By Collins Odhiambo Owino

Author | DatalytIQs Academy

Source: IMF World Economic Outlook (October 2025)

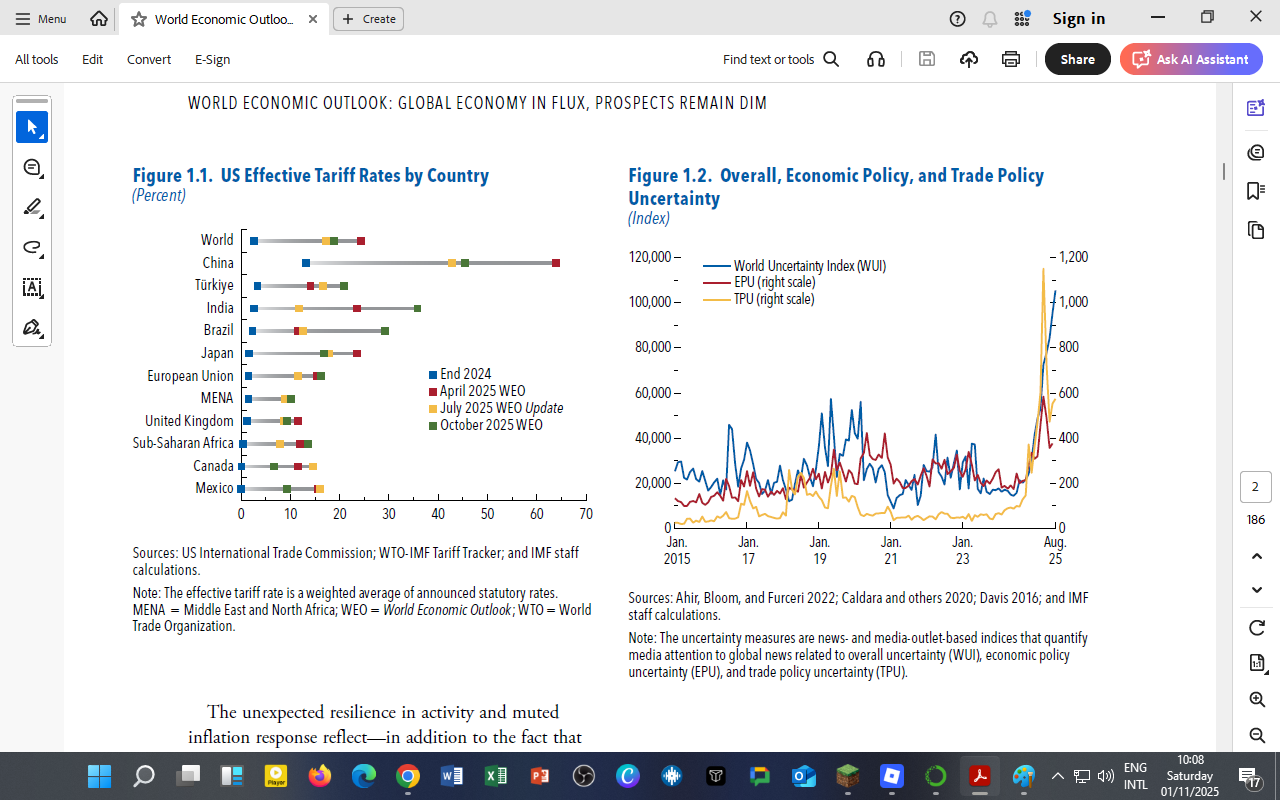

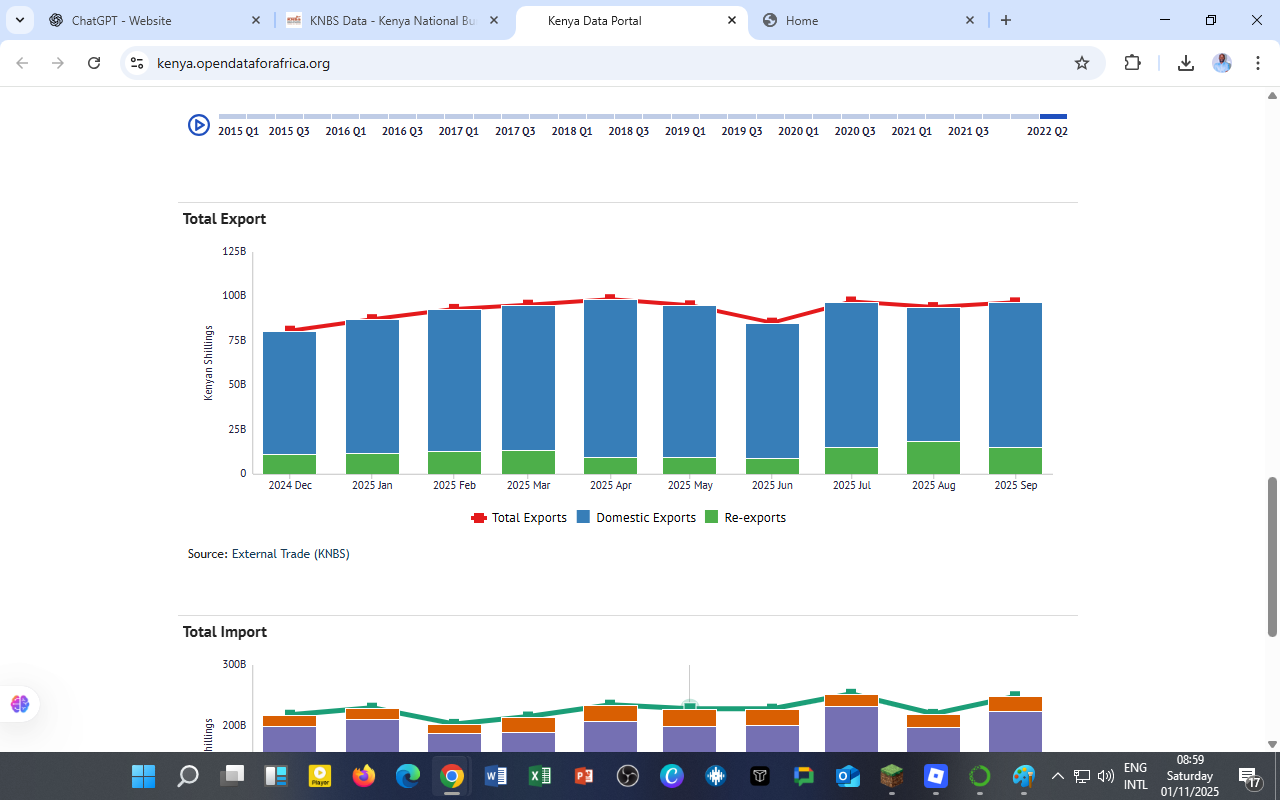

Figure 1 – Trade Barriers and Global Tensions

US Effective Tariff Rates by Country:

-

Tariff levels have risen across nearly all major trading partners between end-2024 and October 2025, with the world average exceeding 25%.

-

China faces the steepest increase — tariff rates jumping to nearly 60–65%, reversing years of liberalization.

-

Emerging markets such as India and Brazil also see moderate hikes, reflecting protectionist spillovers.

-

For Sub-Saharan Africa, average tariffs remain below 15%, but indirect effects (through higher import prices for machinery and inputs) are significant.

Interpretation:

Rising tariffs constrain global value chains, reduce investment confidence, and contribute to slower global trade volumes — directly explaining the IMF’s downward revision of global growth to 3.2% (2025) and 3.1% (2026).

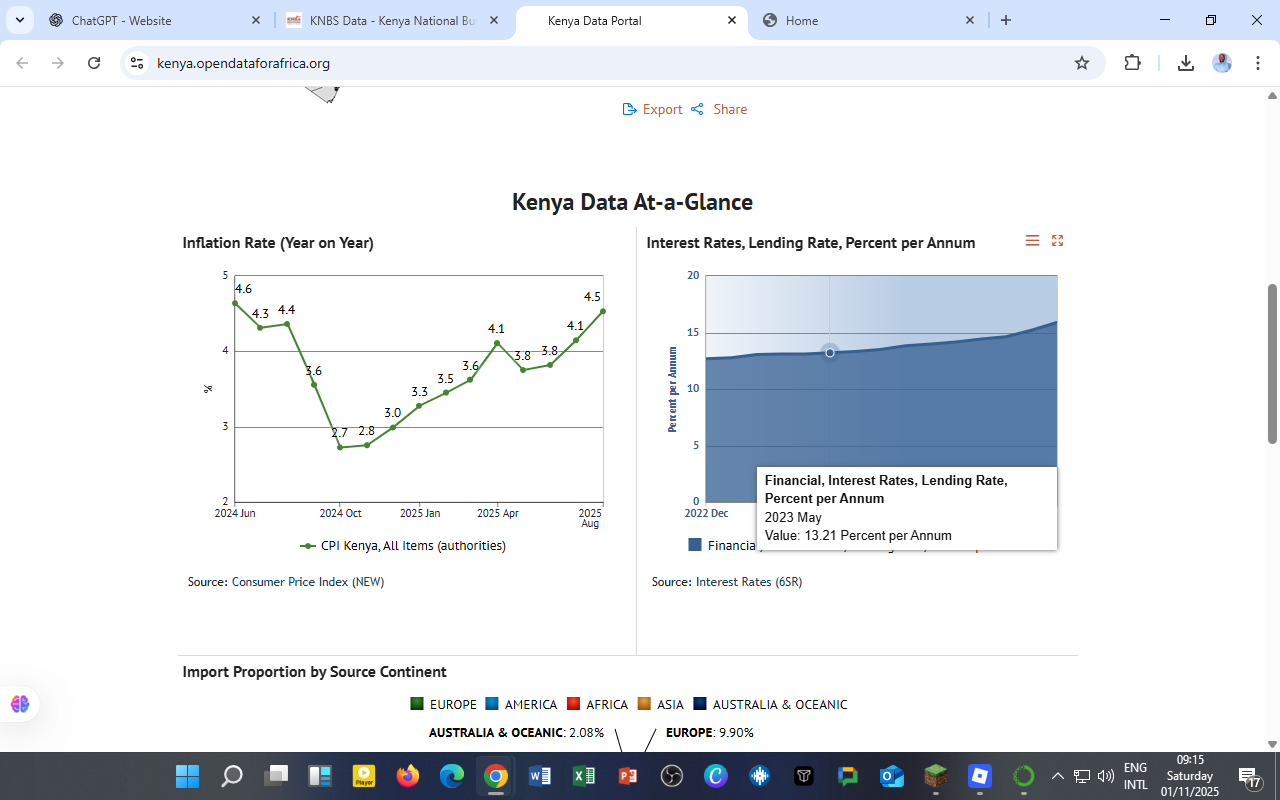

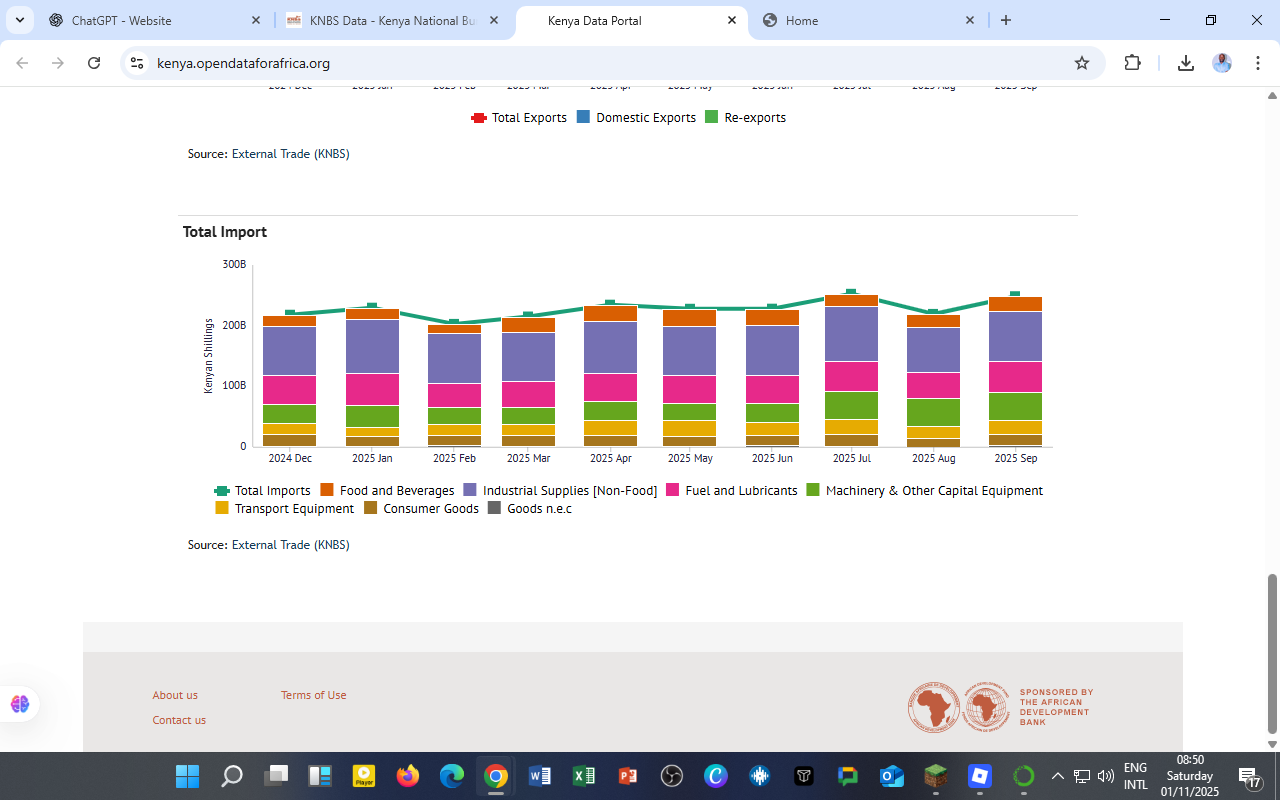

Figure 2 – Policy Uncertainty and Economic Volatility

The chart tracks three indices:

-

WUI (World Uncertainty Index) – measures overall global uncertainty.

-

EPU (Economic Policy Uncertainty) – reflects media-based mentions of fiscal or monetary uncertainty.

-

TPU (Trade Policy Uncertainty) – quantifies trade-related policy risks.

By August 2025, all three indices spike sharply:

-

The WUI surpasses 100,000 points — the highest since 2020.

-

The TPU soars above 1,000 on its index scale, highlighting renewed anxiety about cross-border tariffs.

-

Such spikes typically coincide with global market slowdowns, commodity-price swings, and volatile capital flows into emerging economies.

Economic and trade uncertainty are now systemic risks, feeding through to exchange-rate volatility, capital-market stress, and slower investment — effects that inevitably reach African economies through weaker export demand and higher borrowing costs.

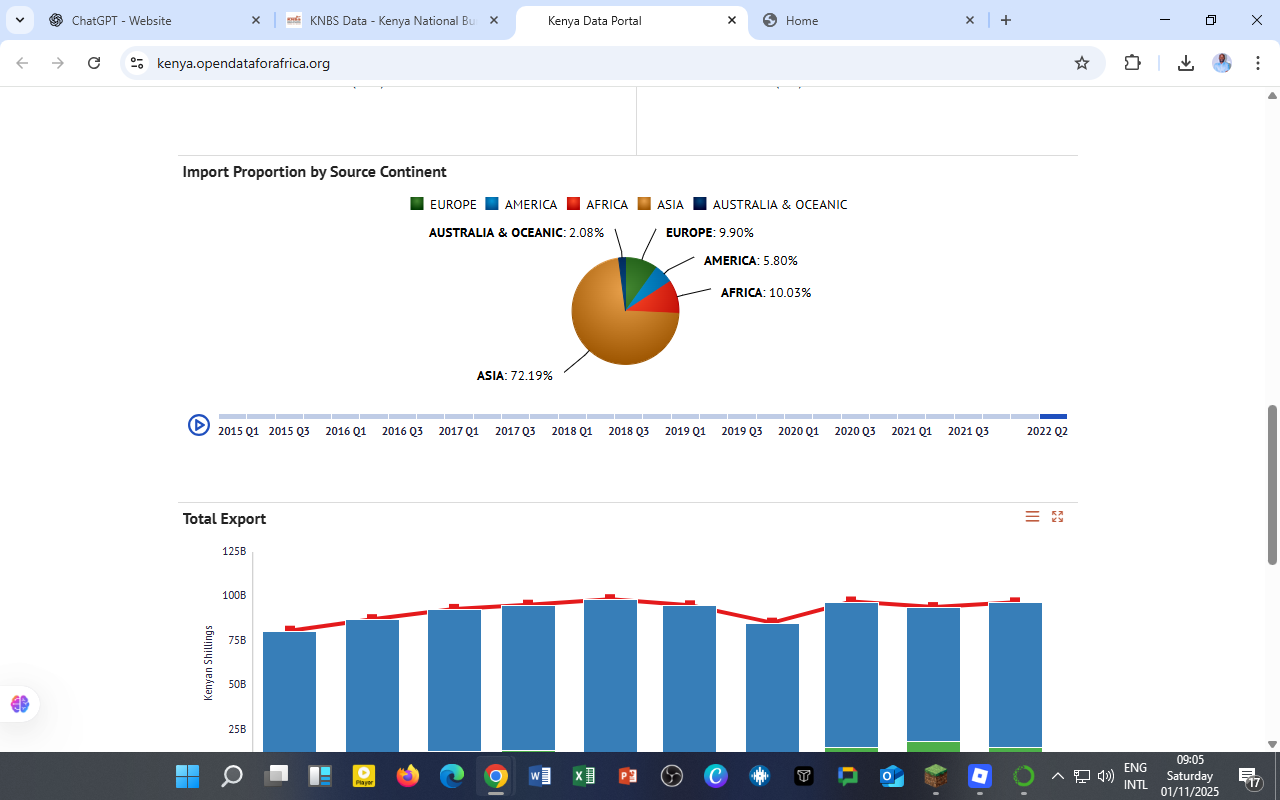

Implications for Kenya and Sub-Saharan Africa

| Channel | Global Shock | Kenya’s Exposure |

|---|---|---|

| Trade | Reduced demand for exports, higher import costs | Tea, coffee, and horticultural exports affected; machinery imports costlier |

| Finance | Tight global liquidity, higher risk premiums | Rising external debt service costs |

| Policy Transmission | US/EU rate hikes | Higher domestic lending and T-bill yields |

| Investor Confidence | Elevated uncertainty | Slower FDI inflows and currency volatility |

Kenya’s policy response should focus on:

-

Strengthening regional value chains under AfCFTA.

-

Deepening domestic capital markets to reduce foreign-debt exposure.

-

Expanding green and digital sectors that attract diversified investment.

Data and Acknowledgment

Figure Sources: IMF World Economic Outlook (October 2025) — Figures 1.1 & 1.2.

Data Sources: US International Trade Commission, WTO-IMF Tariff Tracker, Ahir et al. (2022), Caldara et al. (2020), Davis (2016).

Acknowledgment: International Monetary Fund (IMF) for open global data that informs comparative economic analysis.

Author: Collins Odhiambo Owino, DatalytIQs Academy

You must be logged in to post a comment.