Source: Finance & Economics Dataset (2000–2025), processed in Python (JupyterLab, scikit-learn PCA analysis).

Interpretation

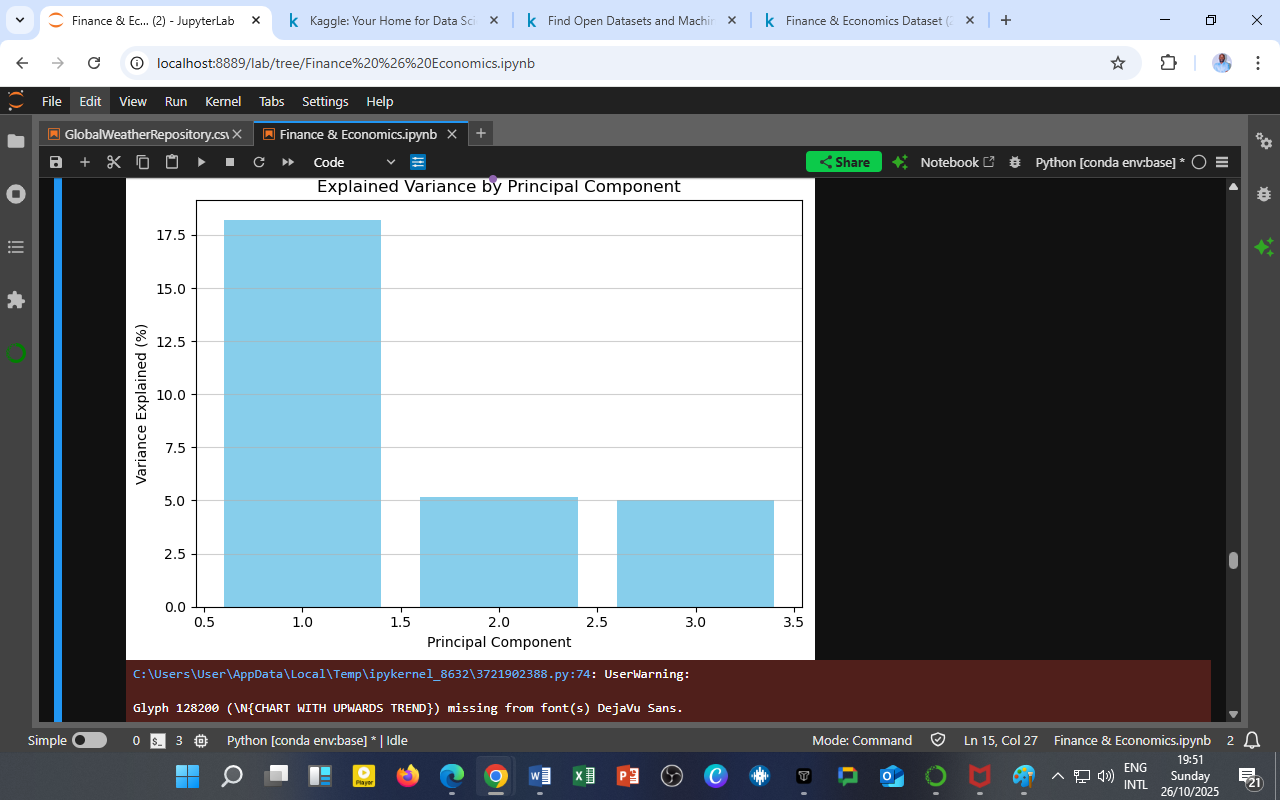

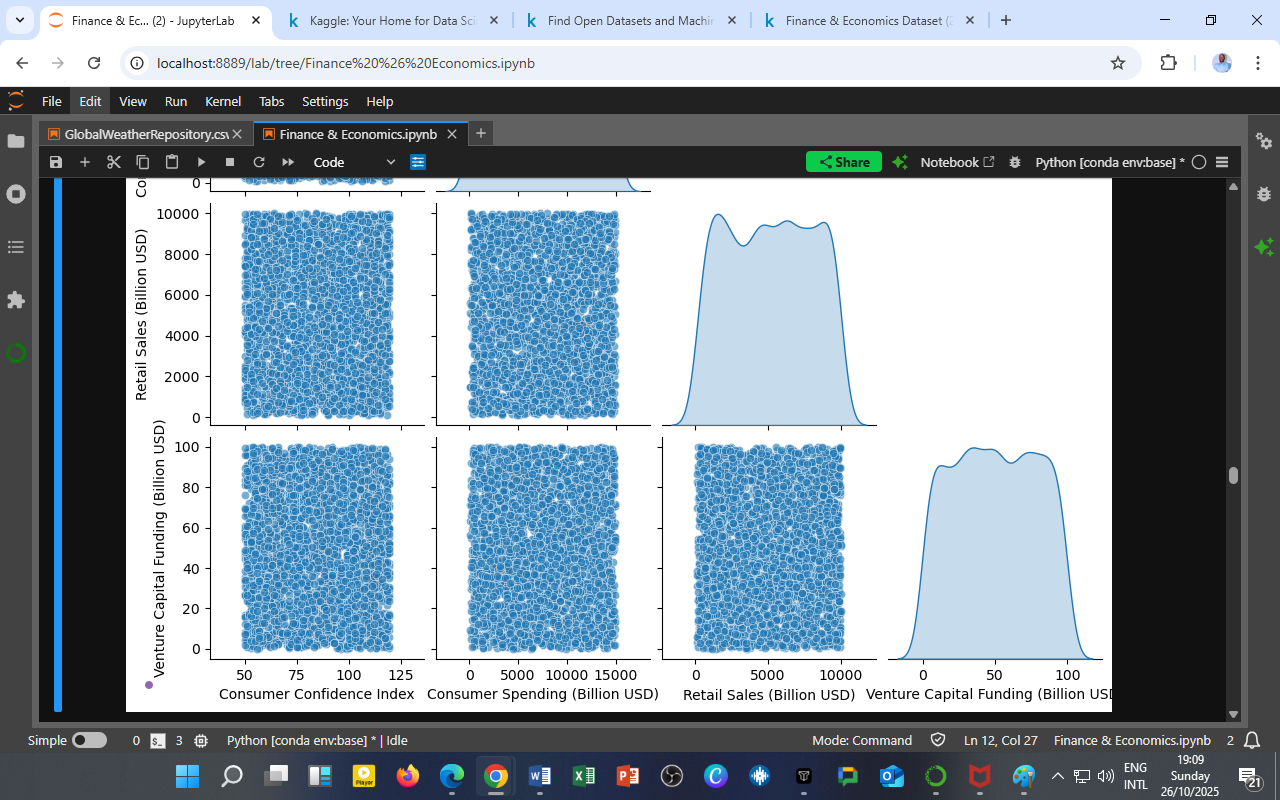

The chart illustrates the proportion of variance explained by each of the first three principal components derived from standardized macroeconomic and financial indicators:

| Component | Explained Variance (%) | Description |

|---|---|---|

| PC1 | 18.22% | Captures dominant patterns in financial market variables (daily price movements). |

| PC2 | 5.16% | Represents macroeconomic stress and fiscal–monetary linkages (inflation, debt, unemployment). |

| PC3 | 5.02% | Reflects global and sentiment-related dynamics (confidence, retail sales, capital flows). |

Together, the three components explain about 28.4% of the total variance, indicating that while economic data are highly multidimensional, these components capture nearly one-third of the system’s structural variability.

Analytical Insight

-

Sharp Drop After PC1:

The first principal component dominates due to the high-frequency volatility of financial markets, suggesting they account for most short-term movements. -

Relatively Flat PC2 and PC3:

The second and third components represent broader macroeconomic and behavioral cycles, whose influence unfolds over longer periods and across sectors. -

Dimensionality Reduction Benefit:

These three components can serve as latent factors in regression, forecasting, or clustering models — significantly reducing complexity while retaining key informational value.

Policy & Research Relevance

The PCA variance structure supports a three-pillar economic monitoring framework:

-

Market Sentiment Tracking (PC1)

-

Fiscal–Monetary Synchronization (PC2)

-

Confidence and Innovation Dynamics (PC3)

This tri-structure can guide both policy simulations and financial risk analytics within the DatalytIQs Academy Macro-Financial Dashboard environment.

Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy — Department of Data Science & Economics

Software Environment: Python (pandas, scikit-learn, matplotlib), executed in JupyterLab

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

License: Educational Research License — DatalytIQs Open Repository Initiative

You must be logged in to post a comment.