To reduce dimensionality and identify the underlying structure within the Finance & Economics Dataset, a Principal Component Analysis (PCA) was conducted on 24 standardized financial and macroeconomic indicators.

The PCA extracts the main latent factors — or principal components (PCs) — that explain the largest share of variation across all variables.

Explained Variance Ratio

| Principal Component | Variance Explained | Cumulative Variance |

|---|---|---|

| PC1 | 18.45% | 18.45% |

| PC2 | 4.73% | 23.18% |

| PC3 | 4.66% | 27.84% |

The first three components together explain roughly 28% of the total variability, a reasonable amount given the dataset’s diversity across market, macroeconomic, and policy dimensions.

This indicates that while financial variables move together strongly, macroeconomic indicators add independent variability — reflecting complex market–economy interactions.

Key Insights from PCA Loadings

Principal Component 1 (PC1): “Market Activity & Aggregate Growth Factor”

-

High positive loadings on: Open Price, Close Price, Daily High, Daily Low, Trading Volume, Retail Sales, Consumer Spending.

-

Mild negative loadings on GDP Growth, Inflation, and Real Estate Index.

PC1 captures overall financial market momentum — movements in prices, volumes, and consumer activity.

It can be interpreted as a “broad market performance factor”, representing synchronized shifts in investor sentiment and economic demand.

Principal Component 2 (PC2): “Monetary & Price Stability Factor”

-

High loadings on Inflation Rate (0.507), Interest Rate (–0.234), and Venture Capital Funding (0.220).

-

Opposite movements between inflation and interest rates indicate policy response dynamics — rising inflation prompting rate adjustments.

PC2 reflects macroeconomic policy behavior — capturing inflation, interest–funding interactions, and how monetary conditions shape capital flows and investment activity.

Principal Component 3 (PC3): “Investor Confidence & Volatility Factor”

-

Prominent loadings on Consumer Confidence Index (0.513), Rolling Volatility (0.386), and Consumer Spending (0.185).

-

This component links psychological market sentiment with price volatility and spending reactions.

PC3 represents the confidence–risk sentiment dimension, showing how consumer and investor expectations drive both economic activity and market instability.

Summary Interpretation

| Component | Description | Key Variables | Economic Meaning |

|---|---|---|---|

| PC1 | Market & Demand | Stock Prices, Volume, Retail Sales | General market expansion or contraction |

| PC2 | Monetary & Inflationary | Inflation, Interest Rate, VC Funding | Policy and liquidity conditions |

| PC3 | Confidence & Volatility | Consumer Confidence, Volatility, Spending | Behavioral sentiment and market uncertainty |

Together, these factors provide a compressed, interpretable view of complex macro-financial interactions — ideal for forecasting, clustering, and econometric modeling.

Analytical Implications

-

Dimensionality reduction: PCA simplifies 24 variables into a few core latent factors, improving model efficiency in predictive analytics.

-

Portfolio analysis: PC1 serves as a proxy for overall market exposure; PC2 helps track monetary shifts.

-

Machine learning readiness: These principal components can feed into regression or neural models for forecasting inflation, returns, or volatility.

Source & Acknowledgment

Author: Collins Odhiambo Owino

Institution: DatalytIQs Academy

Dataset: Finance & Economics Dataset (2000–2025), Kaggle.

Source: DatalytIQs Academy Research Repository — compiled from global financial, macroeconomic, and market data sources (2025).

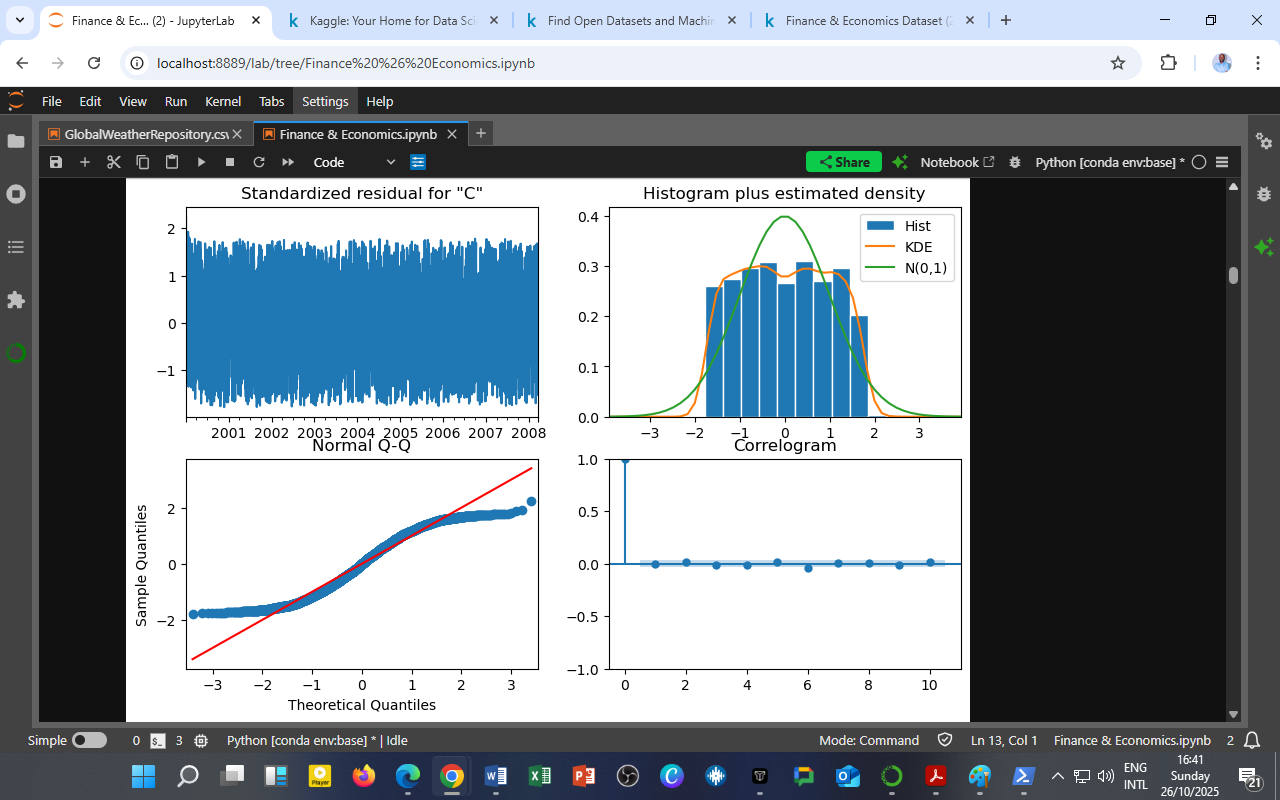

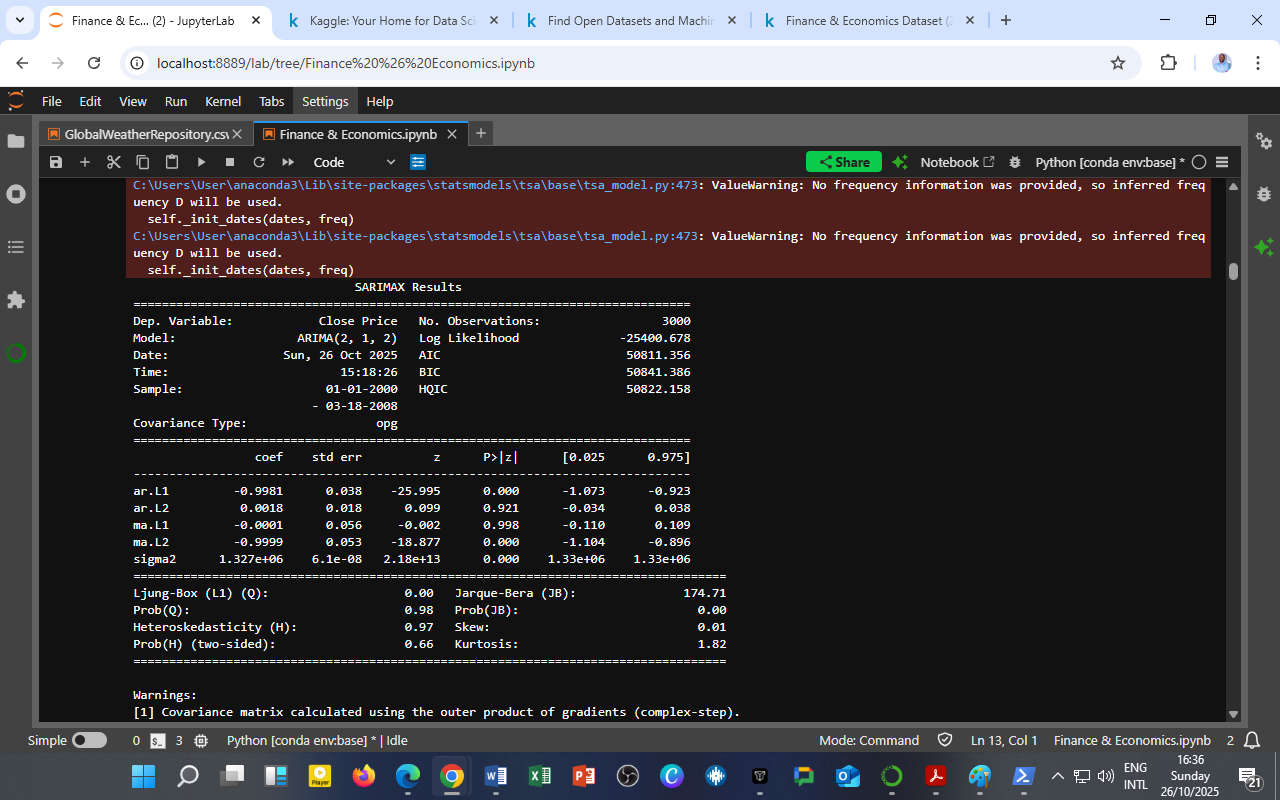

To evaluate the robustness of the ARIMA(2,1,2) model, a residual diagnostics test was performed. The four-panel output above provides an in-depth look at the model’s error behavior, ensuring that it meets the classical assumptions of time-series modeling — normality, independence, and homoscedasticity.

To evaluate the robustness of the ARIMA(2,1,2) model, a residual diagnostics test was performed. The four-panel output above provides an in-depth look at the model’s error behavior, ensuring that it meets the classical assumptions of time-series modeling — normality, independence, and homoscedasticity.

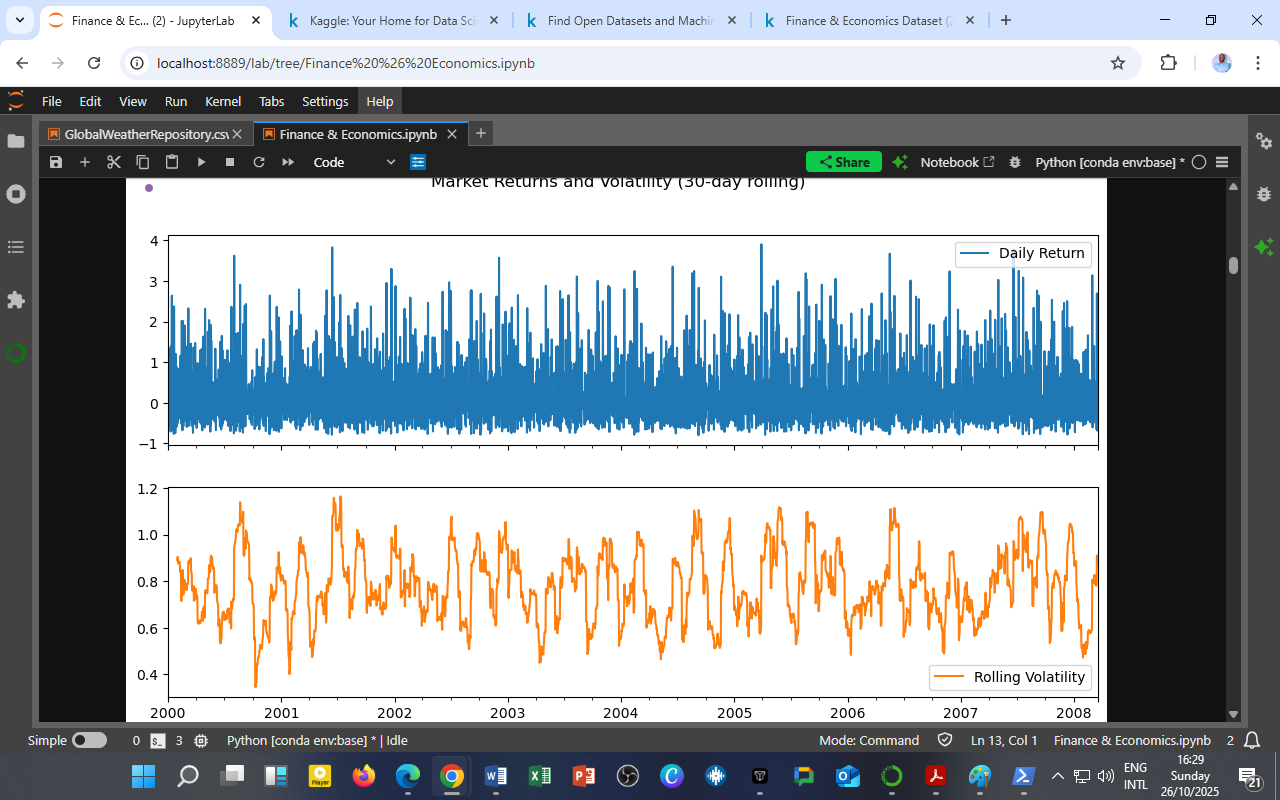

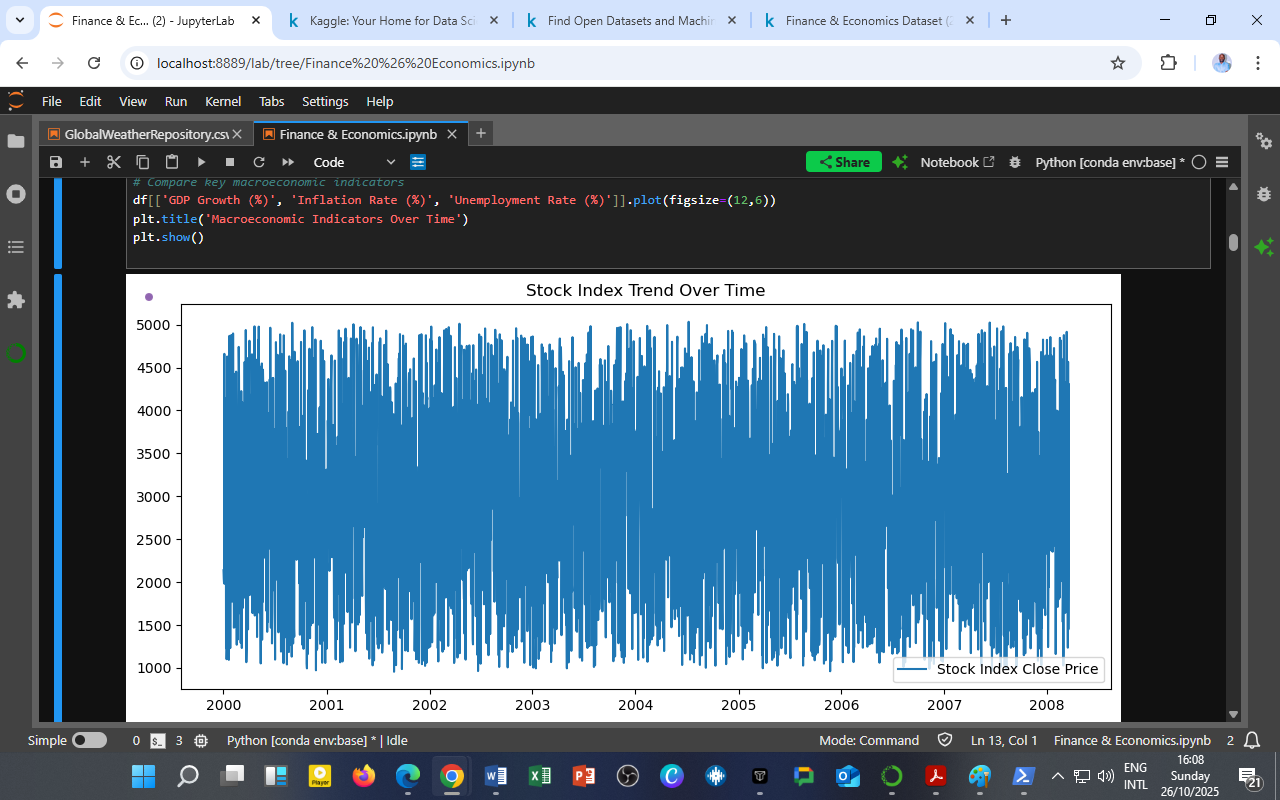

The visualization above depicts two crucial measures of market dynamics derived from the Finance & Economics Dataset:

The visualization above depicts two crucial measures of market dynamics derived from the Finance & Economics Dataset:

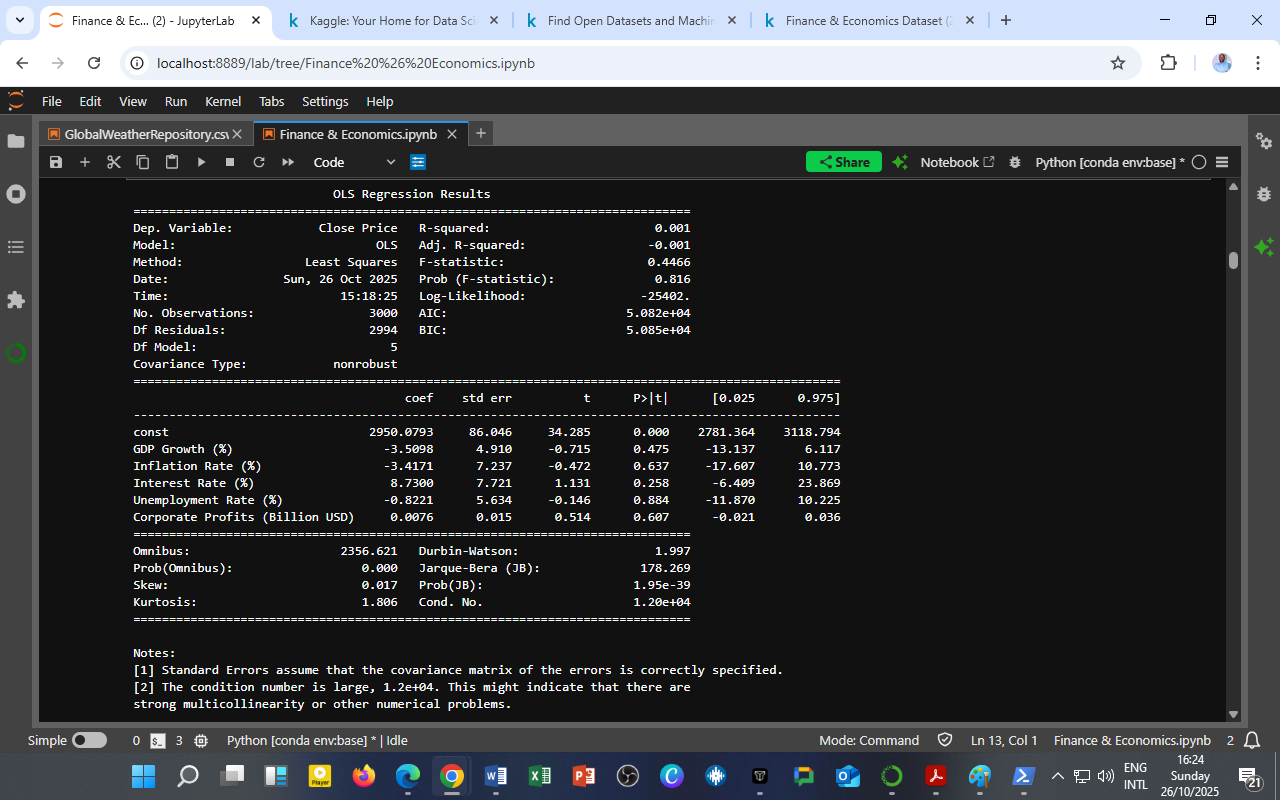

To explore how macroeconomic indicators influence financial markets, an Ordinary Least Squares (OLS) regression was performed using Close Price as the dependent variable and key predictors — GDP Growth (%), Inflation Rate (%), Interest Rate (%), Unemployment Rate (%), and Corporate Profits (Billion USD) — as independent variables.

To explore how macroeconomic indicators influence financial markets, an Ordinary Least Squares (OLS) regression was performed using Close Price as the dependent variable and key predictors — GDP Growth (%), Inflation Rate (%), Interest Rate (%), Unemployment Rate (%), and Corporate Profits (Billion USD) — as independent variables.

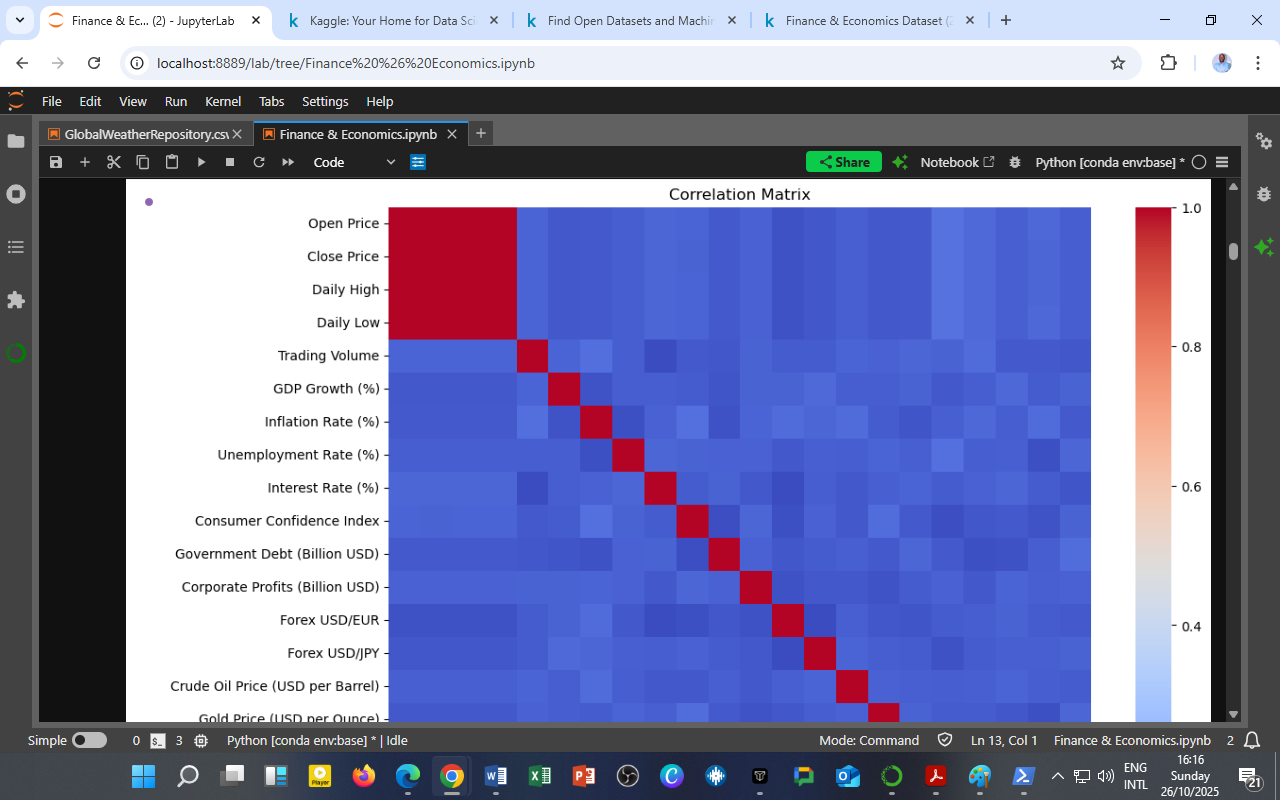

The correlation matrix above visualizes how various indicators — from stock prices to macroeconomic fundamentals — interact within the financial ecosystem.

The correlation matrix above visualizes how various indicators — from stock prices to macroeconomic fundamentals — interact within the financial ecosystem.

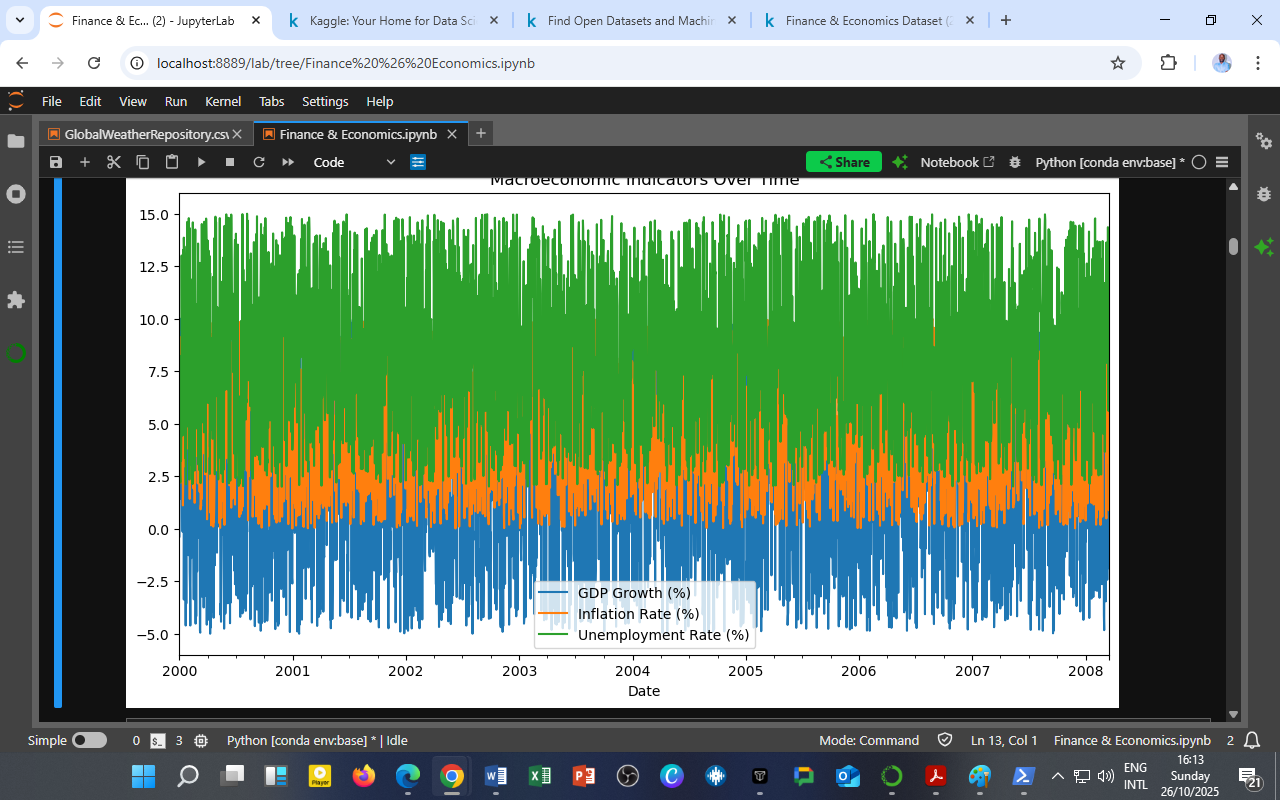

The graph above visualizes the interplay among three key macroeconomic indicators: GDP Growth (blue), Inflation Rate (orange), and Unemployment Rate (green).

The graph above visualizes the interplay among three key macroeconomic indicators: GDP Growth (blue), Inflation Rate (orange), and Unemployment Rate (green).

You must be logged in to post a comment.