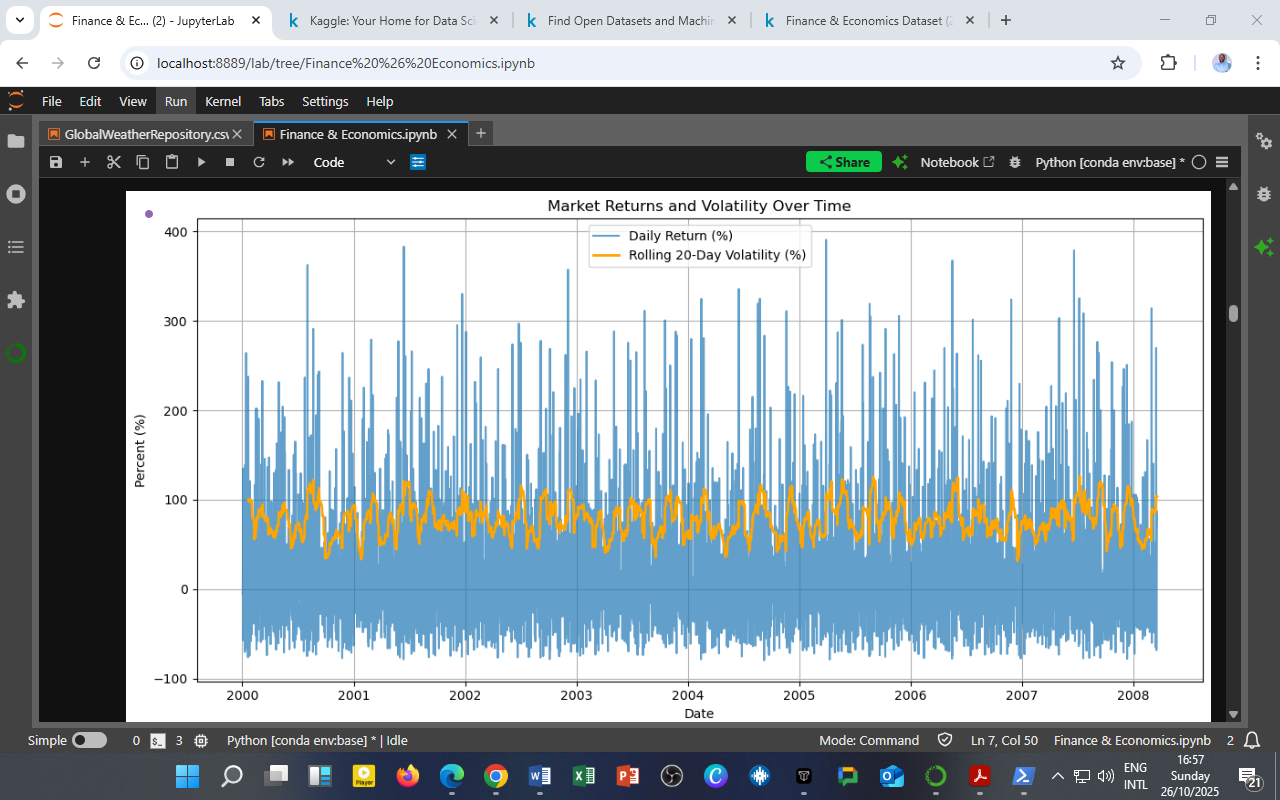

The chart above illustrates the behavior of daily market returns (blue) and 20-day rolling volatility (orange) — both expressed as percentages — derived from the Finance & Economics Dataset covering 2000–2008.

The chart above illustrates the behavior of daily market returns (blue) and 20-day rolling volatility (orange) — both expressed as percentages — derived from the Finance & Economics Dataset covering 2000–2008.

You must be logged in to post a comment.