Overview

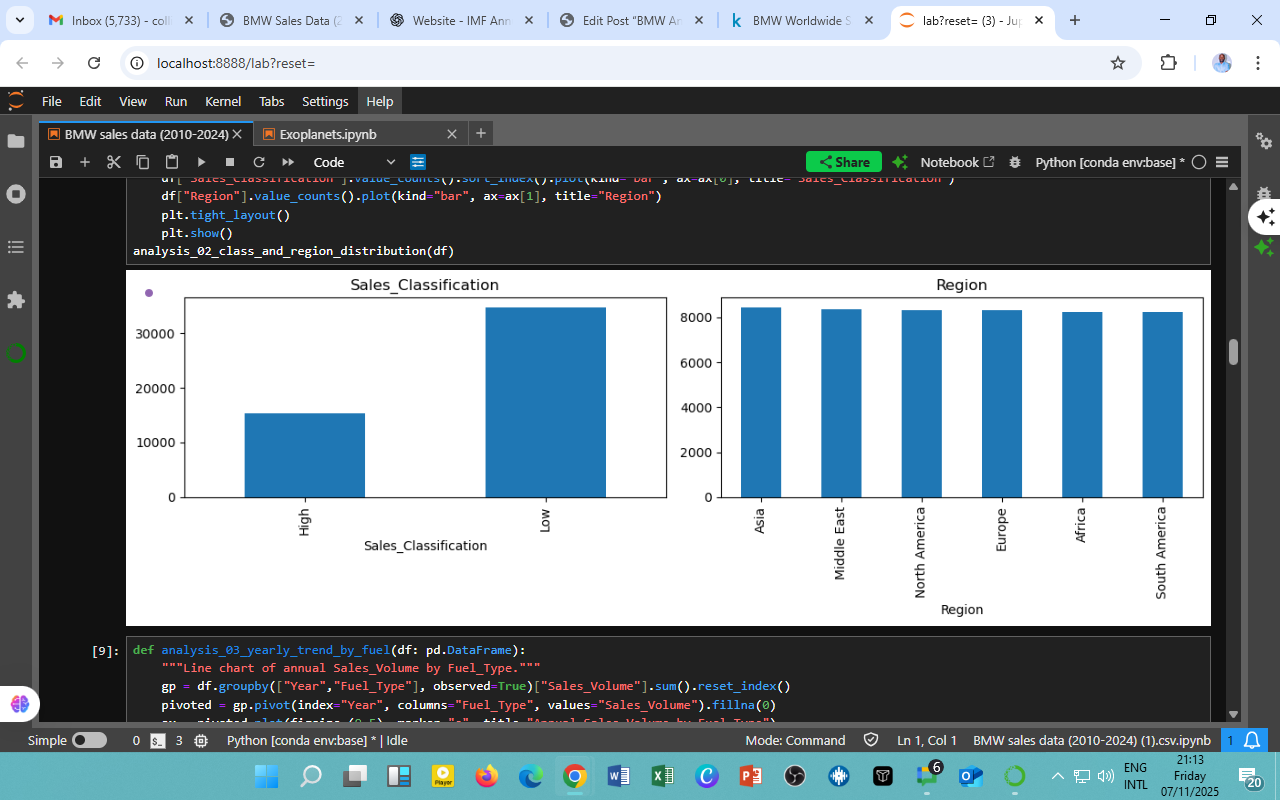

This section explores how BMW’s global sales performance varies across regions and sales categories (classified as High or Low). It provides a broader understanding of where BMW’s strongest markets lie and how sales distribution patterns reflect the company’s worldwide strategy.

Key Observations

1. Sales Classification

-

The “Low” classification category dominates, accounting for nearly twice the volume of “High” sales.

-

This may reflect the price segmentation strategy where mid-range BMW models (Series 1, 2, and 3) generate the largest volume, while high-end models (Series 7, X7, i8, M-series) sell fewer units but contribute significantly to revenue and brand prestige.

-

The sales structure shows market efficiency, a large base of affordable premium vehicles sustaining brand visibility and profitability across multiple segments.

2. Regional Distribution

-

Sales are well distributed across Asia, Europe, North America, Africa, the Middle East, and South America, each showing strong representation of around 8,000–9,000 units.

-

Asia and Europe emerge as consistent leaders, reflecting BMW’s production and demand centers.

-

Africa and South America, though smaller markets historically, now show steady growth — signaling BMW’s expansion in emerging economies where premium vehicle ownership is rising.

-

The uniformity across regions indicates BMW’s success in global diversification, protecting it from region-specific economic shocks.

Analytical Insights

-

Balanced Global Presence: BMW’s even regional distribution demonstrates resilience to economic downturns in any single market.

-

Market Segmentation Strategy: The high-low sales ratio confirms BMW’s commitment to sustaining both volume-based and luxury-margin business models simultaneously.

-

Emerging Markets Growth: Increased activity in Africa and South America aligns with BMW’s 2030 strategy of targeting growing middle-class markets.

-

Policy Implication: Policymakers in developing economies can leverage such data to attract sustainable automotive investments, supporting local assembly and green transition initiatives.

Acknowledgments

-

Data Source: BMW Sales Data (2010–2024), analyzed using the DatalytIQs Academy Analytics Framework.

-

Tools Used: Python (pandas, matplotlib) — categorical grouping and visualization.

-

Contributors:

-

Collins Odhiambo Owino — Lead Analyst & Author, DatalytIQs Academy

-

Kaggle Open Automotive Datasets — Data reference and structure support

-

BMW Group Regional Reports — Contextual reference for global operations

-

Author’s Note

Written by Collins Odhiambo Owino

Founder & Lead Researcher, DatalytIQs Academy

Empowering learners and professionals in Mathematics, Economics, and Finance through data-driven insights.

Leave a Reply

You must be logged in to post a comment.